Please use a PC Browser to access Register-Tadawul

Gulfport Energy (GPOR): Evaluating Valuation After Preferred Stock Redemption and Strong Financial Results

GULFPORT ENERGY CORP GPOR | 199.72 | -2.33% |

Most Popular Narrative: 21.8% Undervalued

The most widely followed narrative suggests Gulfport Energy shares are significantly undervalued by more than 20%, compared to where analysts believe fair value lies.

Ongoing discretionary acreage acquisitions and organic inventory expansion in the core Utica wet and dry gas windows strengthen the company's drilling runway by more than 2 years, enhance development optionality, and sustain high-return drilling activity. This supports sustainable production growth and EBITDA expansion.

What is at the root of this bullish outlook? The narrative points to an ambitious path built on growth initiatives and profitability targets. Want to know which performance levers analysts believe could push this stock well above its current price? Dive deeper to see the assumptions and projections powering this discounted valuation.

Result: Fair Value of $222.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as lower natural gas demand or tighter regulations could quickly shift Gulfport’s outlook and place pressure on its future earnings growth.

Find out about the key risks to this Gulfport Energy narrative.Another View: Looking at Value from a Different Angle

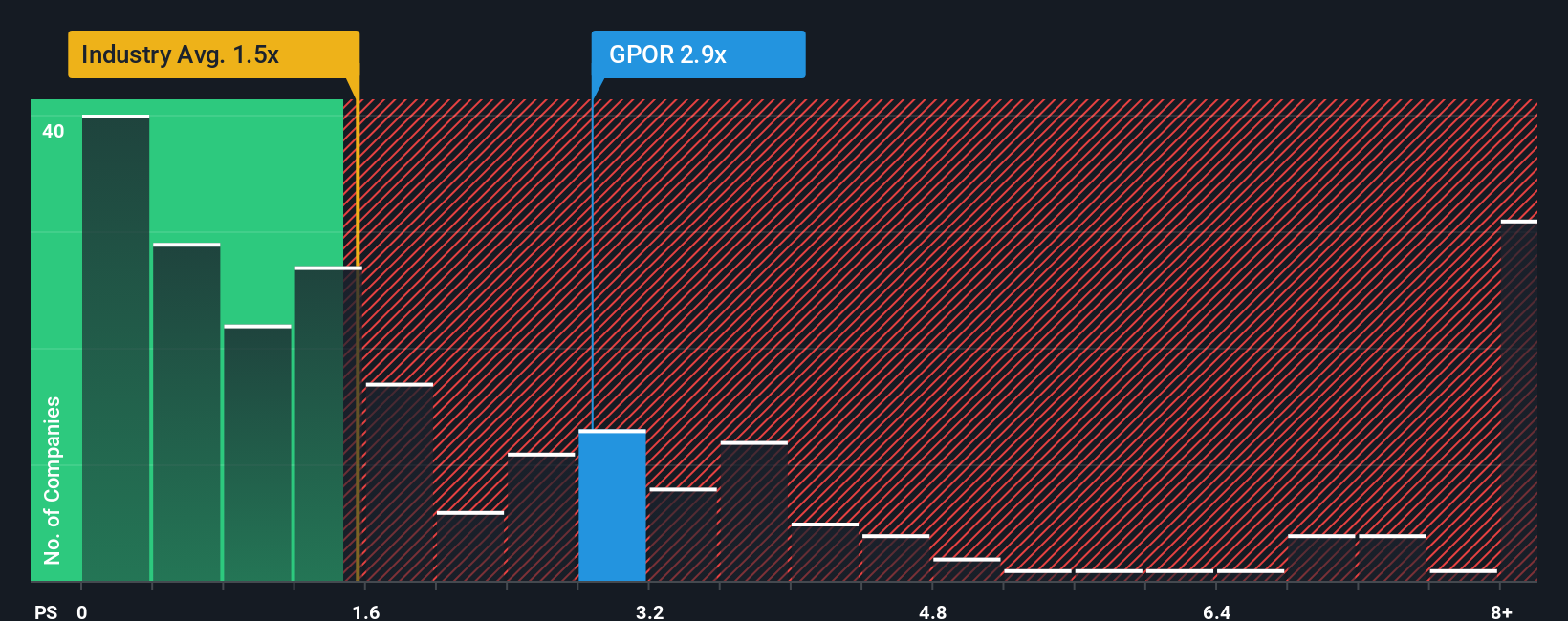

Not everyone agrees with the optimistic outlook from analysts. Compared to similar companies, Gulfport’s current valuation looks higher using its sales ratio against the industry standard. This suggests the market may be pricing in more growth than some expect. Could this premium hint at hidden strength, or is caution warranted?

Build Your Own Gulfport Energy Narrative

If you see things differently or enjoy delving into the details on your own, you can easily craft your own narrative and insights in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Gulfport Energy.

Looking for More Smart Investment Opportunities?

Don’t just stop at Gulfport Energy when you could be tapping into unique strategies and fresh investment angles. With powerful screening tools at your fingertips, you can target exactly the kind of opportunities that match your goals, whether that means building steady income, finding hidden value, or spotting tomorrow’s market leaders. Don’t let your next big win pass you by.

- Maximize your yield by targeting companies with track records of strong and sustainable payouts using our dividend stocks with yields > 3%.

- Hunt for tomorrow’s undervalued gems with robust fundamentals by taking advantage of our undervalued stocks based on cash flows.

- Get ahead of the curve and find promising advances in healthcare technology with the help of our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.