Please use a PC Browser to access Register-Tadawul

Halozyme Biotech Acquisitions And M&A Plan Weigh On Valuation Case

Halozyme Therapeutics, Inc. HALO | 70.98 | -1.47% |

- Halozyme Therapeutics (NasdaqGS:HALO) has acquired three biotech startups as part of a broader push to expand its business.

- The company highlighted these transactions alongside fresh CEO commentary on how it is approaching M&A.

- The deals arrive at a time of faster consolidation activity across the biotech sector.

Halozyme focuses on drug delivery and biotechnology platforms, and these new acquisitions signal a clear push to widen its reach within the sector. For investors watching biotech, the cluster of three deals stands out because it ties directly to how the company is thinking about growth through transactions rather than relying only on internal projects.

The CEO’s remarks on M&A provide a clearer view of how Halozyme might use acquisitions, partnerships, or asset deals to build out its portfolio over time. In the context of active deal making across the biotech sector, Halozyme’s approach may shape how investors evaluate its potential pipeline, capital allocation decisions, and possible collaborations with larger pharmaceutical partners.

Stay updated on the most important news stories for Halozyme Therapeutics by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Halozyme Therapeutics.

Quick Assessment

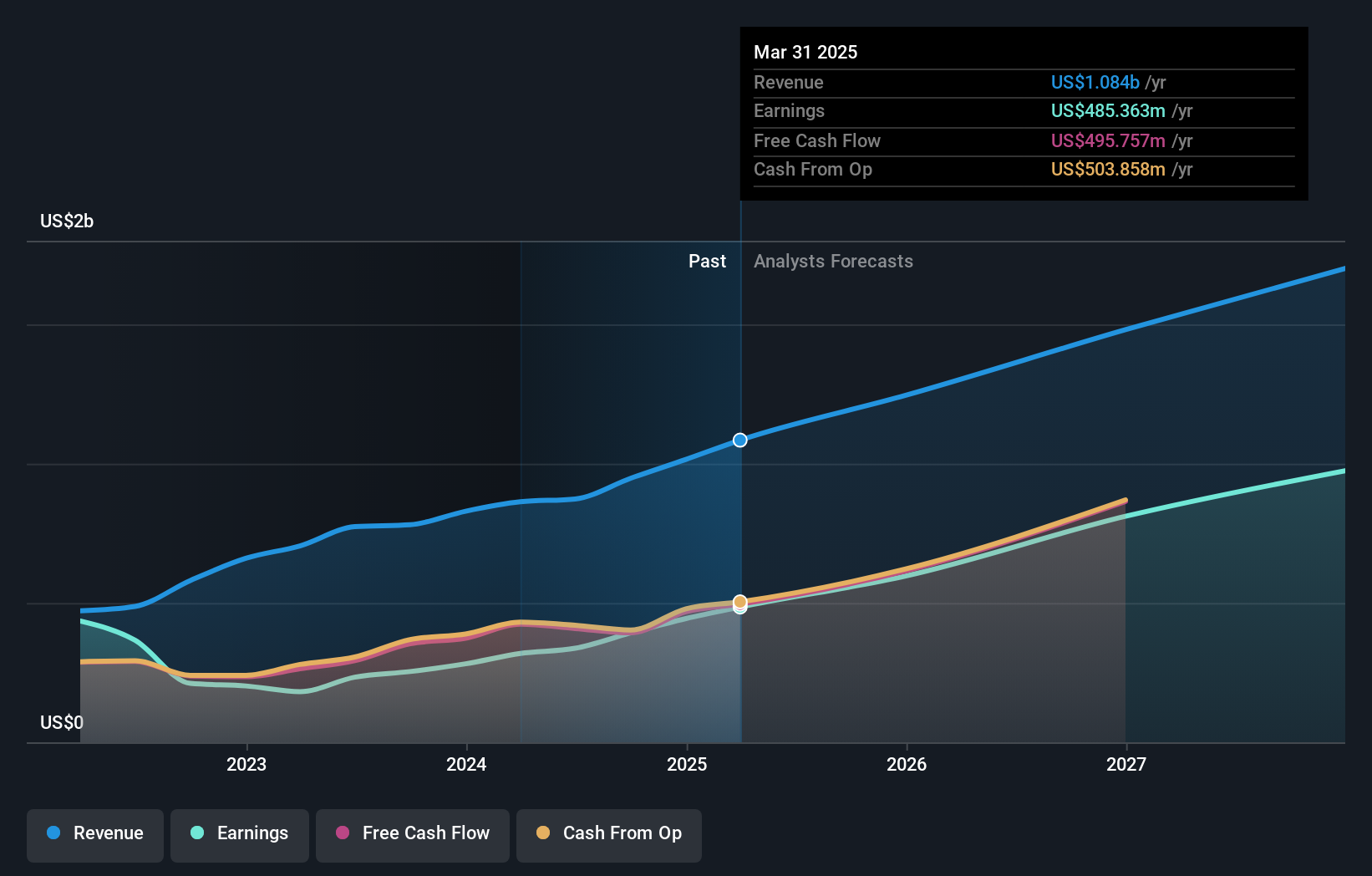

- ⚖️ Price vs Analyst Target: At US$79.51, the share price is about 1.9% above the US$78.00 analyst target, so it sits close to consensus.

- ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading about 61.6% below fair value, which screens as undervalued.

- ✅ Recent Momentum: The 30 day return of roughly 11% shows recent positive price momentum as these acquisitions land.

There is only one way to know the right time to buy, sell or hold Halozyme Therapeutics. Head to Simply Wall St's company report for the latest analysis of Halozyme Therapeutics's Fair Value.

Key Considerations

- 📊 The three biotech acquisitions and clear M&A playbook could reshape Halozyme's future pipeline and revenue mix, so this news goes straight to the core investment case.

- 📊 Watch how management talks about integration, deal costs, and any new revenue or partnership updates on future calls, alongside metrics like P/E of 15.7 versus the 22.3 industry average.

- ⚠️ The company already carries a high level of debt, so added deal commitments make balance sheet strength and funding terms especially important to track.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Halozyme Therapeutics analysis. Alternatively, you can visit the community page for Halozyme Therapeutics to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.