Please use a PC Browser to access Register-Tadawul

Green Brick Partners, Inc. (NYSE:GRBK) Looks Inexpensive But Perhaps Not Attractive Enough

Green Brick Partners GRBK | 66.98 | -0.45% |

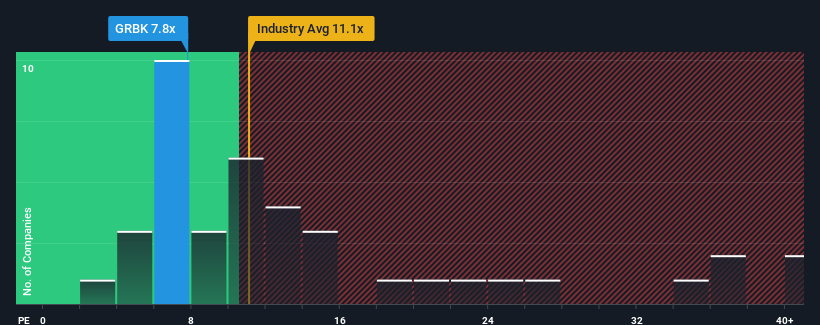

Green Brick Partners, Inc.'s (NYSE:GRBK) price-to-earnings (or "P/E") ratio of 7.8x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Green Brick Partners has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is Green Brick Partners' Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Green Brick Partners' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 34% last year. The latest three year period has also seen an excellent 154% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 7.7% over the next year. Meanwhile, the rest of the market is forecast to expand by 15%, which is noticeably more attractive.

In light of this, it's understandable that Green Brick Partners' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Green Brick Partners' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Green Brick Partners maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

If these risks are making you reconsider your opinion on Green Brick Partners, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.