Please use a PC Browser to access Register-Tadawul

High Insider Ownership Growth Companies To Watch In June 2025

Orange County Bancorp OBT | 28.95 | -0.99% |

Over the past year, the United States market has seen a 13% increase, with earnings projected to grow by 14% annually. In this thriving environment, stocks that combine robust growth potential with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Prairie Operating (PROP) | 34.5% | 71.1% |

| OS Therapies (OSTX) | 23.2% | 13.4% |

| Hesai Group (HSAI) | 21.3% | 45.2% |

| FTC Solar (FTCI) | 27.9% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Duolingo (DUOL) | 14.3% | 40% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.7% | 44.4% |

Let's uncover some gems from our specialized screener.

Orange County Bancorp (OBT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Orange County Bancorp, Inc. operates through its subsidiaries to offer commercial and consumer banking products and services, with a market cap of $329.38 million.

Operations: The company's revenue is derived from two main segments: Wealth Management, contributing $12.80 million, and Banking (excluding Wealth Management), accounting for $88.08 million.

Insider Ownership: 12.1%

Return On Equity Forecast: N/A (2028 estimate)

Orange County Bancorp exhibits characteristics of a growth company with high insider ownership, despite recent substantial insider selling. Its earnings are forecasted to grow at 22.5% annually, outpacing the US market. The stock is trading significantly below its estimated fair value, with analysts predicting a 21.6% price increase. Recent events include a $39.999998 million follow-on equity offering and steady dividend declarations, though shareholders have experienced dilution over the past year.

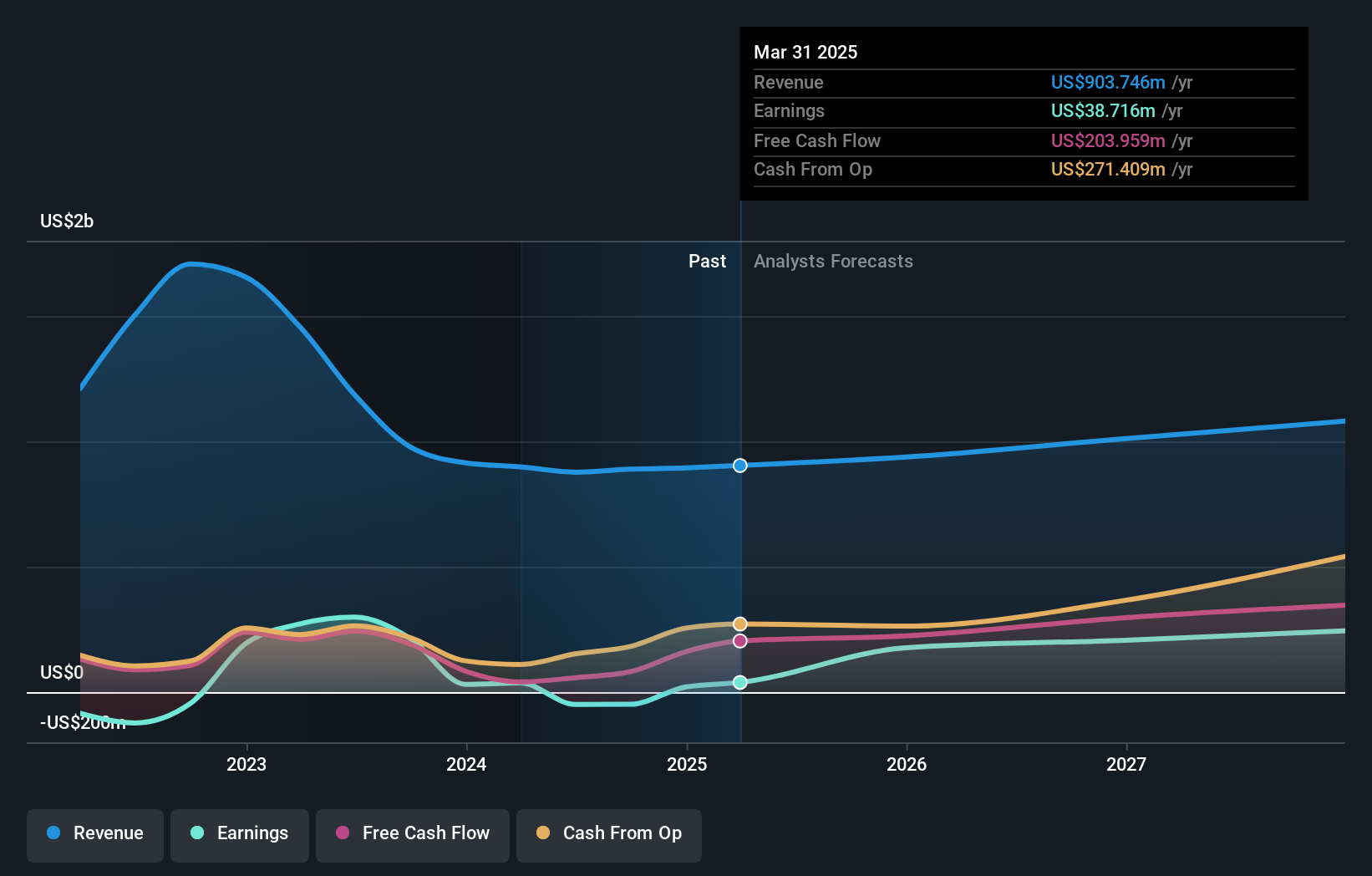

CarGurus (CARG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CarGurus, Inc. operates an online automotive platform facilitating the buying and selling of vehicles both in the United States and internationally, with a market cap of approximately $3.17 billion.

Operations: The company's revenue is primarily generated from its U.S. Marketplace segment, which accounts for $755.93 million, followed by the Digital Wholesale segment at $82.13 million.

Insider Ownership: 15.2%

Return On Equity Forecast: 33% (2028 estimate)

CarGurus demonstrates growth potential with earnings projected to grow at 31% annually, surpassing US market expectations. Despite revenue growth trailing the market, the company trades significantly below its estimated fair value. Recent innovations include an AI-powered search experience enhancing user interaction on their platform. The first quarter of 2025 showed strong financial performance with net income rising to US$39.05 million, and a completed share buyback worth US$184.21 million further supports shareholder value.

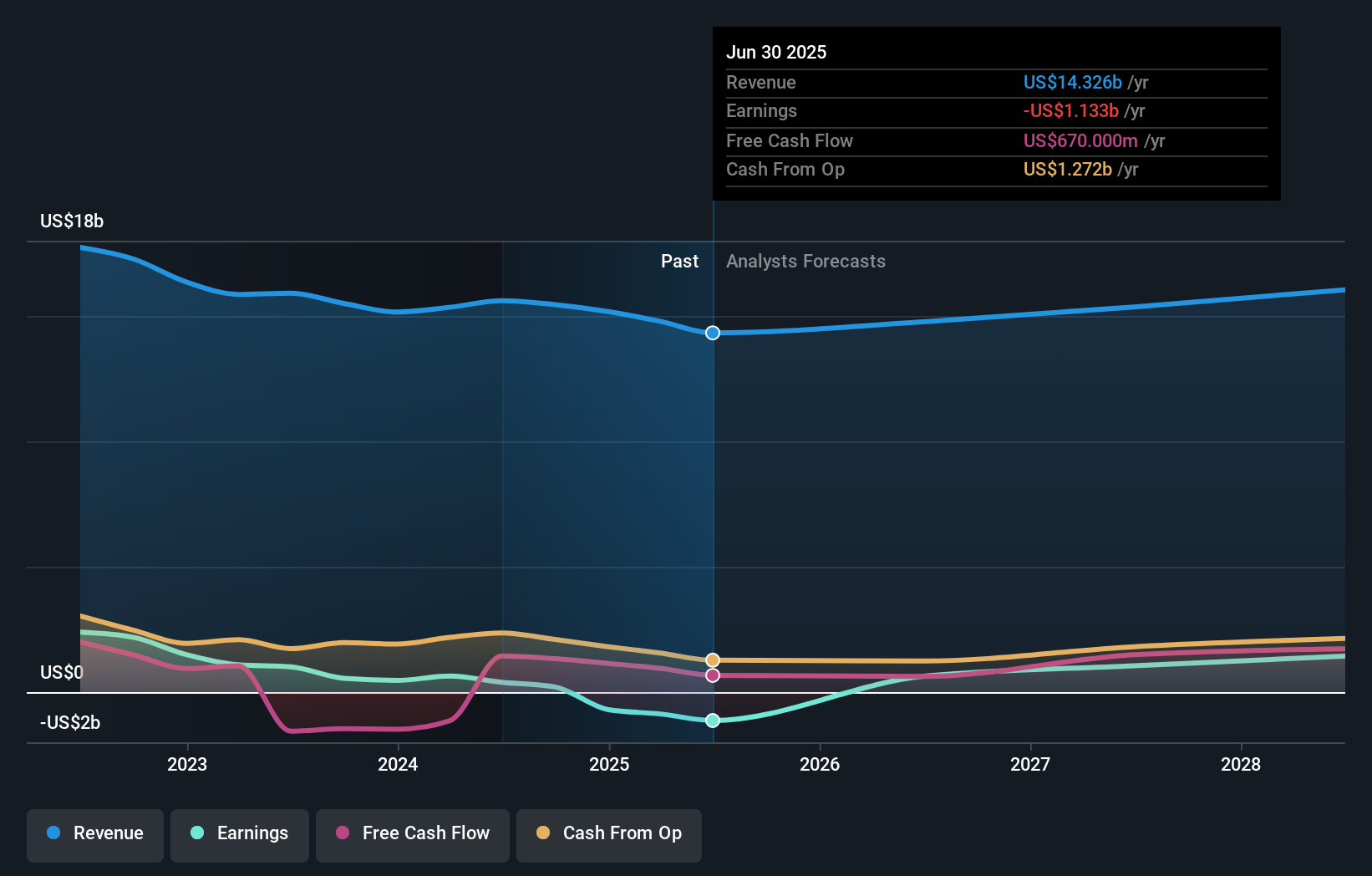

Estée Lauder Companies (EL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Estée Lauder Companies Inc. manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide with a market cap of approximately $24.82 billion.

Operations: The company's revenue segments consist of $7.29 billion from skin care, $4.33 billion from makeup, $2.47 billion from fragrance, and $589 million from hair care.

Insider Ownership: 12.7%

Return On Equity Forecast: 29% (2028 estimate)

Estée Lauder Companies faces challenges with a significant decline in travel retail sales, yet it is expected to become profitable within three years, outpacing average market growth. The stock trades well below its estimated fair value. Recent leadership appointments aim to drive innovation and enhance brand strategies. Despite high debt levels and slower revenue growth projections compared to the US market, earnings are forecasted to grow significantly at 68.45% annually, indicating potential for recovery and expansion.

Turning Ideas Into Actions

- Gain an insight into the universe of 192 Fast Growing US Companies With High Insider Ownership by clicking here.

- Seeking Other Investments? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.