Please use a PC Browser to access Register-Tadawul

High Insider Ownership Fuels Growth Stocks In July 2025

WK Kellogg Co Common Stock KLG | 23.00 | Delist |

In July 2025, the U.S. markets have been experiencing mixed movements as inflation data and earnings reports from major financial institutions influence investor sentiment. Despite these fluctuations, major indices like the Nasdaq Composite continue to reach record highs, driven by strong performances in the tech sector. In this environment, growth companies with high insider ownership can offer unique insights into potential investment opportunities as insiders who hold significant stakes may be more aligned with long-term company success and shareholder value creation.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Victory Capital Holdings (VCTR) | 10.1% | 32.5% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Ryan Specialty Holdings (RYAN) | 15.6% | 95.3% |

| Prairie Operating (PROP) | 34.6% | 92.4% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 48.2% |

| Credo Technology Group Holding (CRDO) | 11.8% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 13% | 44.4% |

Let's review some notable picks from our screened stocks.

Sportradar Group (SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sportradar Group AG operates as a provider of sports data services for the sports betting and media industries across various global regions, with a market cap of approximately $8.54 billion.

Operations: The company's revenue is primarily derived from its Data Processing segment, which generated €1.15 billion.

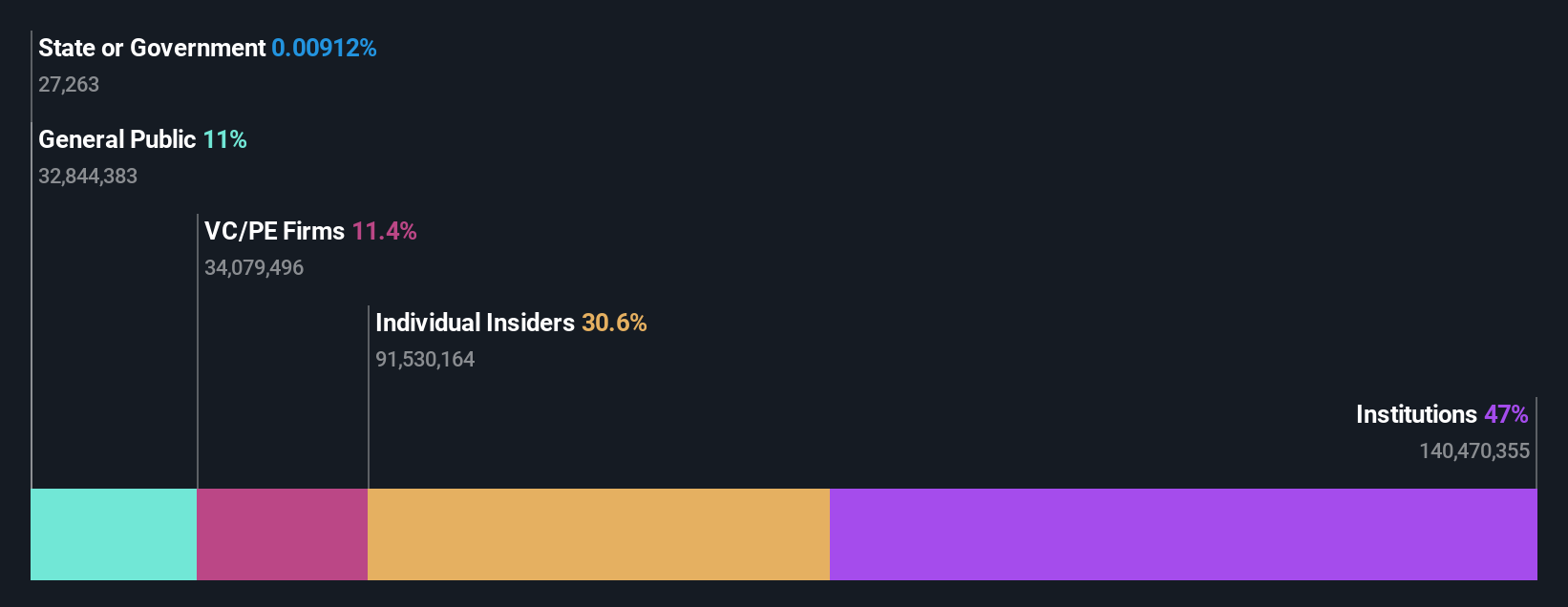

Insider Ownership: 30.6%

Sportradar Group is poised for significant growth, with earnings forecasted to increase by 32.9% annually, surpassing the US market's average. Trading at 30.7% below its estimated fair value, it represents a potentially attractive investment opportunity despite a low projected return on equity of 11.8%. The recent partnership with DAZN for exclusive FIFA Club World Cup data rights enhances its expansive sports portfolio and could drive revenue growth beyond the expected 13% annually.

Hims & Hers Health (HIMS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally, with a market cap of approximately $10.72 billion.

Operations: The company's revenue is primarily generated through its online retailers segment, which amounts to $1.78 billion.

Insider Ownership: 13%

Hims & Hers Health faces challenges following the termination of its partnership with Novo Nordisk due to alleged deceptive practices, impacting its share price. Despite this setback, the company is forecasted to achieve significant earnings growth at 22.6% annually, outpacing the US market average. Trading at a substantial discount to its estimated fair value, Hims & Hers remains focused on expanding personalized healthcare solutions through technological advancements and strategic leadership appointments.

WK Kellogg Co (KLG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WK Kellogg Co is a food company operating in the United States, Canada, Mexico, and the Caribbean with a market cap of approximately $1.97 billion.

Operations: The company's revenue primarily comes from the manufacturing, marketing, and sales of cereal products, totaling $2.66 billion.

Insider Ownership: 12.5%

WK Kellogg Co is experiencing significant earnings growth, forecasted at 28.3% annually, despite anticipated revenue declines of 0.7% per year over the next three years. The company recently announced its acquisition by Ferrero International S.A. for US$2.1 billion, with a cash consideration of US$23 per share, pending regulatory and shareholder approval expected in the second half of 2025. This strategic move follows WK Kellogg's addition to several Russell Value Indexes in June 2025.

Summing It All Up

- Embark on your investment journey to our 192 Fast Growing US Companies With High Insider Ownership selection here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.