Please use a PC Browser to access Register-Tadawul

How Arista’s Strong Q4 2025 Results and AI Cloud Guidance Will Impact Arista Networks (ANET) Investors

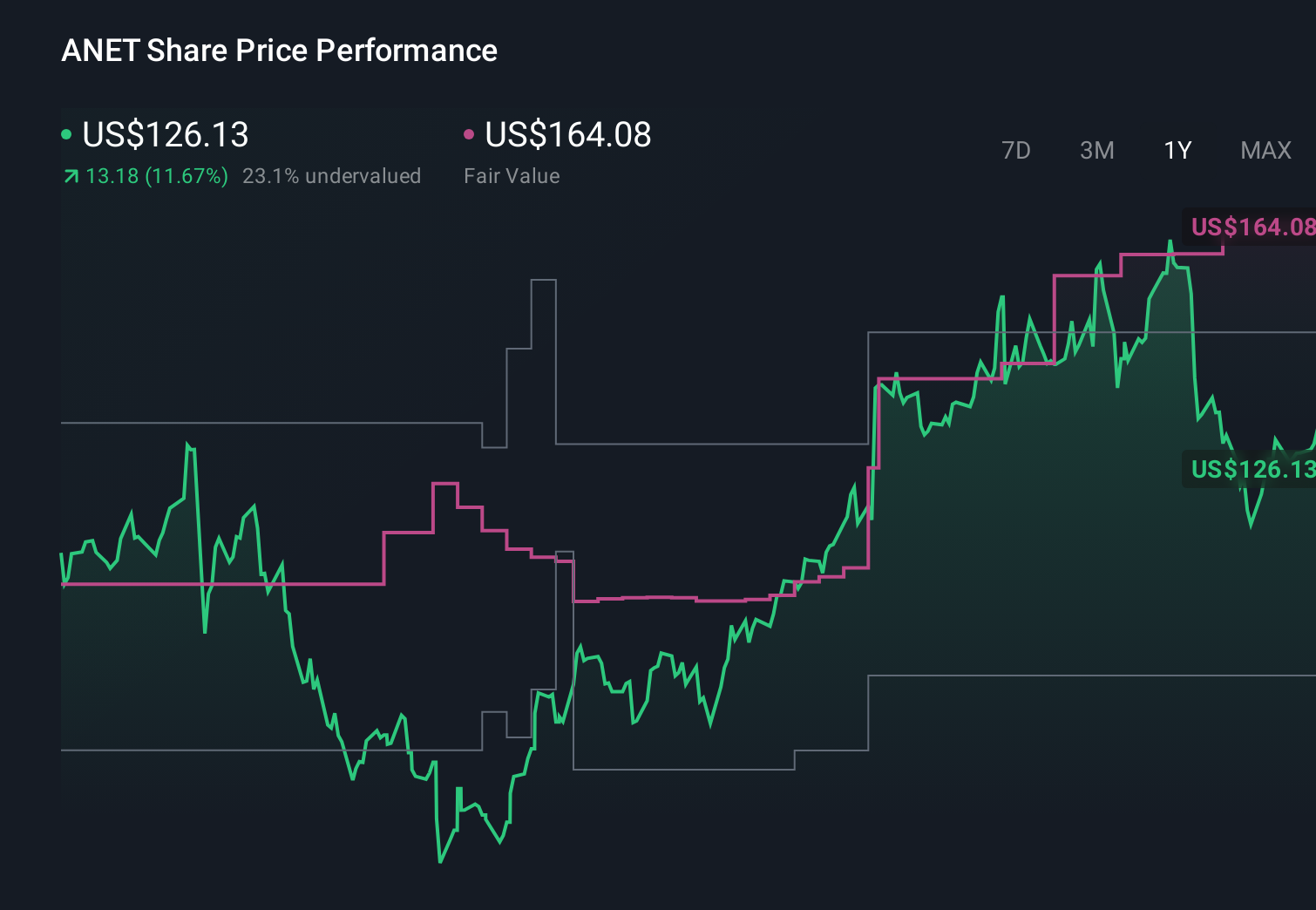

Arista Networks, Inc. ANET | 132.79 | -3.24% |

- In February 2026, Arista Networks reported fourth-quarter 2025 results showing revenue of about US$2.49 billion and net income of roughly US$955.8 million, and issued first-quarter 2026 revenue guidance of approximately US$2.60 billion.

- The company’s performance highlighted strong demand for its AI and cloud networking portfolio, with management also signaling resilient margins despite supply-chain and memory cost pressures.

- Next, we’ll examine how Arista’s stronger-than-expected AI and cloud-driven revenue guidance may reshape the existing investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Arista Networks Investment Narrative Recap

To own Arista Networks, you need to believe that AI and cloud networking will keep driving healthy demand for its high‑performance switches, software and services, and that the company can defend its margins despite rising costs and customer concentration. The latest Q4 2025 beat and Q1 2026 revenue guidance of about US$2.60 billion reinforce the near term AI and cloud build‑out catalyst, while leaving the key risk of dependence on a handful of hyperscalers very much in focus.

One announcement that ties directly into this quarter is management’s decision to lift its 2026 revenue growth outlook to 25%, anchored by a higher AI networking revenue target of US$3.25 billion. That guidance sits squarely on the same AI infrastructure spending trend that underpins the current results, but it also raises the stakes: if hyperscaler capex or in‑house networking efforts shift, the impact on Arista’s premium valuation could be meaningful.

Yet behind the strong AI narrative, there is a concentration risk that investors should be aware of if one or two major customers were to...

Arista Networks’ narrative projects $13.6 billion revenue and $5.4 billion earnings by 2028. This requires 19.5% yearly revenue growth and roughly a $2.1 billion earnings increase from $3.3 billion today.

Uncover how Arista Networks' forecasts yield a $163.37 fair value, a 15% upside to its current price.

Exploring Other Perspectives

While consensus focuses on robust AI demand, the most bearish analysts were assuming about US$12.7 billion of revenue and US$4.8 billion of earnings by 2028, so this upside surprise could eventually soften their concerns about hyperscalers building more networking hardware in house or it could prove their caution warranted if spending patterns later reset.

Explore 23 other fair value estimates on Arista Networks - why the stock might be worth 20% less than the current price!

Build Your Own Arista Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arista Networks research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arista Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arista Networks' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The future of work is here. Discover the 32 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.