Please use a PC Browser to access Register-Tadawul

Hewlett Packard Enterprise (HPE): Exploring Valuation After Recent Share Strength and Operational Gains

Hewlett Packard Enterprise Co. HPE | 23.87 | -2.73% |

Shares of Hewlett Packard Enterprise have shown renewed strength lately, highlighting a gradual but meaningful uptrend as the market starts factoring in the company’s consistent operational results. While momentum is building, solid revenue expansion and net income growth have supported a sturdy 1-year total shareholder return of 22%, as well as an impressive 3-year total return above 113%.

If recent strength in HPE has you curious about other opportunities in tech, now is the perfect time to explore the full range of innovation with our curated See the full list for free.

With shares approaching analyst price targets but still trading at a noticeable discount to some measures of intrinsic value, the question becomes whether HPE is undervalued or if the company’s future growth is already priced in.

Most Popular Narrative: 5.4% Undervalued

Hewlett Packard Enterprise’s latest narrative valuation estimates fair value just above the last close, suggesting there is still room for upside as the market catches up to company fundamentals.

Operational efficiencies and cost-saving initiatives are expected to further improve margins, boost free cash flow, and support long-term earnings growth. Strategic acquisitions and expansion in high-growth technologies, including the integration of Juniper, launches of next-generation Gen12 servers, and AI-driven management platforms, are enhancing HPE's competitive positioning in edge, networking, and AI. These efforts are laying the groundwork for continued share gains and outsized revenue growth relative to traditional industry averages.

Which bold earnings projections and margin leaps drive this valuation higher? The narrative depends on tech platform expansion and profit forecasts rarely seen in legacy hardware companies. Want to see exactly which explosive financial assumptions will keep investors talking?

Result: Fair Value of $25.82 (UNDERVALUED)

However, lingering integration challenges after the Juniper acquisition and continued competition in legacy hardware could slow HPE's anticipated margin expansion and growth.

Another View: Market Ratios Paint a Cautious Picture

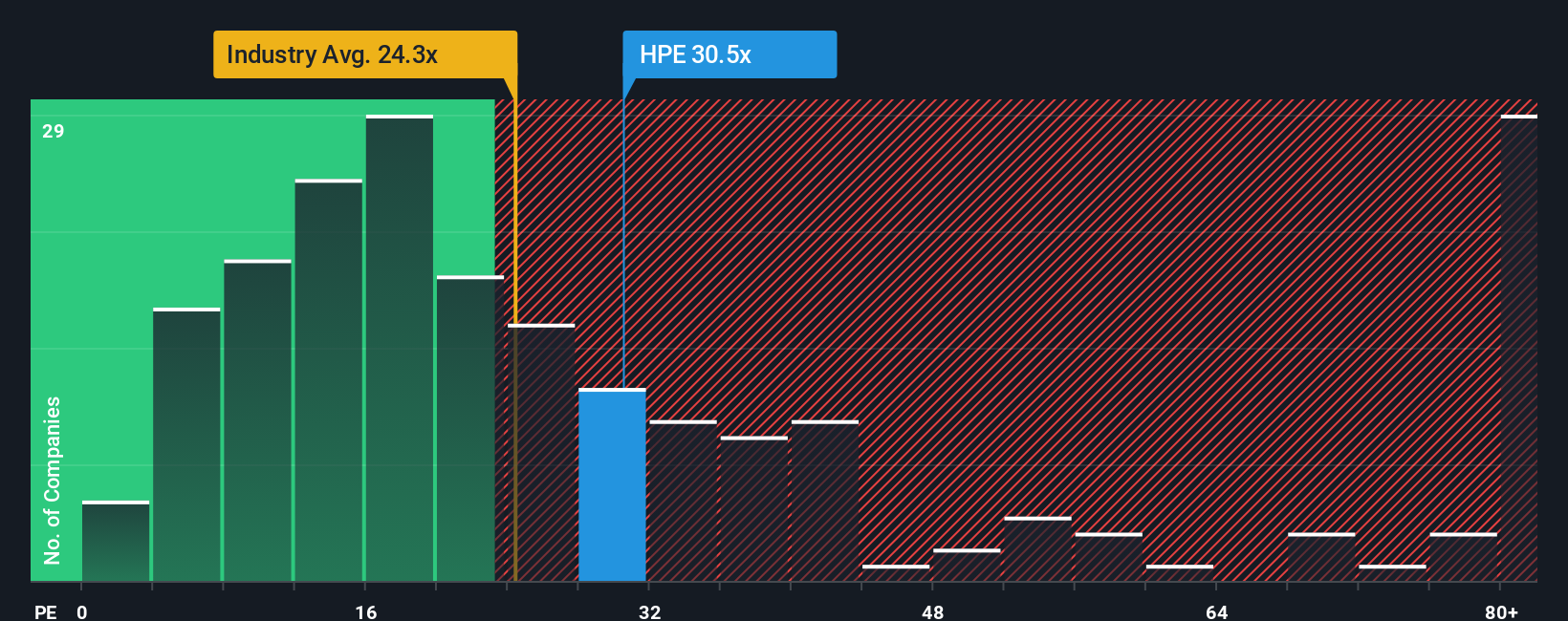

While some models point to HPE's upside, the market is pricing its shares at a price-to-earnings ratio of 28.4x, which stands higher than both the peer average of 23.7x and the global tech industry benchmark of 24x. Despite a fair ratio closer to 47.4x, investors could face valuation risk if industry standards weigh more heavily on future pricing. Does this high multiple signal optimism or a need for careful second-guessing as the sector shifts?

Build Your Own Hewlett Packard Enterprise Narrative

If these conclusions do not match your view or you want to check the numbers yourself, you can shape your own HPE narrative and insights in just a few minutes. Do it your way.

A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay a step ahead by tracking markets beyond just one company. Don’t let standout opportunities pass you by as trends shift fast.

- Capitalize on the next wave of artificial intelligence leaders by targeting these 24 AI penny stocks as they rapidly redefine entire industries with new tech breakthroughs.

- Secure reliable income streams when you seek out these 19 dividend stocks with yields > 3% that reward shareholders with robust payouts and proven cash flow stability.

- Position yourself ahead of the curve by evaluating these 78 cryptocurrency and blockchain stocks as they revolutionize payments and digital infrastructure on a global scale.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.