Please use a PC Browser to access Register-Tadawul

GreenTree Hospitality Group Ltd.'s (NYSE:GHG) Prospects Need A Boost To Lift Shares

GREENTREE HOSPITALITY GROUP LTD. GHG | 1.76 | -2.22% |

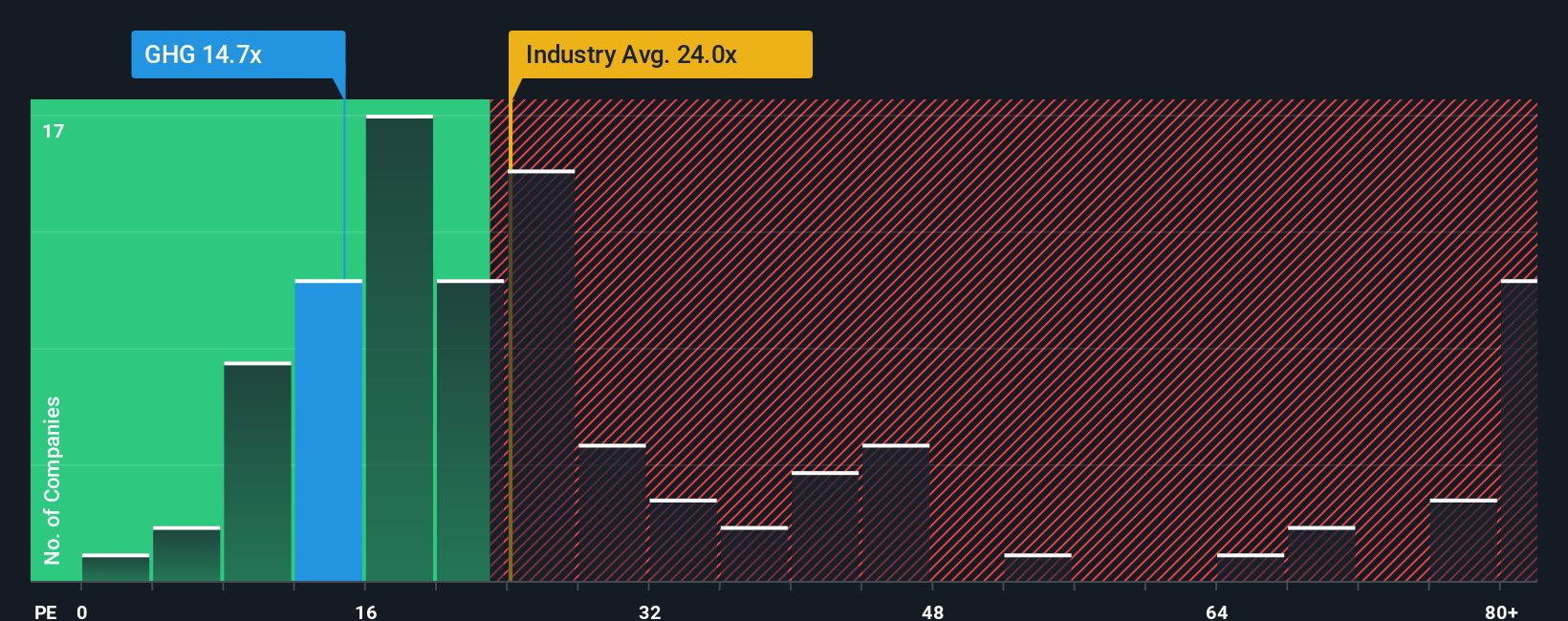

GreenTree Hospitality Group Ltd.'s (NYSE:GHG) price-to-earnings (or "P/E") ratio of 14.7x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 20x and even P/E's above 34x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that GreenTree Hospitality Group's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

How Is GreenTree Hospitality Group's Growth Trending?

In order to justify its P/E ratio, GreenTree Hospitality Group would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 59%. Regardless, EPS has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why GreenTree Hospitality Group is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that GreenTree Hospitality Group maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks.

You might be able to find a better investment than GreenTree Hospitality Group.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.