Please use a PC Browser to access Register-Tadawul

HealthEquity (HQY) Is Up 5.5% After Launching GLP-1 Access and Digital HSA Enrollment Platforms

HealthEquity Inc HQY | 96.79 | -0.62% |

- HealthEquity, Inc. recently announced two new consumer-focused initiatives: a curated platform for HealthEquity HSA members to access affordable healthcare solutions starting with GLP-1 weight management medications, and a direct enrollment platform enabling individuals to open and fund HSAs digitally.

- These offerings come as HSAs reach nearly US$147 billion across more than 39 million accounts, and coincide with new eligibility rules that could make millions more Americans able to open HSAs, significantly increasing access to tax-advantaged healthcare solutions.

- We'll examine how HealthEquity's launch of GLP-1 access for HSA members could reshape its growth story and investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

HealthEquity Investment Narrative Recap

To remain confident in HealthEquity as a shareholder, you would need to believe that the company can capitalize on the expanding HSA market despite volatile interest rates and macroeconomic uncertainty. The recent launch of affordable GLP-1 access and direct HSA enrollment platforms could support short-term account growth, a primary near-term catalyst, but does not materially reduce the company’s exposure to earnings volatility if interest rates decline, which remains the most significant current risk.

Among the latest announcements, HealthEquity’s direct HSA enrollment platform stands out due to recent regulatory changes that could make millions more Americans eligible for HSAs. This creates a meaningful tailwind for organic account and asset growth, reinforcing a key catalyst while putting the company’s scale and technology investments to the test.

Yet for all the promise, investors should be aware that heavy reliance on interest income exposes HealthEquity to a risk that could quickly shift the outlook if the rate environment changes…

HealthEquity's narrative projects $1.6 billion revenue and $325.3 million earnings by 2028. This requires 7.9% yearly revenue growth and a $179.5 million earnings increase from $145.8 million today.

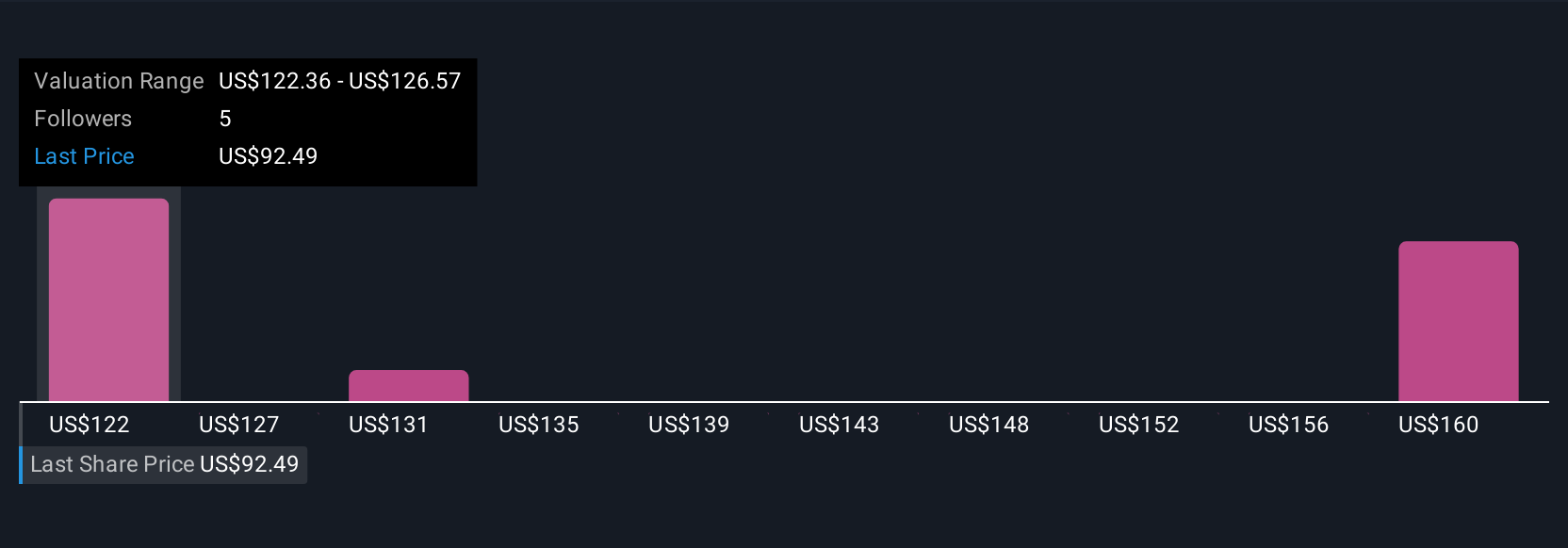

Uncover how HealthEquity's forecasts yield a $122.36 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Four retail fair value estimates from the Simply Wall St Community span from US$97.01 to US$168.06, suggesting wide-ranging outlooks for HealthEquity. Strong regulatory tailwinds may help fuel future HSA account growth, but readers should consider multiple perspectives when evaluating potential performance.

Explore 4 other fair value estimates on HealthEquity - why the stock might be worth as much as 74% more than the current price!

Build Your Own HealthEquity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HealthEquity research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HealthEquity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HealthEquity's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.