Please use a PC Browser to access Register-Tadawul

How Arrow Electronics’ (ARW) Interim CEO Appointment Could Shape Its Leadership Transition and Strategic Focus

Arrow Electronics, Inc. ARW | 113.59 | -1.40% |

- On September 16, 2025, Arrow Electronics announced that William F. Austen, a current board member with extensive executive background, was appointed as Interim President and CEO, succeeding Sean Kerins, whose departure was unrelated to the company’s financial statements.

- The appointment of an experienced interim leader as the Board initiates a search for a permanent CEO signals a period of transition for Arrow, with the outgoing executive assisting in the leadership handover.

- We’ll consider how the leadership change and board-level transition could influence Arrow’s investment outlook and operational priorities.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

Arrow Electronics Investment Narrative Recap

To be a shareholder in Arrow Electronics, you need to believe in the company's ability to expand electronics distribution alongside digitalization and end-market recovery, while managing risks like supply chain disruption and margin pressure. The recent appointment of William F. Austen as Interim President and CEO brings experienced but transitional leadership, but does not appear to materially affect the near-term catalysts or biggest current risks, such as inventory normalization and evolving customer sourcing trends.

Among recent announcements, Arrow’s addition of AirBorn to its interconnect, passive, and electromechanical components portfolio stands out. This product expansion into aerospace and defense aligns with the same sectoral tailwinds that underpin Arrow’s revenue growth thesis and is relevant for shareholders interested in how new offerings might support operating leverage as the market recovers. However, in contrast, investors should remain alert to...

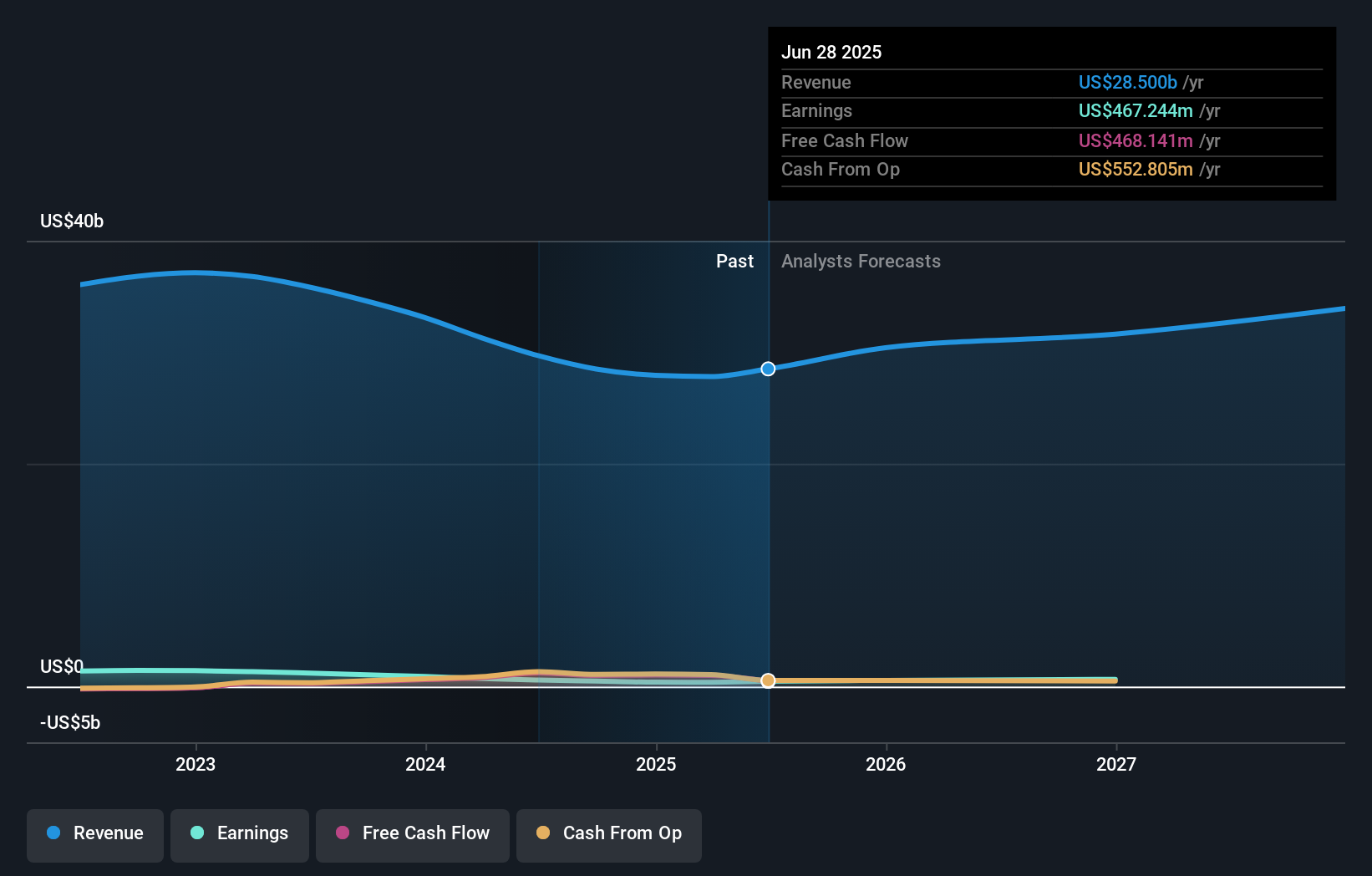

Arrow Electronics' outlook anticipates $35.2 billion in revenue and $734.1 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 7.3% and a $266.9 million increase in earnings from the current $467.2 million level.

Uncover how Arrow Electronics' forecasts yield a $116.75 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$19.29 to US$116.75, reflecting two different individual forecasts. With Arrow facing risks around disintermediation and direct customer procurement, these diverging views highlight how company performance could shift as distribution business models evolve.

Explore 2 other fair value estimates on Arrow Electronics - why the stock might be worth less than half the current price!

Build Your Own Arrow Electronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arrow Electronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arrow Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arrow Electronics' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.