Please use a PC Browser to access Register-Tadawul

Hilton (HLT): How Brand Expansion and Jacksonville Launch Shape the Latest Valuation Narrative

Hilton Worldwide Holdings, Inc. HLT | 272.25 | -0.44% |

Hilton Worldwide Holdings (NYSE:HLT) is making headlines with the launch of its 25th brand, Outset Collection, and the recent opening of a flagship hotel on Jacksonville’s Mayo Clinic campus. These moves highlight a focused growth strategy and an expanding presence in key markets.

Hilton’s latest brand launch and its high-profile Jacksonville debut come at a time when investor momentum is still building. Over the past year, Hilton’s total shareholder return hit a solid 12%, underscoring management’s commitment to long-term performance, even as the stock’s shorter-term movements have been relatively muted.

If Hilton’s steady progress has you curious about standout growth stories, now is a great time to explore fast growing stocks with high insider ownership

With shares climbing steadily but hovering just shy of analyst targets, the question is whether Hilton is now undervalued or if recent successes mean the market has already priced in its next stage of growth.

Most Popular Narrative: 4.9% Undervalued

Hilton’s last closing price of $260.18 sits just below the most popular narrative’s fair value estimate of $273.50, suggesting some upside potential if key drivers pan out. The debate centers on whether fast global expansion and investment in premium experiences will translate to lasting value for shareholders.

The rapid expansion of Hilton's development pipeline, including opening 221 hotels in the quarter and a record 510,000 rooms in progress, with strategic focus on emerging markets (Asia-Pacific, Africa, India), positions Hilton to capture rising demand from growing middle-class travelers worldwide. This supports long-term revenue and earnings growth. Hilton's emphasis on new lifestyle and luxury brands, plus robust conversion activity leveraging its existing portfolio, enables the company to address shifting consumer preferences toward experiential travel and premium accommodations. This approach is expected to fuel future RevPAR growth and higher net margins.

Want to unpack the assumptions behind this edge? This outlook counts on Hilton turning expansion into headline growth, reaching profit margins and multiples that defy recent history. Find out what numbers the narrative is banking on and why analysts think it justifies a premium price.

Result: Fair Value of $273.50 (UNDERVALUED)

However, ongoing RevPAR weakness in key regions and increased competition for property conversions could limit Hilton’s growth and put pressure on profit margins going forward.

Another View: Multiples Signal a Premium Price

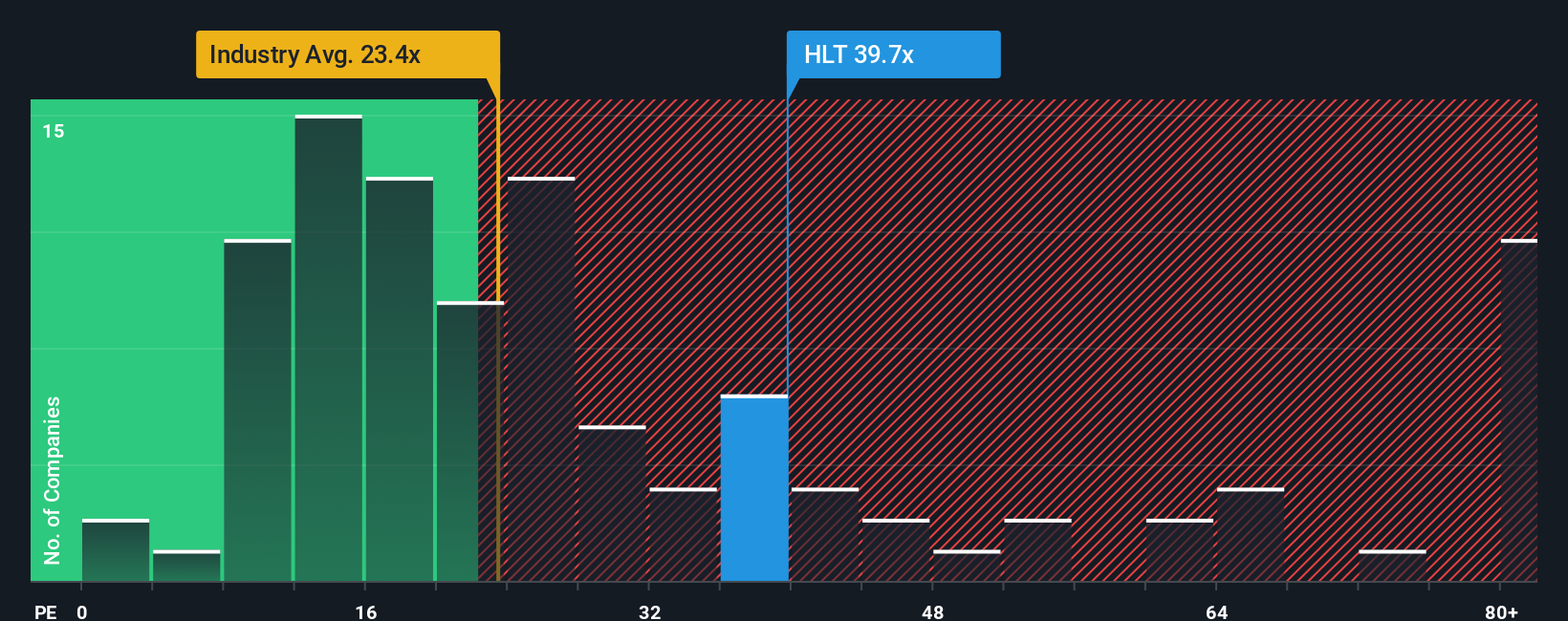

Looking at Hilton's valuation through the lens of earnings multiples reveals a very different picture. The company trades at 38.5 times earnings, well above both the US Hospitality industry average of 24.4 and its peer average of 24.1. Even against the fair ratio of 31.1, Hilton appears expensive. This sizable gap points to increased valuation risk, raising the question: are investors paying too much for future growth?

Build Your Own Hilton Worldwide Holdings Narrative

If you see these numbers differently or want to dig into the details yourself, you can build your own view of Hilton in just a few minutes. Do it your way.

A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy? Seize new opportunities with companies making waves in emerging industries and untapped markets using the tools below.

- Capitalize on high-yield potential with these 19 dividend stocks with yields > 3%, offering consistent income streams that go beyond traditional investments.

- Find undervalued gems ready for tomorrow’s upside. Start your search with these 894 undervalued stocks based on cash flows for stocks that may be flying under the radar.

- Position yourself at the forefront of innovation by following these 25 AI penny stocks, transforming the landscape with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.