Please use a PC Browser to access Register-Tadawul

Horace Mann Educators (HMN): Revisiting Valuation After Strong Q3 Results and Upgraded Full-Year Outlook

Horace Mann Educators Corporation HMN | 44.77 | -1.24% |

Horace Mann Educators (HMN) just posted an exceptional third quarter and lifted its full year outlook, signaling a sharp earnings rebound and healthier profitability across every business line.

The market seems to be waking up to the turnaround story, with a robust year to date share price return of 20.29% and a 1 year total shareholder return of 22.86%. This suggests momentum is building as investors reassess Horace Mann’s earnings power and capital returns.

If this kind of improving earnings profile has your attention, it could be a good moment to see what else is setting up for a similar rerating through fast growing stocks with high insider ownership

Yet even after that rally, HMN still trades below analyst price targets and at a discount to peers. This raises the key question: is this a quiet value opportunity, or is the market already pricing in its earnings revival?

Most Popular Narrative Narrative: 8.1% Undervalued

Against a last close of $46.54, the most followed narrative sees Horace Mann’s fair value nearer $50.67, framing today’s rally as only partway through.

Extension of product offerings into supplemental and group benefits, combined with growing sales force and new strategic partnerships (e.g., Crayola, Lakeshore Learning), is delivering record supplemental sales growth and helps diversify revenue streams away from core P&C, supporting both revenue growth and improved margin stability.

Curious how steady but unspectacular top line growth can still justify a richer future earnings multiple and higher margins for an insurer like this? The narrative leans on a tightly modeled mix of revenue expansion, margin uplift, and modest de rating to bridge today’s price to that higher fair value. Want to see exactly how those moving parts fit together, year by year, in the valuation roadmap?

Result: Fair Value of $50.67 (UNDERVALUED)

However, the narrative could quickly unravel if educator employment shrinks faster than expected and catastrophe losses spike, squeezing premium growth and underwriting margins.

Another Way To Look At Value

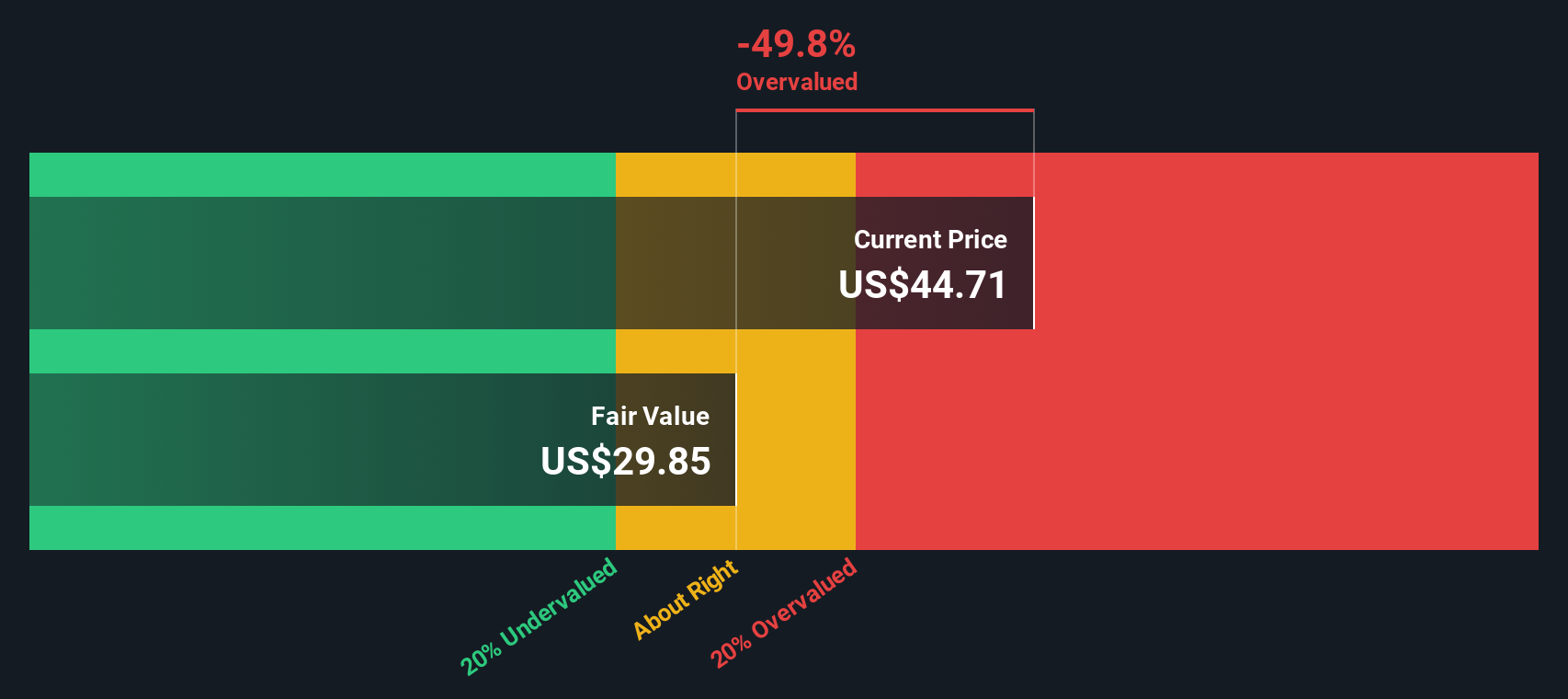

Our SWS DCF model paints a very different picture, putting fair value closer to $24.88 per share, well below today’s $46.54 price. That implies HMN could be significantly overvalued if cash flows disappoint. Which story do you trust more: multiples or cash flows?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Horace Mann Educators for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Horace Mann Educators Narrative

If you see the numbers differently or want to test your own thesis from the ground up, you can build a custom narrative in minutes: Do it your way

A great starting point for your Horace Mann Educators research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about compounding your returns, do not stop at one insurer when you can systematically uncover more opportunities with targeted, data driven screens on Simply Wall St.

- Lock in potential income streams by scanning for companies that consistently reward shareholders through these 13 dividend stocks with yields > 3% offering yields above 3% with solid fundamentals.

- Position yourself early in transformative innovation by focusing on these 26 AI penny stocks that are building real businesses around machine learning and automation.

- Strengthen your long term returns by zeroing in on these 906 undervalued stocks based on cash flows where market pessimism may have pushed quality cash flow rich companies below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.