Please use a PC Browser to access Register-Tadawul

Green Plains (GPRE) Q4 Profit Of US$11.9 Million Tests Loss-Focused Bearish Narratives

Green Plains Inc. GPRE | 14.02 | +3.32% |

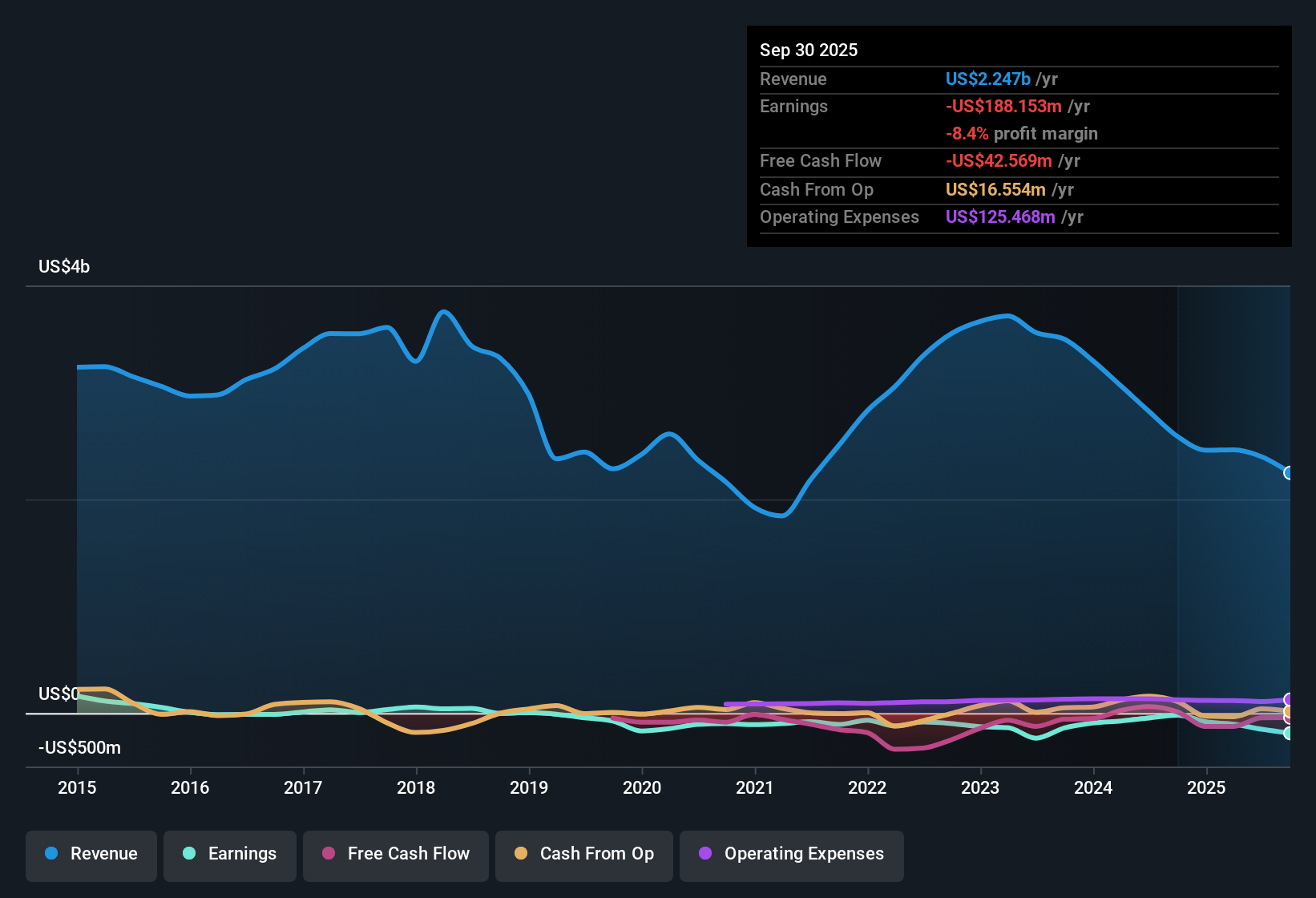

Green Plains (GPRE) closed out FY 2025 with Q4 revenue of US$428.8 million and basic EPS of US$0.17, alongside net income of US$11.9 million. Trailing twelve month figures show total revenue of about US$2.1 billion and a loss of US$121.3 million, or basic EPS of US$1.80. Over recent quarters, the company has reported quarterly revenue ranging from US$508.5 million in Q3 2025 to US$601.5 million in Q1 2025. Basic EPS has moved between a loss of US$1.14 in Q1 2025 and a profit of US$0.75 in Q3 2024. This sets up a mixed picture in which investors are weighing improving quarterly profitability against still pressured margins on a trailing basis.

See our full analysis for Green Plains.With the headline numbers on the table, the next step is to see how these results line up with the widely followed growth and profitability narratives around Green Plains and where those stories might need a reset.

Two Small Profits Against A US$121.3 Million Yearly Loss

- Across FY 2025, Green Plains posted two profitable quarters of around US$11.9 million each in Q3 and Q4, yet on a trailing twelve month basis it still recorded a net loss of US$121.3 million on about US$2.1b of revenue.

- What stands out for the bearish view is that these positive quarters sit inside a year where losses have grown at about 3.8% per year over five years, and

- Trailing twelve month EPS is a loss of US$1.80 even after the recent profitable quarters.

- Critics highlight that past net profit margin and earnings quality are both described as negative, which lines up with the trailing net loss and keeps the bearish focus on the durability of any profit improvement.

Revenue Holds Above US$2.0 Billion While Margins Stay Weak

- Revenue over the last twelve months sits at about US$2.1b, with quarterly revenue ranging from US$428.8 million in Q4 2025 to US$658.7 million in Q3 2024, yet the trailing period still produced a net loss of US$121.3 million.

- Supporters of a more bullish angle point to the characterization of revenue as growing around 15% per year, but

- Those same trailing numbers show losses persisting, with net losses over the last twelve months and historically weaker margins.

- This mix of growing revenue and ongoing losses means the bullish focus on growth has to be weighed against the fact that higher sales have not yet translated into positive trailing profitability.

Low 0.5x P/S Versus DCF Fair Value Of US$71.18

- With a current share price of US$13.85 and a P/S of 0.5x compared with 1.6x for the US Oil & Gas industry and 0.9x for peers, the stock is also described as trading well below a DCF fair value of about US$71.18.

- What is interesting for a bullish narrative check is that this low multiple comes alongside forecasts for about 15% revenue growth and 56.36% earnings growth per year, yet

- The company remains unprofitable today, with a trailing twelve month net loss of US$121.3 million and losses that have grown at about 3.8% per year over five years.

- That combination of a discount to DCF fair value and peers on P/S, together with ongoing losses, creates a clear tension that bullish investors need to reconcile when they lean on the growth forecasts.

Curious how other investors are piecing together Green Plains' growth forecasts, losses, and low P/S multiple into a bigger story? Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Green Plains's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Green Plains is still working through weak trailing profitability, with a US$121.3 million yearly loss and negative margins despite recent profitable quarters.

If that mix of ongoing losses and fragile margins feels too uncomfortable, you may want to check out 85 resilient stocks with low risk scores, which score better on stability and downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.