Please use a PC Browser to access Register-Tadawul

Has The Recent Rally Left Matson (MATX) Trading Close To Its Estimated Fair Value?

Matson, Inc. MATX | 167.75 | +1.88% |

- Are you wondering whether Matson at around US$160.66 is offering fair value today, or if the recent run has left the stock looking stretched for new investors like you?

- The share price has seen a 21.7% return over the last 30 days, on top of a 29.9% return year to date and 142.2% over 3 years. However, the last 7 days show a 2.8% decline that may have some investors reassessing the balance of risk and opportunity.

- Recent attention on Matson has centered on its position in US shipping and logistics, as investors weigh how demand for freight services could affect the business and sentiment around the stock. Broader discussions about trade flows and supply chain resilience have also kept the company on the radar of investors who track transportation names closely.

- Despite this price history, Matson currently has a valuation score of 1 out of 6. In this article we will look at how different valuation approaches line up with that score, and then finish with a framework that can help you make more sense of valuation than any single number on its own.

Matson scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Matson Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth by projecting its future cash flows and discounting them back to today using a required rate of return. It focuses on the cash that could be available to shareholders over time, rather than just current earnings.

For Matson, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month free cash flow is about $229.6 million, with analyst and extrapolated estimates pointing to free cash flow of $247.6 million in 2035. Simply Wall St only has direct analyst inputs for the nearer years, and the later years in this 10 year path are extrapolated rather than separately forecast by analysts.

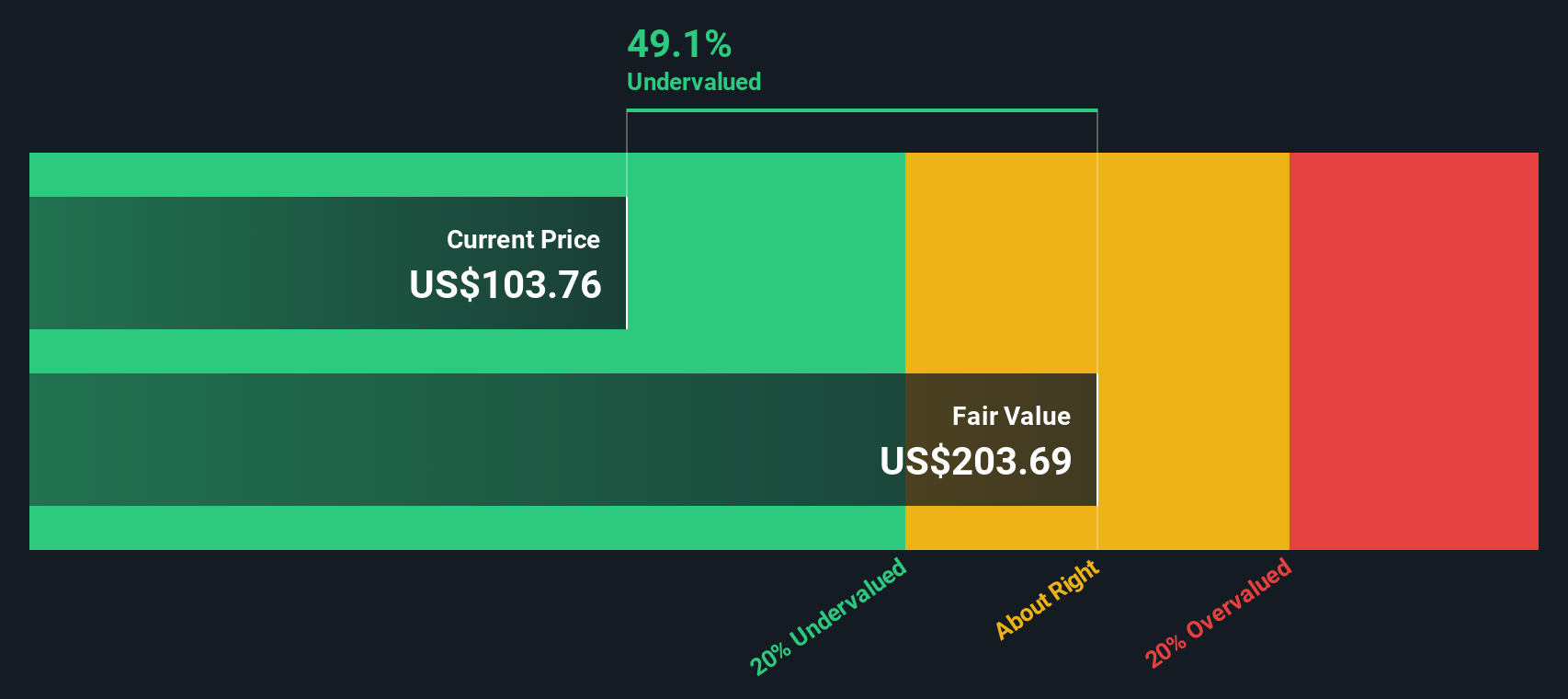

Putting these projected cash flows together, the model arrives at an estimated intrinsic value of about $151.28 per share. Against a recent share price around $160.66, the DCF output implies Matson is roughly 6.2% overvalued, which is a relatively small gap that can easily move around with changes in assumptions.

Result: ABOUT RIGHT

Matson is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Matson Price vs Earnings

For a profitable company like Matson, the P/E ratio is a useful check because it links what you pay per share to the earnings that support that price. It helps you see how many dollars the market is willing to pay for each dollar of current earnings.

What counts as a “normal” or “fair” P/E usually reflects two things: how quickly earnings are expected to grow and how risky those earnings are perceived to be. Higher growth or lower perceived risk often supports a higher P/E, while slower growth or higher risk tends to line up with a lower P/E.

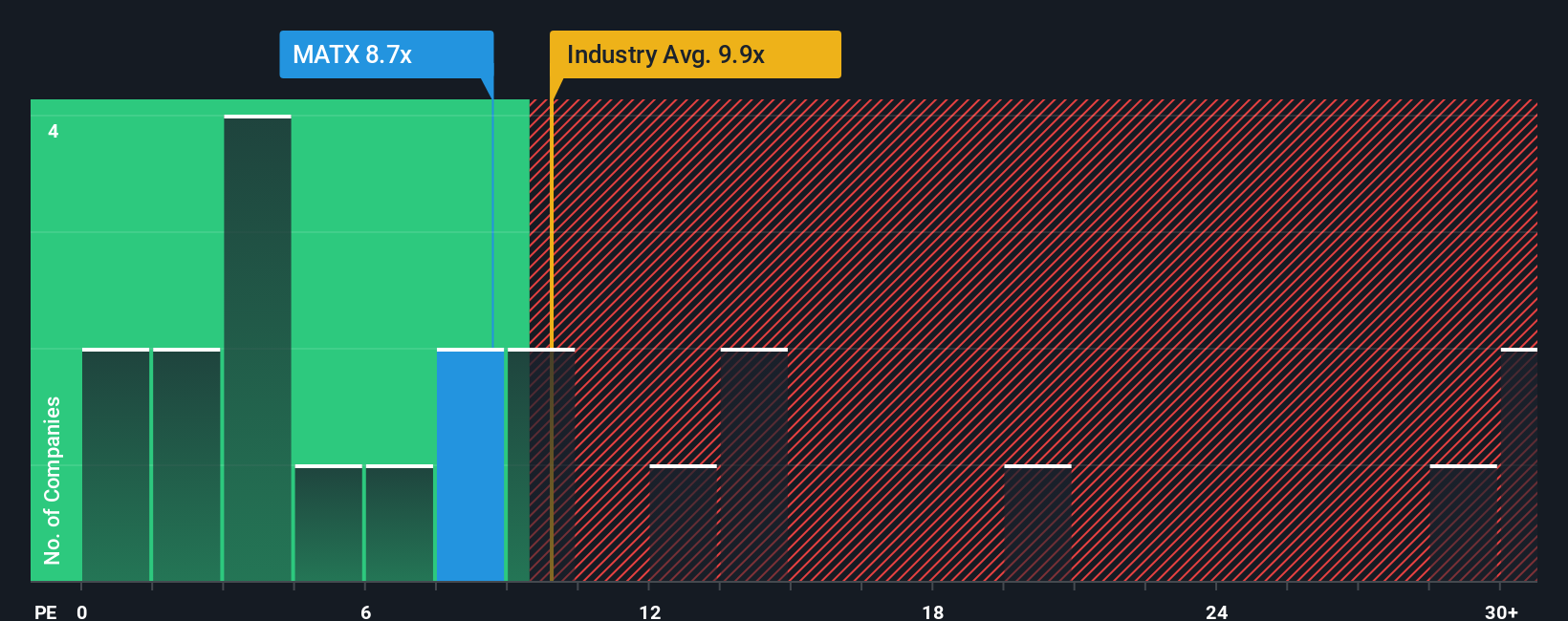

Matson currently trades on a P/E of 11.66x. That is above the Shipping industry average of about 10.17x, but below the broader peer group average of 17.01x. Simply Wall St also calculates a “Fair Ratio” of 11.25x for Matson, which is the P/E it might typically trade on given factors like its earnings profile, industry, profit margins, market cap and specific risks.

The Fair Ratio is more tailored than a simple industry or peer comparison because it incorporates those company specific factors rather than using broad group averages alone. Against this 11.25x Fair Ratio, Matson’s actual 11.66x P/E is only modestly higher, which points to a valuation that is broadly aligned with its fundamentals.

Result: ABOUT RIGHT

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Matson Narrative

Earlier we mentioned that there is an even better way to understand valuation, and on Simply Wall St that means using Narratives. These let you spell out your view of Matson’s story, link it to a set of revenue, earnings and margin assumptions, then turn that into a fair value you can compare with today’s price.

Put simply, a Narrative is your own storyline for the company written in numbers. You decide what you think happens to freight demand, profitability and capital returns. The platform turns that into a forecast and a fair value, and you can then see whether that fair value suggests Matson looks cheap or expensive against the current share price.

These Narratives sit in the Community section used by millions of investors, update automatically when new earnings or news arrive, and show you side by side outcomes. For example, one investor might see fair value around US$213.0 based on higher assumed P/E and margins, while another might anchor closer to US$115.0 with more cautious expectations. This makes it easier to see which story fits your own view before deciding if, when and at what price you might want to act.

For Matson, however, we will make it really easy for you with previews of two leading Matson Narratives:

Fair value in this bull case narrative: US$213.0 per share

Implied discount to fair value at the recent US$160.66 share price: around 24.5%

Revenue growth assumption used in this narrative: 2.85%

- Focuses on continued benefits from Southeast Asia expansion, fleet modernization and logistics technology supporting premium services and higher quality revenue.

- Builds in analysts' assumptions for slightly positive revenue growth, lower profit margins and higher future P/E, with buybacks helping earnings per share.

- Flags risks such as trade tensions, industry overcapacity, tighter environmental rules and Matson's concentration in Hawaii and the Pacific, and encourages you to test whether the bullish inputs match your own view.

Fair value in this bear case narrative: US$115.0 per share

Implied premium to fair value at the recent US$160.66 share price: around 39.6%

Revenue growth assumption used in this narrative: 0.14% decline per year

- Argues that pressure on Asia origin volumes, evolving trade policies and higher compliance costs could limit the benefit from Southeast Asia exposure and fleet upgrades.

- Assumes slightly declining revenue, narrower profit margins and a lower future P/E than the bull case, even while buybacks reduce the share count.

- Highlights concentration in key routes, potential long term pressure on transpacific volumes, higher capital spending needs and geopolitical risks as reasons the current share price could sit above what the business is worth.

These two Narratives frame the same company with different assumptions. If you want to see how other investors are joining the dots on Matson's earnings, risk profile and valuation, Curious how numbers become stories that shape markets? Explore Community Narratives.

Do you think there's more to the story for Matson? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.