Please use a PC Browser to access Register-Tadawul

How Amylyx Pharmaceuticals’ (AMLX) Move Into GLP-1 Rare Diseases Has Changed Its Investment Story

Amylyx Pharmaceuticals, Inc. AMLX | 14.30 | +5.77% |

- Amylyx Pharmaceuticals announced in early January 2026 that it has selected AMX0318, a long-acting GLP-1 receptor antagonist discovered with Gubra A/S, as a development candidate for post-bariatric hypoglycemia and certain other rare diseases following extensive preclinical evaluation.

- The program’s progression toward investigational new drug–enabling studies and a potential 2027 IND filing, alongside more than US$50.00 million in potential milestones and royalties for Gubra, highlights Amylyx’s effort to broaden its pipeline beyond neurology.

- We’ll now examine how the selection of AMX0318 as a long-acting GLP-1 receptor antagonist shapes Amylyx’s evolving investment narrative.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

What Is Amylyx Pharmaceuticals' Investment Narrative?

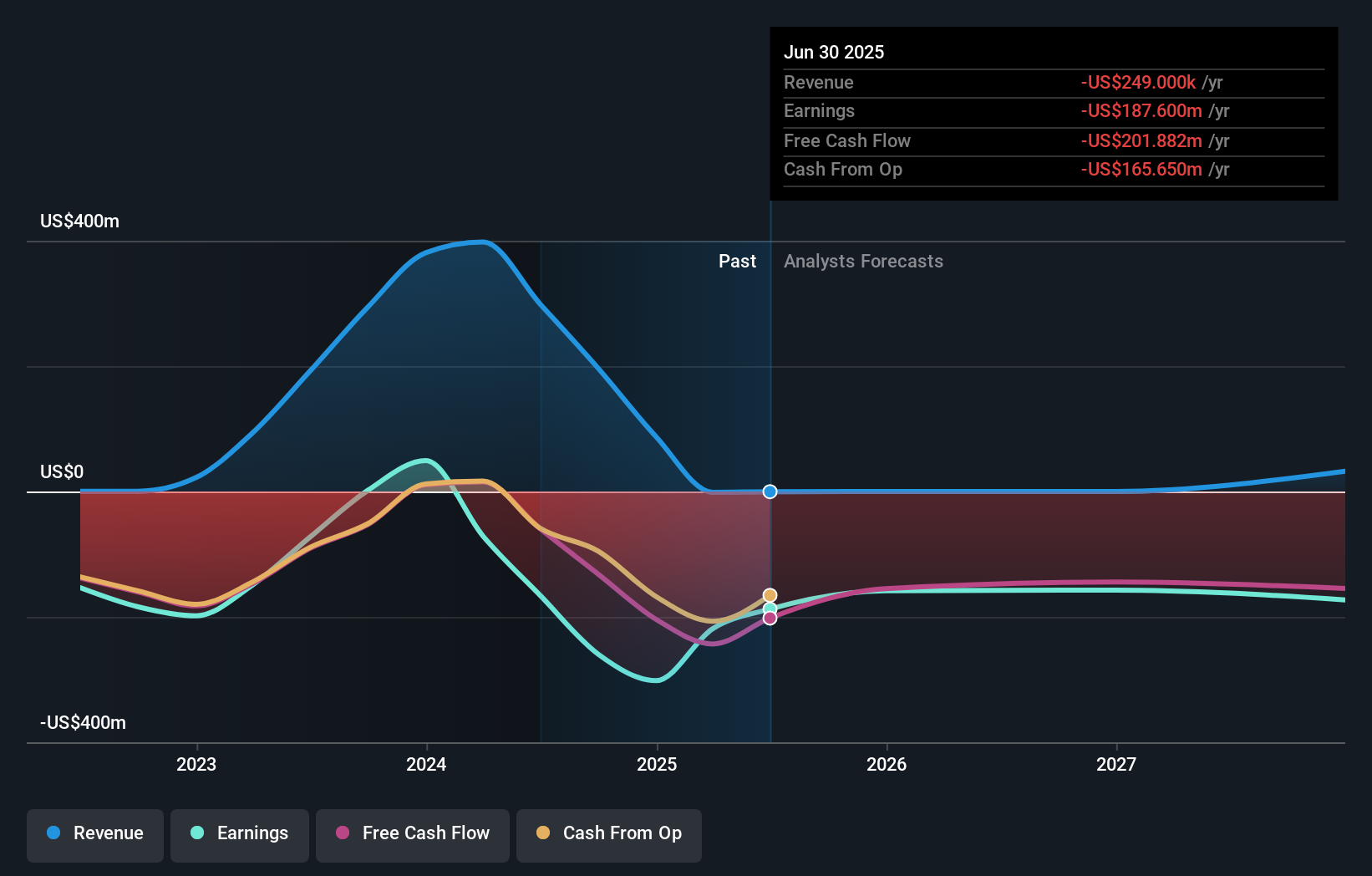

To own Amylyx today, you need to believe that its late‑stage PBH program and broader rare‑disease focus can ultimately justify owning an early‑stage, loss‑making biotech that has been highly volatile. The new AMX0318 candidate adds a second GLP‑1–related PBH asset behind avexitide, which slightly reshapes the near‑term story: the main catalyst still looks like the LUCIDITY Phase 3 readout, but Amylyx is quietly building a longer runway in metabolic and rare endocrine disorders. In the short term, AMX0318’s impact on revenue, cash usage and dilution risk appears limited relative to existing trials and past capital raises, although it modestly increases R&D complexity. Given the share price pullback after a very large one‑year total return, execution risk around clinical data, funding and eventual commercialization remains front and center, with AMX0318 reinforcing both the opportunity and the dependency on successful trial outcomes.

However, one near‑term funding and dilution risk could catch some shareholders off guard. Despite retreating, Amylyx Pharmaceuticals' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Amylyx Pharmaceuticals - why the stock might be worth less than half the current price!

Build Your Own Amylyx Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amylyx Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Amylyx Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amylyx Pharmaceuticals' overall financial health at a glance.

No Opportunity In Amylyx Pharmaceuticals?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.