Please use a PC Browser to access Register-Tadawul

Honest Company (HNST): A Deep Dive Into Valuation Perspectives and Market Sentiment

The Honest Company, Inc. HNST | 2.86 2.86 | -1.38% 0.00% Pre |

Honest Company (HNST) shares have caught the eye of investors this week, as recent trading reflects shifts in overall sentiment. The company’s performance continues to spark conversations about its value and future direction.

Honest Company’s share price has struggled lately, with a 30-day share price return of -5.47% and a year-to-date drop of 44.04%. However, the one-year total shareholder return presents a more resilient story at just -2.81%, while the three-year figure stands in positive territory at 8.57%. This suggests that long-term investors have still seen reasonable gains even as shorter-term momentum remains muted.

If you’re interested in broadening your search beyond a single name, now is a great moment to discover fast growing stocks with high insider ownership.

With its shares trading well below analyst price targets despite signs of improving profitability, the question remains: is Honest Company quietly undervalued, or are investors right to see limited upside from here?

Most Popular Narrative: 44% Undervalued

Honest Company's latest close sits well below the consensus fair value, with the narrative suggesting the market may be too bearish. There are strong drivers of future potential that bulls are watching closely at this price.

The company is capitalizing on the accelerating shift towards natural and clean-label products, evident from strong growth in sensitive skin, fragrance-free, and natural baby personal care items. This positions Honest to benefit from increasing consumer demand and supports future revenue expansion.

Want to know what financial assumptions could power such a large gap between price and fair value? Hint: this narrative relies on ambitious growth, expanding margins, and bold projections for future profits. The valuation is based on numbers that might surprise even seasoned investors. Click through to find out what the bulls are seeing.

Result: Fair Value of $6.79 (UNDERVALUED)

However, slowing revenue growth and potential tariff risks could quickly challenge the optimistic view. This may make the company's future performance less certain.

Another View: Market Ratios Send a Different Signal

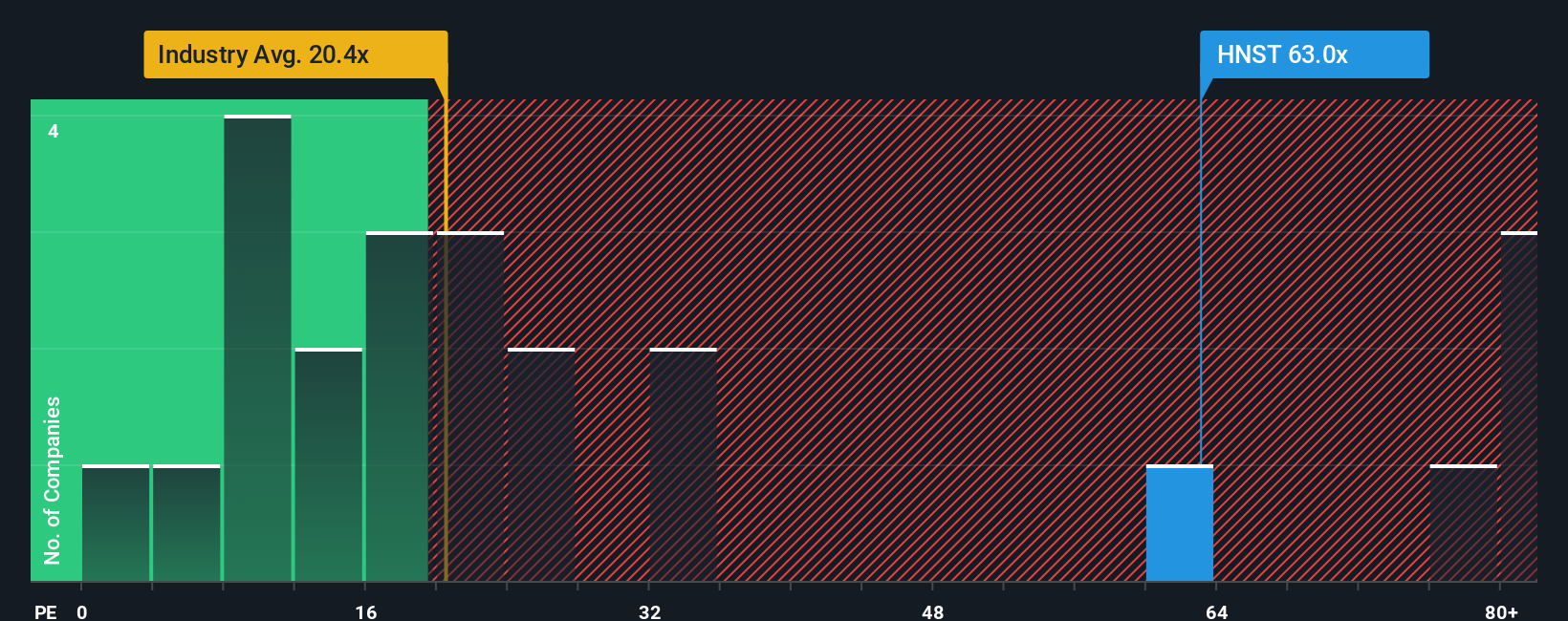

Looking at price-to-earnings multiples offers a much less optimistic take on Honest Company’s valuation. Shares trade at 64.1x earnings, which is far higher than peers at 11.9x and the fair ratio of 21.3x. Such a wide gap could signal market skepticism about delivering on growth or profit projections. Could this premium mean investors are underestimating risks, or is the market poised for a turnaround?

Build Your Own Honest Company Narrative

If you have your own perspective or want to examine the figures firsthand, you can build your unique case for Honest Company in just a few minutes. Do it your way

A great starting point for your Honest Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just stop here. Take your strategy to the next level by checking out other high-potential opportunities that could quickly transform your portfolio.

- Fuel your search for strong recurring income by checking out these 18 dividend stocks with yields > 3%, selected for solid yields and stable growth potential.

- Spot breakout tech trends before the crowd and see which companies are leading breakthroughs through these 25 AI penny stocks.

- Capitalize on undervalued opportunities poised for a rebound by scanning through these 880 undervalued stocks based on cash flows, which are rooted in solid fundamentals and future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.