Please use a PC Browser to access Register-Tadawul

How Cognizant’s Acquisition Strategy Amid Financial Pressures Will Impact CTSH Investors

Cognizant Technology Solutions Corporation Class A CTSH | 83.63 | -0.50% |

- In recent weeks, Cognizant Technology Solutions revealed it is actively seeking acquisitions to expand into new markets, enhance capabilities, or enter under-penetrated geographies, according to comments from Head of Americas Surya Gummadi.

- This announcement comes alongside accolades for workplace excellence and sustainability, but occurs amid concerns about shrinking cash reserves, reduced free cash flow, and slower growth in key company segments.

- We'll now assess how Cognizant's focus on acquisitions, despite operational headwinds, could influence its long-term investment outlook.

These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cognizant Technology Solutions Investment Narrative Recap

Cognizant investors are typically betting on the company's ability to expand its capabilities and market reach through both innovation and acquisitions, especially as enterprise demand shifts toward advanced AI and automation. The recent news of an acquisition push is an effort to bolster core offerings, but does not materially shift the most important short-term catalyst, momentum in large-scale, AI-powered contract wins, nor does it diminish concerns over shrinking cash reserves and slowing free cash flow, which remain the pressing risks for the business.

Among recent announcements, Cognizant's strategic partnership with WRITER to launch agentic AI solutions stands out. This aligns closely with enterprise clients' growing appetite for automation and large-scale AI implementation, directly feeding into Cognizant's primary catalyst around client adoption and recurring revenues, while signaling continued investment in differentiated digital platforms.

However, despite the focus on acquisitions and new AI alliances, investors should not overlook the growing risk that cash flow pressures may limit the company's financial flexibility, especially if...

Cognizant Technology Solutions is projected to reach $23.5 billion in revenue and $2.9 billion in earnings by 2028. This outlook assumes 4.7% annual revenue growth and a $0.5 billion increase in earnings from the current $2.4 billion level.

Uncover how Cognizant Technology Solutions' forecasts yield a $86.95 fair value, a 26% upside to its current price.

Exploring Other Perspectives

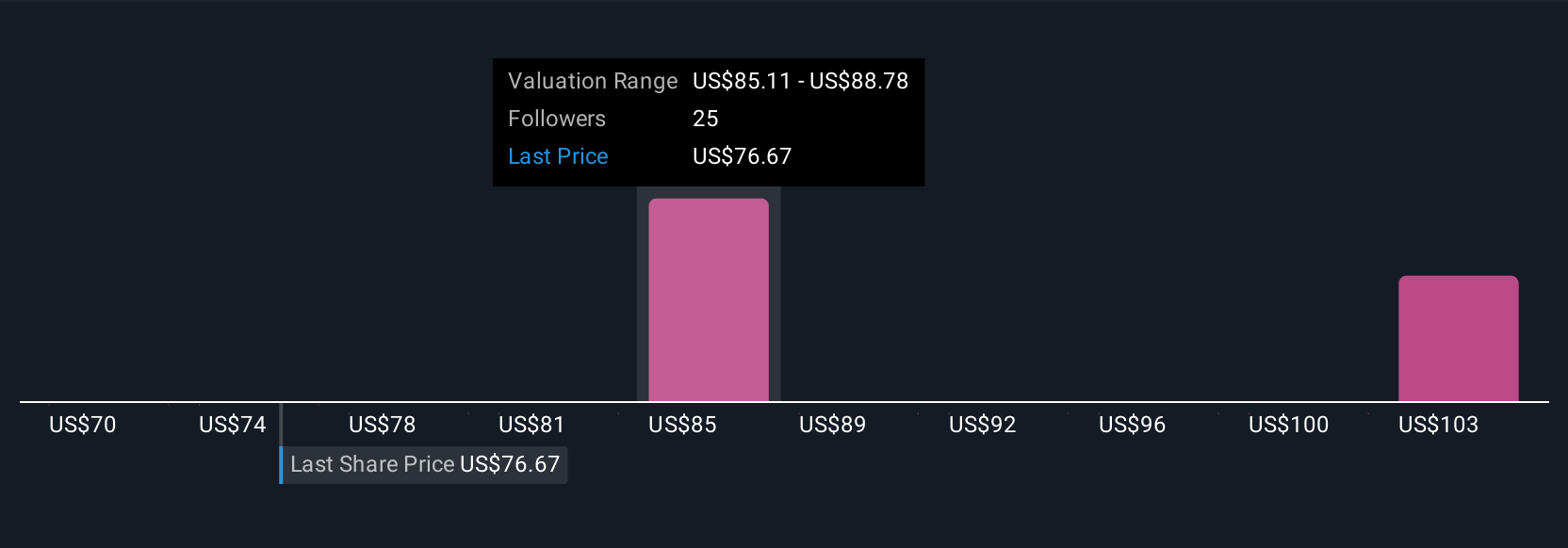

Fair value estimates from the Simply Wall St Community range from US$70.42 to US$117.94 based on four individual projections. While consensus highlights ongoing AI-driven revenue opportunities, your outlook may hinge on how Cognizant manages cash reserves in the face of potential acquisition outlays.

Explore 4 other fair value estimates on Cognizant Technology Solutions - why the stock might be worth just $70.42!

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.