Please use a PC Browser to access Register-Tadawul

Hertz (HTZ): Assessing Valuation After Pershing Square's Stake and Rising Short Interest

HERTZ GLOBAL HOLDINGS, INC. HTZ | 4.90 | -3.54% |

Hertz Global Holdings (HTZ) is back in the spotlight after Bill Ackman’s Pershing Square Capital Management revealed a 19.8% ownership stake. This move, combined with a hefty short interest near 45%, has investors buzzing about possible market shifts.

Even with this high-profile investment and ongoing talk about a short squeeze, Hertz’s share price has continued its volatile ride, down nearly 16% over the last month and falling sharply in recent sessions. Despite recent losses, its one-year total shareholder return still stands at an impressive 60%. However, this follows a challenging longer-term period where the three-year total return remains deeply negative, indicating that near-term momentum is struggling to overcome past headwinds.

If the action around Hertz has you curious about what else is moving, this is a great moment to broaden your search and discover See the full list for free.

With heavyweights like Ackman entering the picture and short interest near record highs, the focus now turns to fundamentals. Is the recent sell-off creating a real buying opportunity, or is the market already pricing in any potential recovery?

Most Popular Narrative: 29.9% Overvalued

The most widely followed narrative sees Hertz trading well above its calculated fair value, pricing in a turnaround ahead of any return to profitability. With shares at $5.22 versus a fair value estimate of $4.01, the gap highlights a skeptical stance on how fast the company's fundamentals can catch up to market expectations.

The continuous shift towards urbanization and increased use of multi-modal transport solutions (such as ride-sharing, public transit, and micro-mobility) threatens to reduce reliance on and demand for conventional car rentals, shrinking Hertz's addressable market and impacting future revenue potential. Persistent pricing pressures, highlighted by delayed improvements in rate per day and the need for modernization of revenue management systems, suggest that Hertz may struggle to achieve projected net margin expansion, particularly in an industry facing increasing competition and volatile demand.

Curious what bold financial projections underpin this valuation? The narrative hints at a make-or-break shift in margins and long-term revenue that could shock the industry. Only a deep dive will reveal the assumptions fueling this gap between fair value and current price.

Result: Fair Value of $4.01 (OVERVALUED)

However, if Hertz’s revamped fleet drives down costs and its digital partnerships unlock new value, this narrative could shift faster than many expect.

Another View: Value Signals Send a Different Message

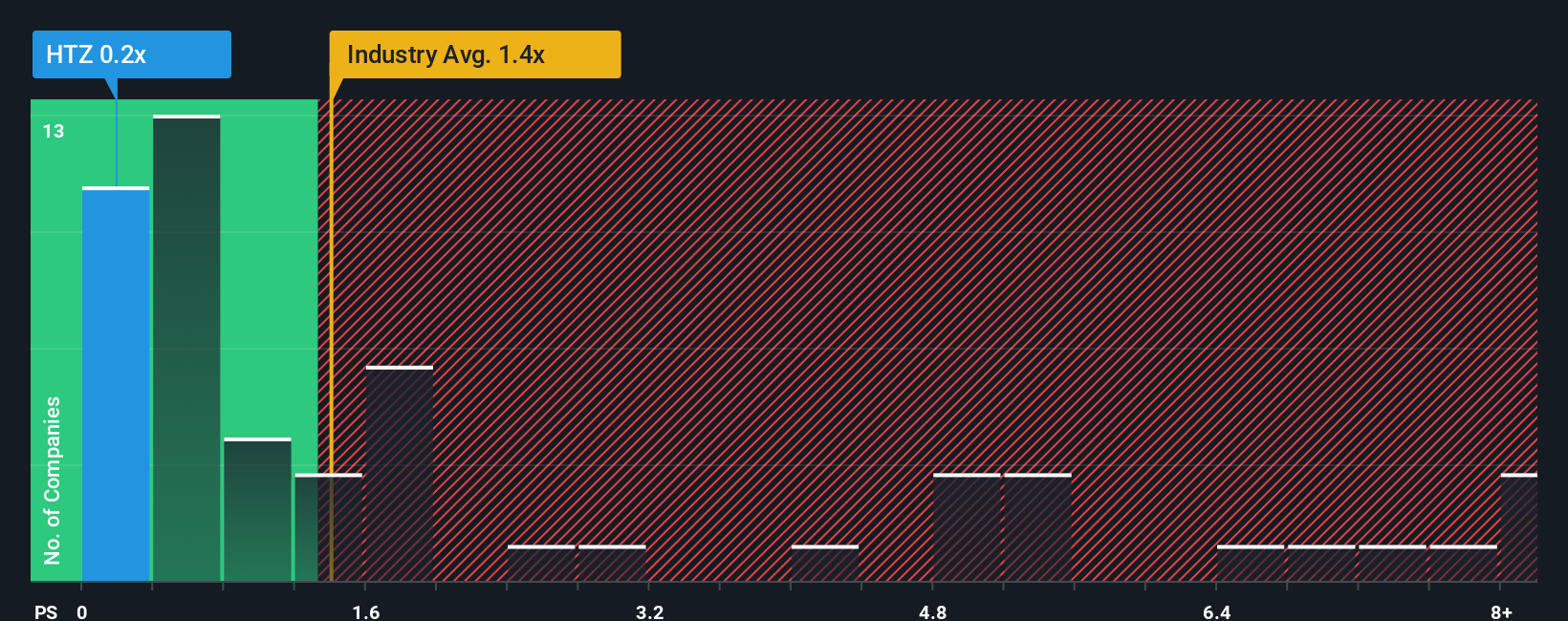

While the analyst consensus sees Hertz as overvalued compared to its fair value, the market’s favorite yardstick tells a different story. Hertz’s price-to-sales ratio sits at just 0.2x, well below both the US Transportation average (1.4x) and its peers (2.4x), and even under the fair ratio of 0.4x. This signals the market is demanding a much steeper discount than history might suggest. This may hint at either deep skepticism or potential opportunity. Does this gap reveal a hidden upside or highlight real risks?

Build Your Own Hertz Global Holdings Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own Hertz story in just a few minutes. Do it your way

A great starting point for your Hertz Global Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity slip by while others seize tomorrow’s winners. Use the Simply Wall Street Screener to pinpoint stocks that can level up your portfolio.

- Unlock high yield potential and start earning with these 18 dividend stocks with yields > 3% offering robust dividends and consistent payouts above 3%.

- Accelerate your growth strategy by targeting these 24 AI penny stocks at the forefront of cutting-edge artificial intelligence innovation.

- Snap up value by finding these 869 undervalued stocks based on cash flows trading below their estimated future cash flows for a bargain entry point.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.