Please use a PC Browser to access Register-Tadawul

Halliburton (HAL) Valuation Check As Nuclear Waste Disposal Project Expands Future Opportunity Set

Halliburton Company HAL | 35.11 | -0.74% |

Why Halliburton’s nuclear waste project is catching investor attention

Halliburton (HAL) is stepping into nuclear waste disposal through a multi year deep borehole demonstration program with Deep Isolation and partners. This move could reshape how investors think about its long term opportunity set.

Alongside the nuclear waste project and recent corporate moves such as a shelf registration and new board committee appointments, Halliburton’s 90 day share price return of 25.6% and 1 year total shareholder return of 34.36% suggest momentum has been building from a US$34.29 share price base.

If this nuclear themed news has your attention, it might be a good moment to see what else is happening across the sector with our 86 nuclear energy infrastructure stocks as a starting list of ideas.

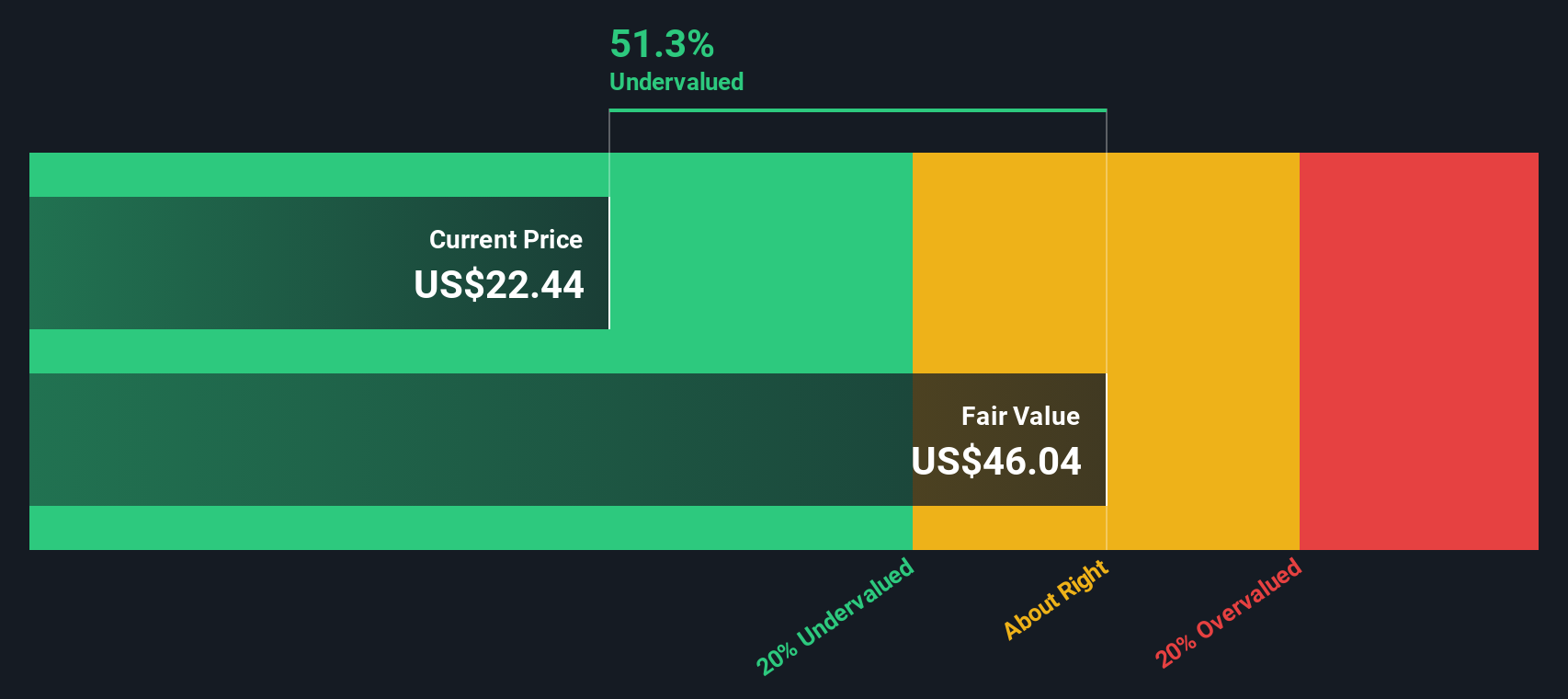

With Halliburton showing a 56% intrinsic discount and only a small 5% gap to average analyst targets, the key question is whether the market is overlooking its nuclear and international growth angles or already pricing them in.

Most Popular Narrative: 8.1% Overvalued

Halliburton’s most followed narrative puts fair value at $31.72, a touch below the recent $34.29 share price, so the story hinges on whether its cash flows justify that gap.

The company's ongoing international diversification, growing faster in regions like Latin America, Africa, and the Middle East, and leveraging U.S.-style unconventional expertise, creates a larger, more stable revenue base and reduces earnings cyclicality, supporting both top-line growth and improved earnings predictability.

Want to see what kind of revenue path, margin uplift and future P/E multiple are built into that fair value math? The narrative spells out the full playbook.

Result: Fair Value of $31.72 (OVERVALUED)

However, the narrative could be knocked off course if faster decarbonization trims long term oilfield spending, or if U.S. shale activity softens more than analysts expect.

Another angle on what the market is pricing in

That 8.1% “overvalued” call from the narrative model sits awkwardly next to our DCF work, which implies a future cash flow value of $77.89 per share versus today’s $34.29. If both cannot be right at once, which set of assumptions do you think is closer to reality?

Build Your Own Halliburton Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised Halliburton story in minutes: Do it your way.

A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If this has sparked new questions, do not stop at one company. Use the tools at your fingertips to quickly surface other opportunities that fit your style.

- Spot opportunities others overlook by scanning our screener containing 23 high quality undiscovered gems and see which under the radar names match your criteria before they get crowded.

- Prioritise resilience with the 85 resilient stocks with low risk scores, so you can focus on companies where our model flags relatively lower risk scores.

- Strengthen the core of your portfolio with the solid balance sheet and fundamentals stocks screener (45 results), built to highlight businesses pairing financial footing with fundamental support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.