Please use a PC Browser to access Register-Tadawul

Houlihan Lokey Expands European Footprint As Growth And Valuation Converge

Houlihan Lokey, Inc. Class A HLI | 167.82 | +1.02% |

- Houlihan Lokey (NYSE:HLI) has expanded its European footprint with the hire of Mark Ward as Managing Director to lead IT Services coverage.

- The firm has also completed acquisitions in European real estate and corporate finance, adding sector depth and local capabilities.

- These moves reflect an active push to grow both organically and through acquisitions in key European markets.

At a share price of $180.53, Houlihan Lokey has delivered a 3 year return of 94.8% and a 5 year return of 199.2%. For investors watching NYSE:HLI, the recent European hiring and acquisition activity adds another layer to an already established growth record over multi year periods.

The combined focus on IT Services coverage and added real estate and corporate finance expertise indicates that Europe is a priority region in the firm’s expansion plans. For you as an investor, these steps can help frame how Houlihan Lokey is positioning its business mix by geography and sector over time.

Stay updated on the most important news stories for Houlihan Lokey by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Houlihan Lokey.

Quick Assessment

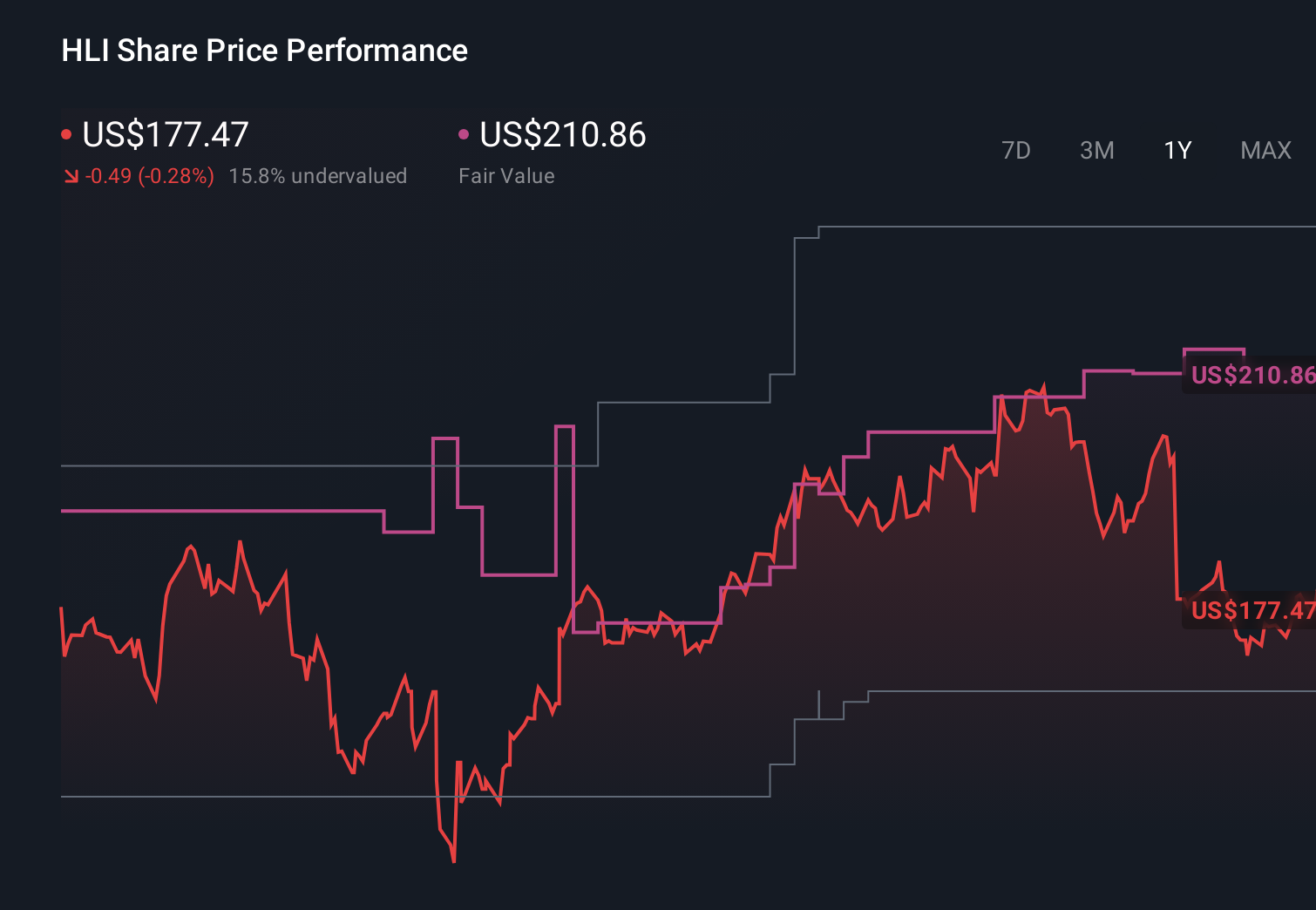

- ⚖️ Price vs Analyst Target: At $180.53 versus a $208.25 analyst target, the price is about 13% below consensus. This is outside the 10% band but still reasonably close given the target range of $173 to $247.

- ⚖️ Simply Wall St Valuation: The stock is described as trading close to estimated fair value, so there is no clear valuation skew in either direction based on this model.

- ✅ Recent Momentum: The 30 day return of roughly 1.7% shows positive but modest recent momentum.

Check out Simply Wall St's in depth valuation analysis for Houlihan Lokey.

Key Considerations

- 📊 The push into Europe through acquisitions and a senior IT Services hire broadens Houlihan Lokey's fee pool by both geography and sector.

- 📊 Watch how European revenue, IT Services mandates and Capital Markets activity trend against the current 29.7x P/E and 24.8x forward P/E.

- ⚠️ Integration of new teams and businesses in Europe could affect margins, especially with the industry average profit margin at 25.7% compared to Houlihan Lokey's 16.6%.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Houlihan Lokey analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.