Please use a PC Browser to access Register-Tadawul

How Collegium’s New $980 Million Credit Facility Could Reshape Collegium Pharmaceutical (COLL) Investors’ Risk Lens

Collegium Pharmaceutical, Inc. COLL | 45.00 | -0.40% |

- In December 2025, Collegium Pharmaceutical, Inc. closed a US$980 million syndicated credit facility maturing in 2030, comprising a US$580 million initial term loan, US$300 million delayed draw term loan, and US$100 million revolver, and used the initial term loan to repay about US$581 million of existing debt.

- The new facility, priced at term SOFR plus a leverage-based spread (initially SOFR plus 2.75%), is expected to lower annual interest costs while adding undrawn borrowing capacity for general corporate uses and potential business development.

- Next, we’ll consider how this lower-cost, flexible credit facility may reshape Collegium’s investment narrative and financial risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Collegium Pharmaceutical Investment Narrative Recap

To own Collegium, you need to believe its focused pain and ADHD portfolio can sustain earnings despite looming patent cliffs, regulatory scrutiny of opioids, and rising commercial spend. The new US$980 million credit facility looks helpful but does not fundamentally change the near term catalyst around Jornay PM execution or the central risk of future generic and pricing pressure.

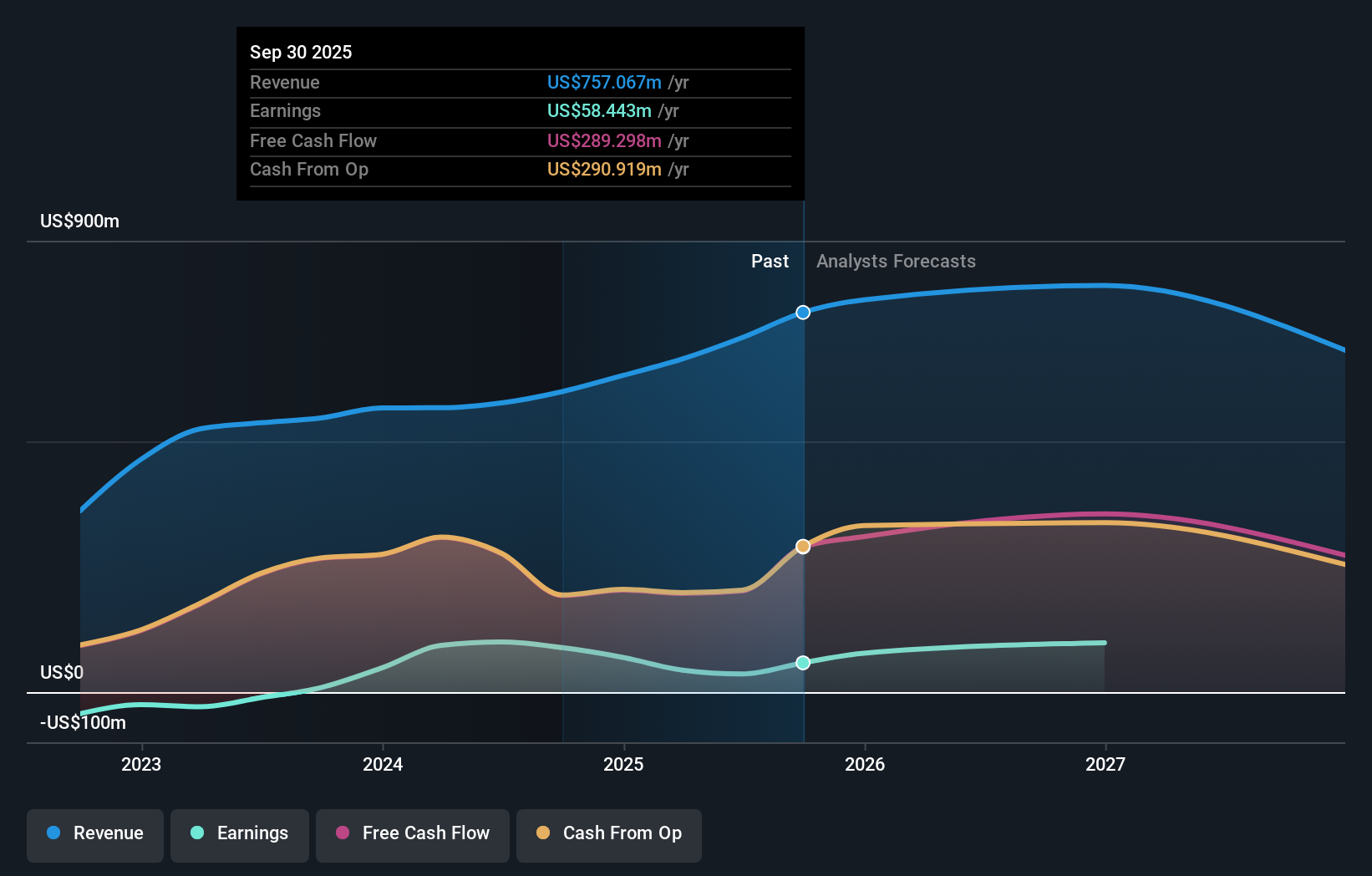

Among recent announcements, the Q3 2025 guidance raise to US$775 million to US$785 million in net product revenue is most relevant here, as it highlights management’s confidence while the company refinances into lower cost, more flexible debt. Together, improving earnings and a reworked balance sheet may influence how investors weigh concentration risk in core pain brands against Collegium’s plans for portfolio expansion.

Yet, against this stronger balance sheet, investors should still be aware of the looming patent expirations and potential generic competition that could...

Collegium Pharmaceutical's narrative projects $695.3 million revenue and $131.4 million earnings by 2028.

Uncover how Collegium Pharmaceutical's forecasts yield a $48.67 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Collegium span roughly US$49 to US$183 per share, underscoring how far apart individual views can be. Against that backdrop, the new lower cost credit facility and associated financial risk considerations give you more context to compare these perspectives and explore alternative views on the company’s future performance.

Explore 3 other fair value estimates on Collegium Pharmaceutical - why the stock might be worth over 3x more than the current price!

Build Your Own Collegium Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Collegium Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Collegium Pharmaceutical's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.