Please use a PC Browser to access Register-Tadawul

How Blue Owl Capital's (OWL) Partnership With Voya Financial Has Changed Its Investment Story

Blue Owl Capital Inc. Class A Common Stock OWL | 15.83 | +1.54% |

- Earlier this month, Blue Owl Capital and Voya Financial announced a new partnership to develop private markets investment products tailored for defined contribution retirement plans, initially focusing on collective investment trusts available through Voya’s retirement platform.

- This initiative brings private market strategies to a broader swath of retirement savers, reflecting the growing appetite for alternative investments within mainstream retirement solutions.

- We'll assess how expanding access to private markets through retirement channels could influence Blue Owl Capital's growth outlook and revenue diversification.

Blue Owl Capital Investment Narrative Recap

To see Blue Owl Capital as a compelling long-term holding, you have to believe its management fee-driven model and focus on private markets can deliver resilient, recurring revenues, even in periods of fundraising pressure or economic unpredictability. The new partnership with Voya Financial brings Blue Owl’s private market strategies to defined contribution retirement plans, broadening distribution, but the biggest near-term catalyst continues to be the activation of its undeployed assets, while the risk of tightening institutional fundraising remains an important factor. The material impact of this Voya announcement on short-term catalysts appears limited, but the diversification of revenue streams could help cushion any softer institutional inflows.

Among the company’s recent updates, the announced $15 billion joint venture to fund an AI-powered data center in Texas stands out as potentially significant. While different in focus from the Voya partnership, this move represents another effort to tap into high-growth sectors and could support additional management fee revenue and asset growth.

However, investors should be aware that if the expected acceleration in institutional capital inflows does not materialize, especially as fundraising conditions tighten...

Blue Owl Capital’s outlook anticipates $4.0 billion in revenue and $2.9 billion in earnings by 2028. Achieving these targets would require annual revenue growth of 17.1% and an earnings increase of about $2.8 billion from the current $91.9 million.

Exploring Other Perspectives

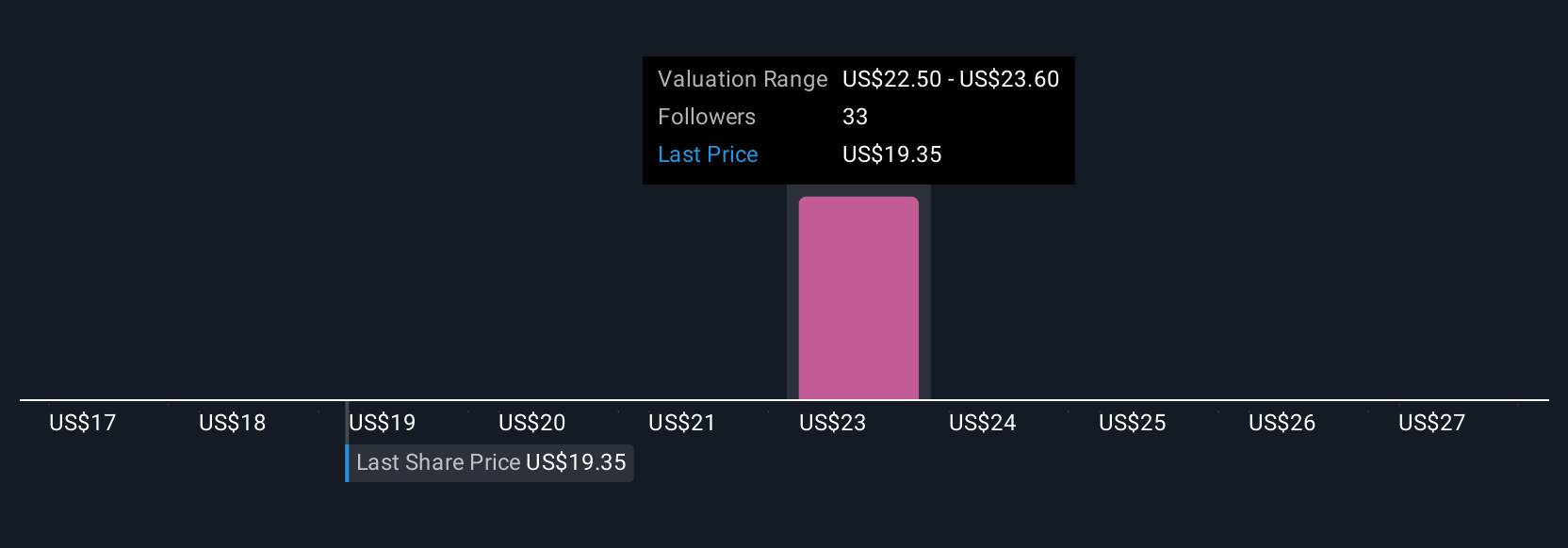

Three member fair value estimates from the Simply Wall St Community span from US$17 to US$28 per share, showing a wide range of opinions about Blue Owl Capital. In light of ongoing risks around institutional fundraising, consider how these varied outlooks might influence broader market sentiment about future revenue streams.

Build Your Own Blue Owl Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Blue Owl Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Owl Capital's overall financial health at a glance.

No Opportunity In Blue Owl Capital?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.