Please use a PC Browser to access Register-Tadawul

Halliburton (HAL): Assessing the Stock’s Valuation After Recent Rebound in Investor Sentiment

Halliburton Company HAL | 34.90 | -0.23% |

Halliburton (HAL) has caught the eye of many investors lately, sparking fresh debates about where the stock could head next. While there hasn't been a single headline-making event behind the recent movement, the stock’s rebound in recent weeks has prompted both optimism and caution among those weighing whether to get in or stay on the sidelines. This kind of activity can easily make you wonder if it is the start of a meaningful shift or simply a passing uptick in sentiment.

Looking back, Halliburton’s share price tells a story of momentum shifts. Although the company is still down over the past year, a roughly 20% gain in the past three months signals that some investors see opportunity in the oilfield services giant. The broader trend this year has been challenging, but recent action suggests a possible change in perception, especially following modest improvements in both revenue and net income over the past twelve months.

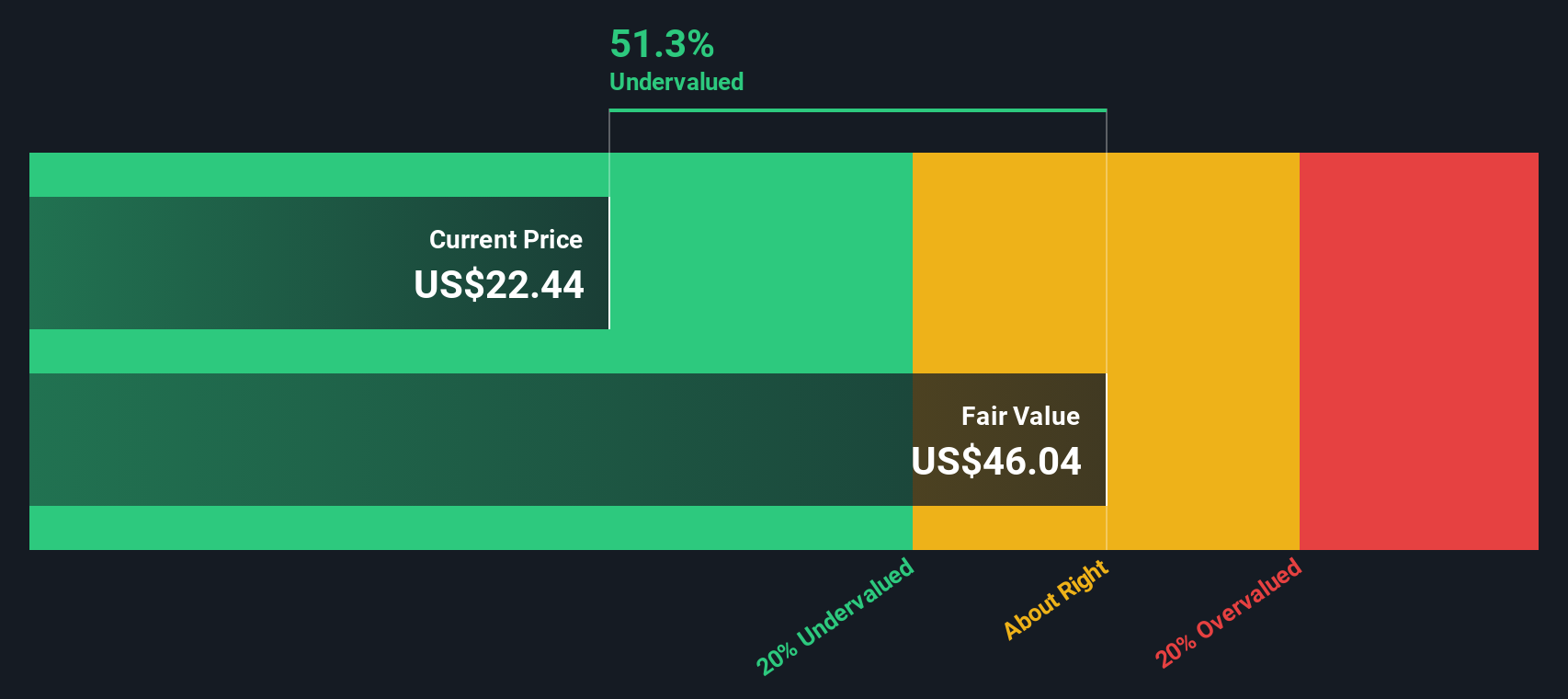

After this stretch of volatility and rebound, the real question is whether Halliburton is undervalued at these levels or if investors are already factoring in a stronger future for the company.

Most Popular Narrative: 8.6% Undervalued

According to the most followed narrative, Halliburton's stock is currently undervalued by 8.6%, based on expectations of its future earnings growth and profit margins. Analysts believe there is upside potential if the company's projections materialize as forecasted.

"Rising global energy needs and decarbonization trends are reinforcing demand for Halliburton's key offerings, offsetting regional softness and reducing earnings volatility."

What exactly is propping up this optimistic price target? The narrative teases future revenue and margin improvement, grounded in detailed financial modeling but leaves the door open for surprise. Could the underlying growth drivers outpace expectations, or is there a catch waiting in the assumptions? The answers and the crucial numbers behind this fair value are revealed in the full story.

Result: Fair Value of $26.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid growth in renewables and tougher regulations could dampen long-term demand for Halliburton’s core services, which may challenge the bullish outlook.

Find out about the key risks to this Halliburton narrative.Another View: What Does the SWS DCF Model Show?

Taking a step back from analyst projections, our DCF model uses cash flow forecasts to estimate Halliburton’s value. Interestingly, this approach also signals the stock could be undervalued, though by a much wider margin than analyst targets suggest. Could this conservative model be missing a shift, or is the market discounting something significant?

Build Your Own Halliburton Narrative

If these conclusions don't match your own view, or if you want to dig deeper into the numbers, you can shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Halliburton research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for the next edge. See what’s out there beyond Halliburton by using these powerful stock searches available now on Simply Wall Street.

- Spot tomorrow’s winners early by checking out undervalued stocks based on cash flows with strong cash flow potential that often fly under most radars.

- Boost your portfolio’s earning power as you tap into dividend stocks with yields > 3% to find stocks providing consistent income with yields above 3%.

- Ride the technology wave by uncovering AI penny stocks offering innovation in artificial intelligence and high-growth ambition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.