Please use a PC Browser to access Register-Tadawul

How a US$100 Million Share Buyback at Daqo New Energy (DQ) Has Changed Its Investment Story

Daqo New Energy Corp. Sponsored ADR DQ | 31.83 | -1.33% |

- Daqo New Energy’s board has approved a share buyback program of up to US$100 million, to be completed by the end of 2026 and funded from existing cash reserves, following new policy developments and industry restructuring in China.

- This move, coupled with positive analyst reassessments, signals growing management confidence in the company’s financial health and the emergence of supportive industry trends.

- We will examine how the new share buyback program may influence Daqo New Energy's investment outlook and long-term positioning.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Daqo New Energy Investment Narrative Recap

To be a shareholder in Daqo New Energy, you need confidence in both the stabilization of the global polysilicon sector and meaningful policy support from China, given the company’s exposure to industry overcapacity and recurring net losses. The board’s recent approval of a US$100 million share buyback program is a positive step, but it does not materially address the pressing risk of prolonged supply-demand imbalance, which remains the most critical short-term factor affecting performance.

Among the company’s recent announcements, the Q2 2025 earnings report stands out. With quarterly sales declining to US$75.19 million and a net loss of US$76.48 million, these results underline the strain from low utilization rates and pricing pressures, even as management signals optimism through shareholder returns and production guidance.

However, investors should also keep in mind that, despite these positive actions, the risk of persistent industry overcapacity is far from resolved and...

Daqo New Energy's narrative projects $2.4 billion revenue and $226.9 million earnings by 2028. This requires 58.5% yearly revenue growth and a $616.1 million increase in earnings from current earnings of -$389.2 million.

Uncover how Daqo New Energy's forecasts yield a $26.58 fair value, a 10% downside to its current price.

Exploring Other Perspectives

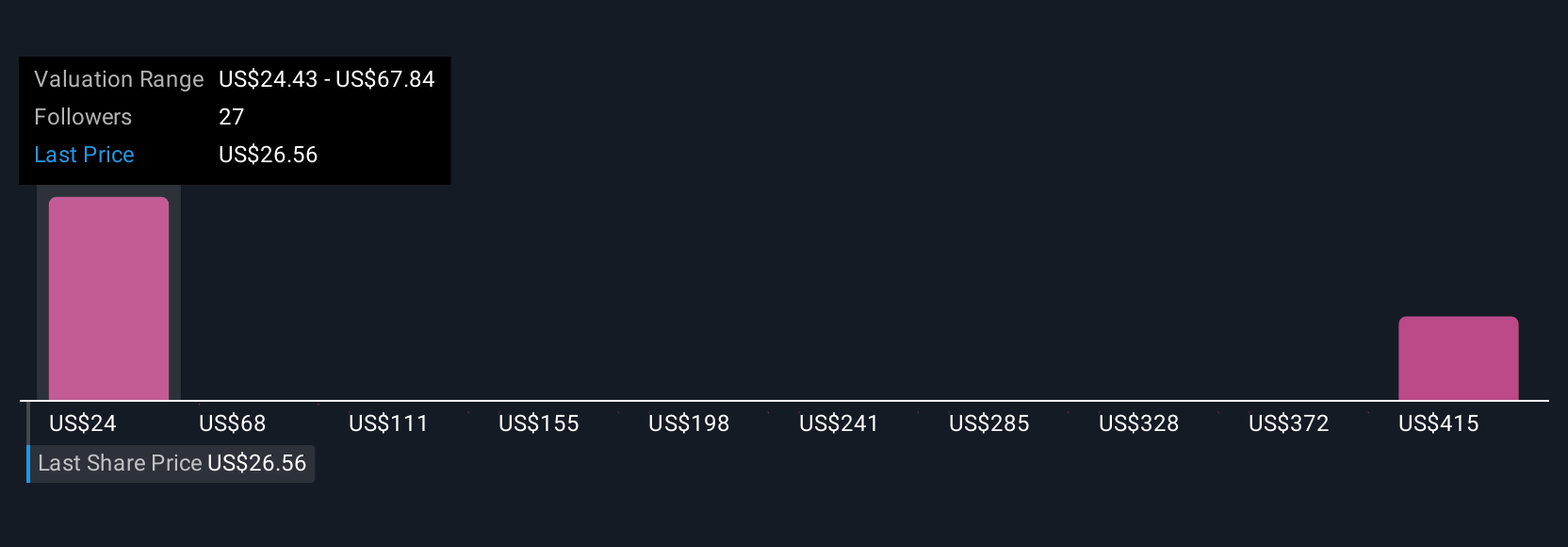

Fair value estimates from the Simply Wall St Community range from US$26.58 to US$465.05, with five contributors offering widely differing views. While some anticipate industry stabilization led by recent policy initiatives, you can see that market participants hold sharply contrasting opinions worth your attention.

Explore 5 other fair value estimates on Daqo New Energy - why the stock might be a potential multi-bagger!

Build Your Own Daqo New Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daqo New Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Daqo New Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daqo New Energy's overall financial health at a glance.

No Opportunity In Daqo New Energy?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.