Please use a PC Browser to access Register-Tadawul

HEICO (NYSE:HEI) Reports Strong Q1 2025 Earnings Amid Volatile Market

HEICO Corporation HEI | 310.49 | -1.51% |

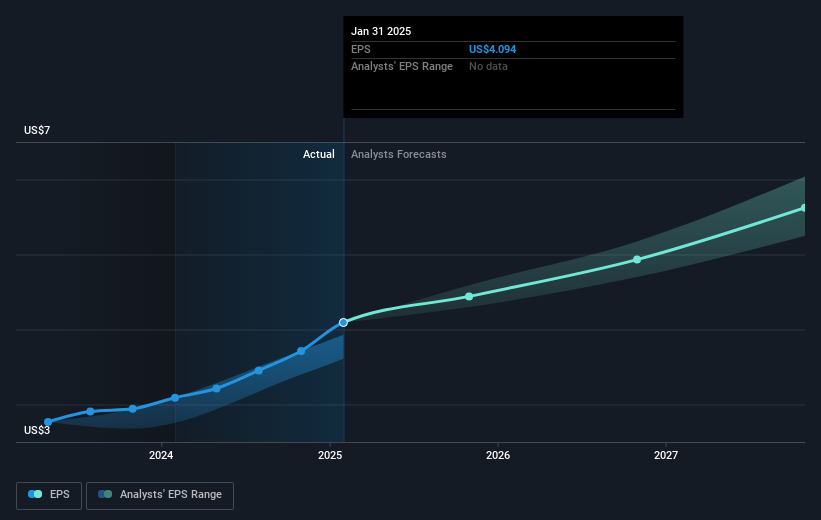

HEICO (NYSE:HEI) recently reported strong earnings for Q1 2025, with sales and net income rising significantly from the previous year, amid the backdrop of a volatile market that saw a 12% decline. Additionally, a seamless transition in the company's leadership with the retirement of its Chief Accounting Officer likely reinforced investor confidence, counterbalancing wider market uncertainties related to trade tensions. Despite the industry's broader challenges, including those impacting technology and airline sectors due to tariff concerns, HEICO's solid financial performance has been a steadying factor, resulting in a price move of 5% over the last quarter.

The recent positive earnings report by HEICO is a significant factor in reinforcing investor confidence, particularly in a volatile market. The company's robust financial performance, coupled with the seamless leadership transition, may strengthen its strategic position in the defense, space, and commercial aviation sectors. These developments could potentially support the company's future revenue growth and earnings as it aligns with pro-business agendas. Over the past five years, HEICO has achieved a total shareholder return of 207.84%, illustrating strong long-term performance.

When comparing its recent performance against the US Aerospace & Defense industry over the last year, HEICO's return exceeded the sector's average annual performance, indicating resilience amid industry-specific challenges. The company's recent advancements may positively affect revenue and earnings forecasts, as the strategic focus is likely to capitalize on new opportunities and acquisitions. This could further drive revenue and boost long-term shareholder value. With the current share price at $270.21 and an analyst price target of $276.31, this modest difference suggests stability and aligns with analyst expectations for future company growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.