Please use a PC Browser to access Register-Tadawul

GXO Logistics (GXO) Is Up 14.1% After Mixed 2025 Results And New Defense Wins Has The Bull Case Changed?

GXO Logistics Inc GXO | 65.59 | +1.53% |

- In February 2026, GXO Logistics reported fourth-quarter 2025 revenue of US$3,507 million and full-year revenue of US$13.18 billion, alongside a sharp fall in net income to US$43 million for the quarter and US$32 million for the year, and issued 2026 guidance for 4%–5% organic revenue growth.

- At the same time, GXO deepened its push into aerospace, defense, and automotive logistics through new BMW Group and BAE Systems contracts and the creation of a Defense Advisory Board, while also winning a London Luton Airport mandate that underscores its focus on higher-value, technology-enabled logistics solutions.

- We'll now examine how GXO's record revenue and expanding aerospace and defense footprint influence the existing investment narrative and risk profile.

Uncover the next big thing with 27 elite penny stocks that balance risk and reward.

GXO Logistics Investment Narrative Recap

To own GXO, you generally need to believe that its record US$13.18 billion in 2025 revenue, technology focus, and blue chip customer base can offset very thin profitability and leadership turnover. The key near term catalyst remains converting its US$1.1 billion of recent wins and automation investments into cleaner earnings, while the biggest risk is that margin pressure and Wincanton integration issues persist. The latest quarter’s sharp net income decline makes that margin risk feel more immediate, but does not change the core thesis yet.

Among the latest announcements, the expanded six year contract with BAE Systems stands out. It reinforces GXO’s positioning in aerospace and defense just as it creates a Defense Advisory Board and targets higher value, specialized logistics. For investors watching catalysts, this kind of long duration, complex work matters because it ties directly into the company’s push toward higher margin, technology enabled contracts that could help support the earnings recovery implied in consensus estimates.

Yet behind the record revenue and new defense wins, one issue investors should be aware of is the risk that Wincanton integration pressures and rising tech spend could...

GXO Logistics' narrative projects $15.3 billion revenue and $440.6 million earnings by 2028. This requires 6.5% yearly revenue growth and about a $377.6 million earnings increase from $63.0 million today.

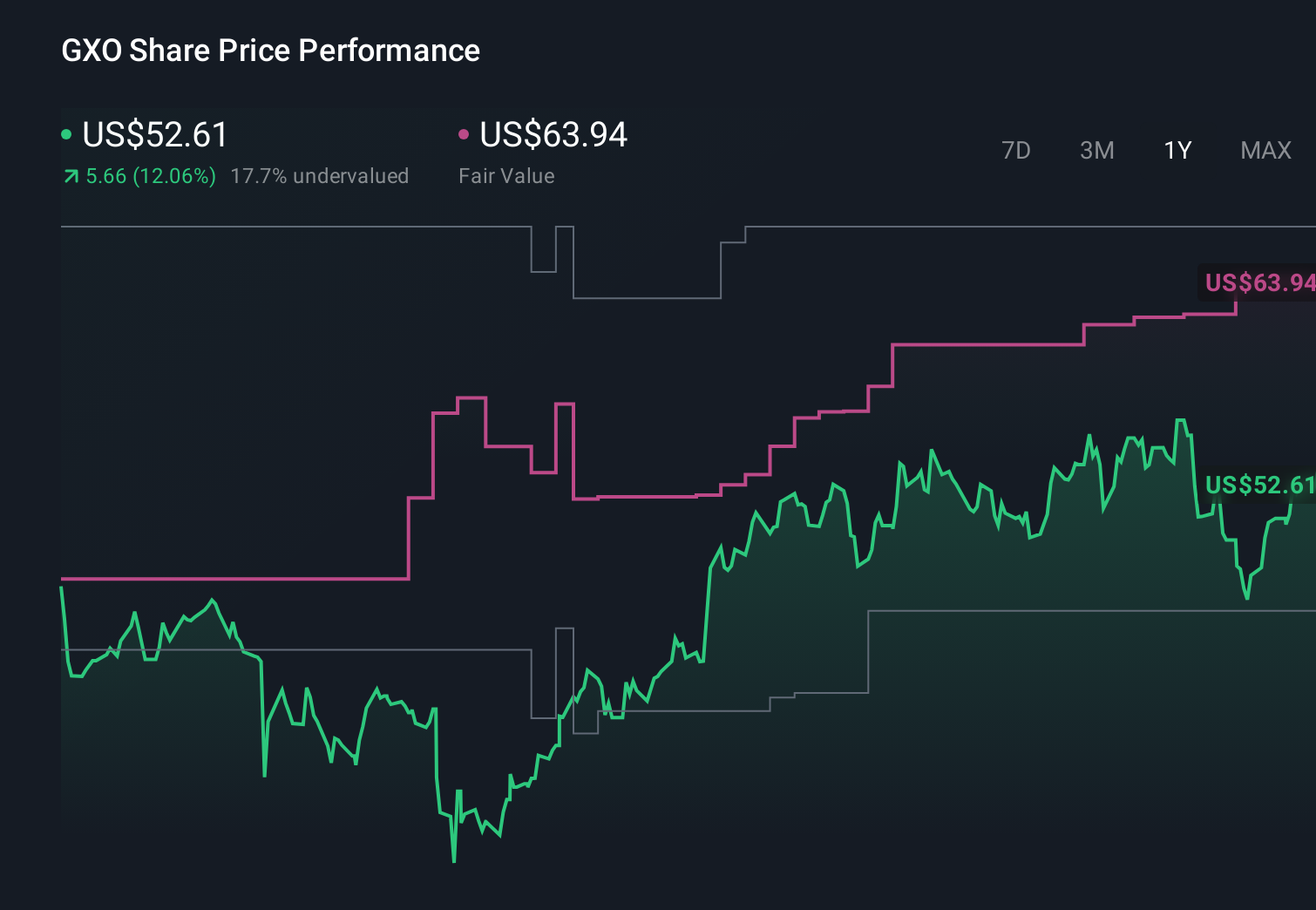

Uncover how GXO Logistics' forecasts yield a $66.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Some of the lowest estimates painted a far tougher path, assuming revenue of about US$13.4 billion and earnings near US$174 million by 2028, with integration and automation headwinds weighing longer on margins than the base case implies.

Explore 3 other fair value estimates on GXO Logistics - why the stock might be worth 10% less than the current price!

Build Your Own GXO Logistics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GXO Logistics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GXO Logistics' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The future of work is here. Discover the 31 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- We've uncovered the 16 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.