Please use a PC Browser to access Register-Tadawul

How Charter’s Subscriber Declines and Layoffs Could Shape the Future for CHTR Investors

Charter Communications, Inc. Class A CHTR | 206.60 | -2.57% |

- Earlier this quarter, Charter Communications (Spectrum) reported flat revenue, a miss on earnings expectations, and announced plans to lay off 1,200 employees, about 1% of its workforce, as the company lost 80,000 cable TV and 117,000 internet subscribers amid ongoing cord-cutting pressures.

- The company is also engaged in merger talks with Cox Communications, which could lead to further operational changes and staff reductions if completed.

- We'll explore how Charter's subscriber losses and operational adjustments highlight the company's ongoing efforts to adapt to evolving industry realities.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Charter Communications Investment Narrative Recap

To be a shareholder in Charter Communications, you need to believe in the company’s ability to innovate its connectivity offerings and manage costs as consumers move away from traditional cable. The recent announcement of significant subscriber losses, earnings misses, and upcoming layoffs puts a spotlight on Charter's biggest short-term risk: defending its broadband market share from aggressive competitors, while the most important catalyst remains the expansion of its converged network and mobile services. The impact of the layoffs and merger talks will be material if they lead to operational efficiencies or further disruption, but at this stage, the main immediate issue continues to be growing broadband competition.

Amid these challenges, Charter’s launch of The Spectrum App Store stands out, aiming to add value for current TV subscribers and encourage those shifting to streaming to remain within the company’s service ecosystem. This move is highly relevant given ongoing subscriber losses and reflects a focus on reinforcing Charter’s competitive position as cord-cutting accelerates.

By contrast, one ongoing risk that investors should be alert to is how decisions about the Affordable Connectivity Program could...

Charter Communications is forecast to reach $56.8 billion in revenue and $6.0 billion in earnings by 2028. This outlook reflects an annual revenue decline of 0.9% and a $0.7 billion increase in earnings from the current $5.3 billion level.

Uncover how Charter Communications' forecasts yield a $373.60 fair value, a 53% upside to its current price.

Exploring Other Perspectives

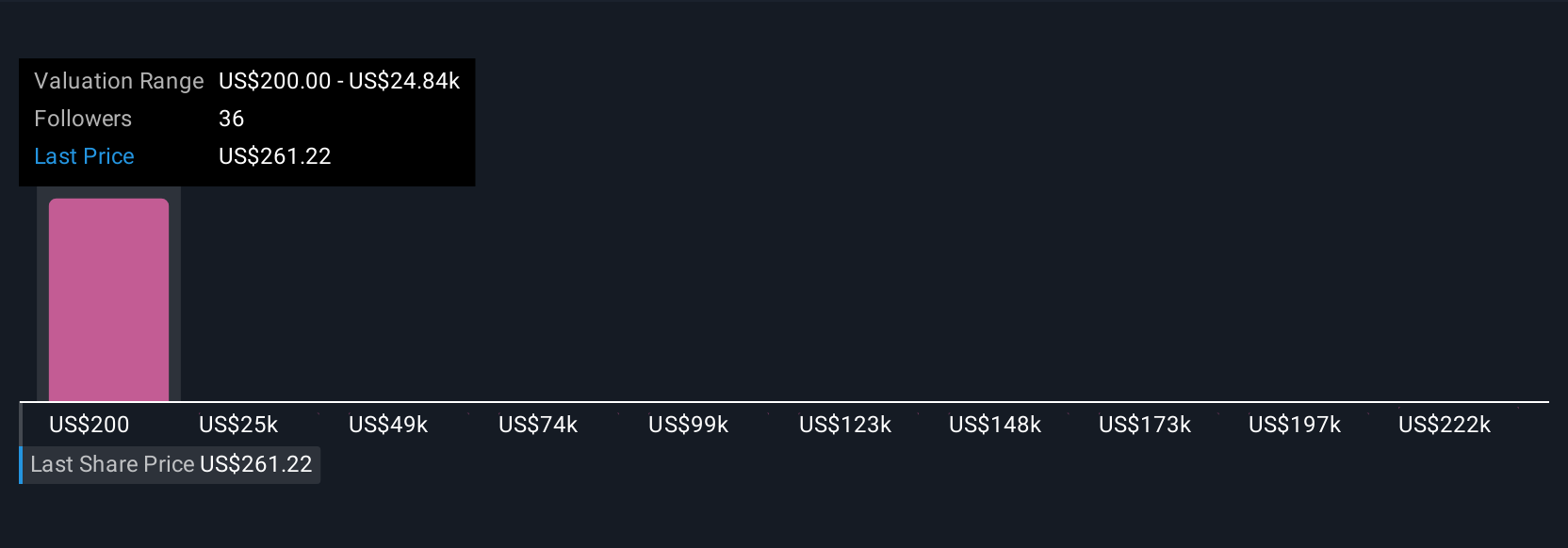

Three private investors from the Simply Wall St Community estimate Charter's fair value between US$373.60 and US$774.74. As competition for broadband intensifies, your view on Charter's future share and margins could vary widely from others'.

Explore 3 other fair value estimates on Charter Communications - why the stock might be worth over 3x more than the current price!

Build Your Own Charter Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charter Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charter Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charter Communications' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.