Please use a PC Browser to access Register-Tadawul

How Apple Partnership and Arizona Investments at Applied Materials (AMAT) Have Changed Its Investment Story

Applied Materials, Inc. AMAT | 336.75 | +1.21% |

- Earlier this month, Apple announced a partnership with Texas Instruments to strengthen the U.S. semiconductor supply chain, supported by Applied Materials supplying American-made chipmaking equipment from its Austin facility and planning over US$200 million in new investments in Arizona.

- This collaboration highlights Applied Materials' expanding manufacturing footprint and deepening role in bolstering domestic semiconductor innovation and workforce growth across the U.S.

- We'll examine how Applied Materials' major investment in Arizona could shape its investment narrative and future competitive position.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Applied Materials Investment Narrative Recap

Applied Materials’ investment case centers on ongoing innovation in semiconductor manufacturing, fueled by the acceleration of AI-related device demand and technology upgrades. The recent US$200 million investment in Arizona and the partnership with Apple and Texas Instruments reinforce its leadership in US supply chain localization, yet the most significant short-term catalyst, AI-driven equipment demand, remains largely unaffected, while exposure to China trade restrictions continues to be a key risk.

Among recent developments, Applied Materials’ expanded collaboration with CEA-Leti stands out, focusing on innovation for specialty semiconductors targeting AI data centers. This aligns with market catalysts driven by advancements in chip technologies, highlighting how broad-based partnerships and investments could strengthen the company’s position should AI infrastructure growth persist.

By contrast, investors should be aware that ongoing US-China trade restrictions could still challenge revenue growth should export conditions shift...

Applied Materials' narrative projects $33.2 billion revenue and $9.1 billion earnings by 2028. This requires 5.8% yearly revenue growth and a $2.3 billion earnings increase from $6.8 billion today.

Uncover how Applied Materials' forecasts yield a $205.84 fair value, a 8% upside to its current price.

Exploring Other Perspectives

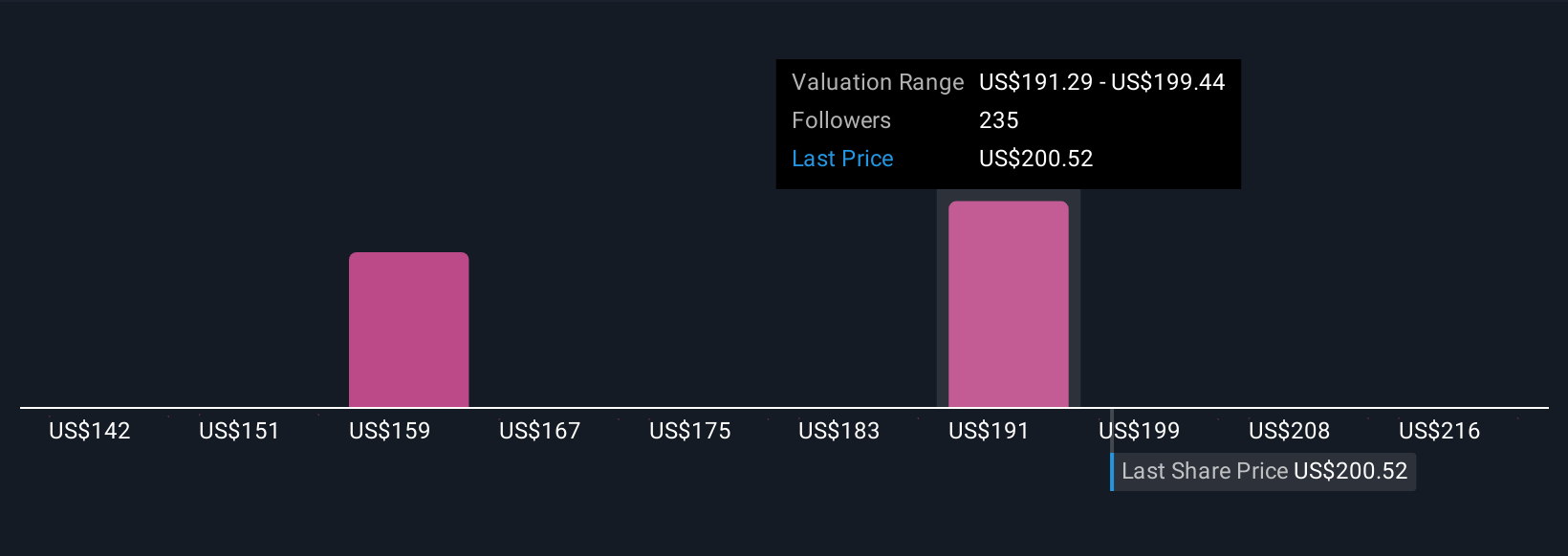

Simply Wall St Community members provide 13 fair value estimates for Applied Materials, from US$150.26 to US$205.84 per share. While opinions reflect wide-ranging outlooks, many recognize ongoing China trade pressures as a crucial factor that could weigh on future revenue streams.

Explore 13 other fair value estimates on Applied Materials - why the stock might be worth as much as 8% more than the current price!

Build Your Own Applied Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Materials research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Applied Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Materials' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.