Please use a PC Browser to access Register-Tadawul

How BlackRock’s (BLK) New Infrastructure ETF Reinforces Its Push Into Alternatives and Product Innovation

BlackRock, Inc. BLK | 1089.09 | -1.16% |

- BlackRock recently expanded its infrastructure investment offerings with the launch of the iShares Infrastructure Active ETF, adding a diversified portfolio of 50-60 listed infrastructure companies worldwide to its $10 billion ETF suite and drawing on over two decades of sector expertise.

- This move underscores BlackRock's ongoing commitment to diversify its product lineup and deepen access to infrastructure assets as global investment in this area is projected to reach US$68 trillion by 2040.

- We'll examine how the introduction of a specialized infrastructure ETF further supports BlackRock's investment narrative around alternatives and product innovation.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

BlackRock Investment Narrative Recap

To be a BlackRock shareholder, I believe in the company's ability to lead global asset management through persistent innovation, diversification, and technological integration, even as pressures from fee compression and higher operational costs create headwinds. The recent launch of the iShares Infrastructure Active ETF reflects BlackRock’s continued push into alternatives, but it does not materially shift the short-term catalyst, which remains the firm’s capacity to profitably grow in private markets, nor does it alleviate the central risk of ongoing margin pressure from industry-wide fee declines.

Among recent announcements, BlackRock’s Q2 earnings update is highly relevant: despite unveiling new products and growing assets under management, margins were impacted by lower performance fees and elevated expenses, underscoring that topline growth alone may not translate into earnings gains unless the company can control costs and execute efficiently on its acquisitions and new ventures.

However, investors should consider that ongoing product launches could magnify underlying risks, especially if...

BlackRock's narrative projects $29.1 billion revenue and $9.0 billion earnings by 2028. This requires 10.5% yearly revenue growth and a $2.6 billion earnings increase from $6.4 billion today.

Uncover how BlackRock's forecasts yield a $1158 fair value, a 3% upside to its current price.

Exploring Other Perspectives

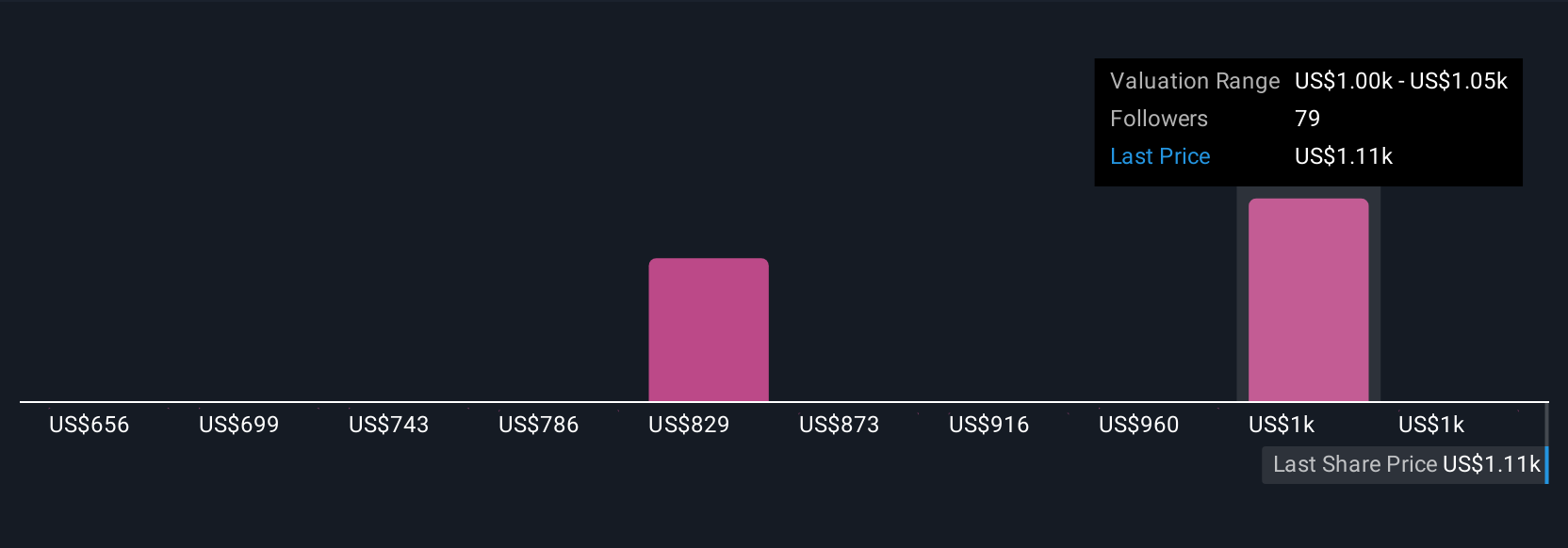

Sixteen members of the Simply Wall St Community estimate BlackRock’s fair value ranges widely from US$679.55 to US$1,391.79 per share. Fee compression and rising expenses remain critical themes, underscoring just how much broader trends can impact investor confidence and future profitability.

Explore 16 other fair value estimates on BlackRock - why the stock might be worth 40% less than the current price!

Build Your Own BlackRock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackRock research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackRock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackRock's overall financial health at a glance.

No Opportunity In BlackRock?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.