Please use a PC Browser to access Register-Tadawul

How a US$250 Million Self-Storage Venture At CubeSmart (CUBE) Has Changed Its Investment Story

CubeSmart CUBE | 40.30 | +4.24% |

- In February 2026, CubeSmart and CBRE Investment Management announced the acquisition of a self-storage property in Phoenix, Arizona, as the first asset in a US$250 million self-storage venture targeting core, core-plus, and value-add opportunities across high growth U.S. markets.

- The venture positions CubeSmart to apply its operating platform across a broader portfolio, aiming to enhance property performance while CBRE Investment Management provides capital and investment oversight.

- We’ll now examine how this new US$250 million venture, and CubeSmart’s role as operator, shapes the company’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is CubeSmart's Investment Narrative?

To own CubeSmart, you need to be comfortable with a self-storage REIT where income is supported by a high, ongoing dividend and where recent profit trends have been softer even as the shares look inexpensive against several fair value models. The key short term catalysts still sit around any shift in demand for storage, updates to earnings guidance, and how rising or falling interest rate expectations influence income-focused sectors. The new US$250 million venture with CBRE Investment Management fits into this by expanding CubeSmart’s fee-based operating footprint without necessarily requiring the same balance sheet commitment, which could modestly ease concerns about debt coverage and capital needs over time. That said, it does not fundamentally remove existing risks tied to earnings pressure and slower expected growth.

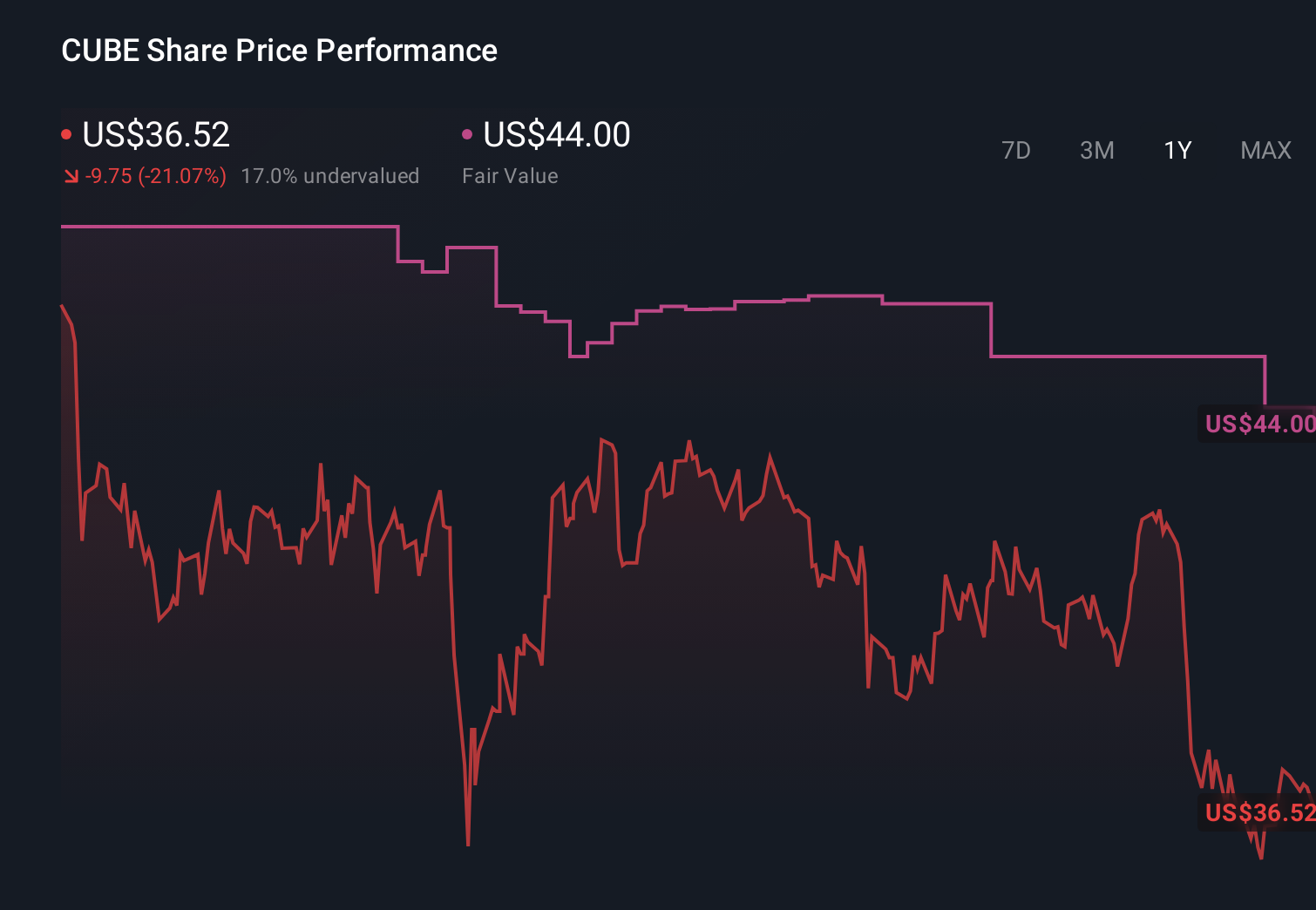

However, one risk around debt coverage and earnings pressure is easy to overlook and matters. CubeSmart's shares have been on the rise but are still potentially undervalued by 33%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on CubeSmart - why the stock might be worth as much as 50% more than the current price!

Build Your Own CubeSmart Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CubeSmart research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CubeSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CubeSmart's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 108 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.