Please use a PC Browser to access Register-Tadawul

How Charter Communications’ (CHTR) New Bylaws and Investor Outreach Could Shape Its Investment Narrative

Charter Communications, Inc. Class A CHTR | 231.14 | +3.40% |

- Charter Communications announced that shareholders have approved the adoption of its Second Amended and Restated Certificate of Incorporation, and the company presented at the Morgan Stanley Media & Communications Corporate Access Day in New York on August 12, 2025.

- This combination of corporate governance changes and a high-profile conference appearance highlights increased attention on Charter’s evolving structure and leadership engagement with investors.

- We’ll examine how the adoption of updated bylaws could influence Charter’s long-term business outlook and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Charter Communications Investment Narrative Recap

To be a Charter Communications shareholder, you would need to believe in the company's ability to grow through expanding its high-speed Internet and mobile offerings, while managing its significant debt load and competitive pressures. The recent approval of the Second Amended and Restated Certificate of Incorporation, while meaningful for governance, does not appear to materially impact the most important short-term catalyst, Spectrum Mobile growth, or the biggest risk, which remains financial leverage and associated flexibility.

Of the various company announcements, the July 2025 completion of significant share buybacks stands out as especially relevant in light of the recent governance changes. Ongoing buybacks highlight Charter’s efforts to boost shareholder value despite near-term business risks, and underscore management’s focus on capital return while continuing to address competitive challenges and margin pressures.

In contrast, investors should also be aware that high debt levels could limit Charter’s ability to respond to unexpected economic downturns, especially if...

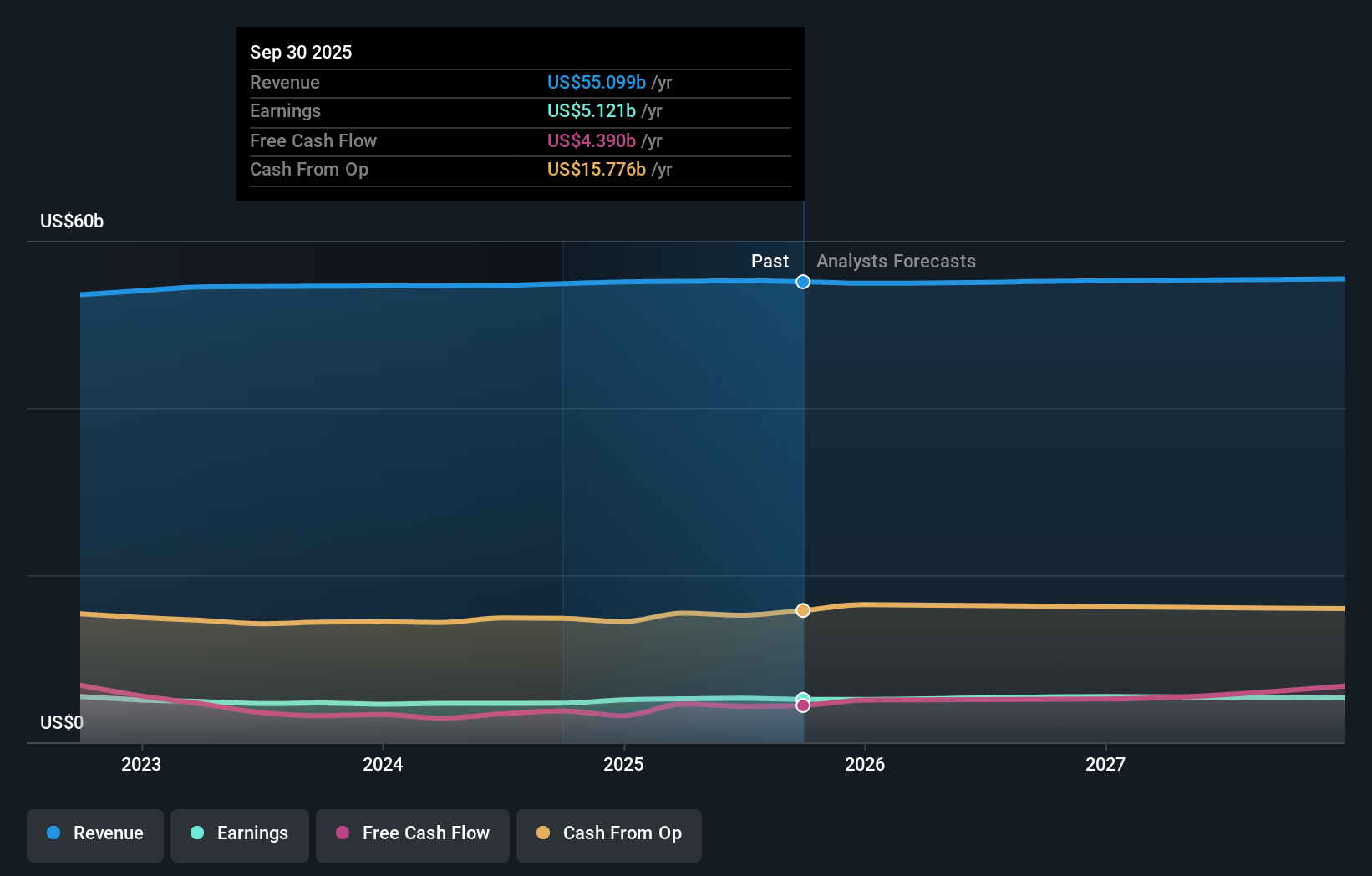

Charter Communications' narrative projects $56.8 billion revenue and $6.1 billion earnings by 2028. This requires a 0.9% yearly revenue decline and a $0.8 billion earnings increase from $5.3 billion today.

Uncover how Charter Communications' forecasts yield a $402.37 fair value, a 55% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community supplied four fair value estimates for Charter Communications ranging from US$200 to US$246,622. Opinions vary sharply, yet many community members are closely watching how leverage and capital allocation might shape future outcomes. Explore diverse viewpoints to better understand the various scenarios that could affect your investment.

Explore 4 other fair value estimates on Charter Communications - why the stock might be worth 23% less than the current price!

Build Your Own Charter Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charter Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charter Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charter Communications' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.