Please use a PC Browser to access Register-Tadawul

How COPT Defense Properties' Expanded $800 Million Credit Facility (CDP) Has Changed Its Investment Story

COPT Defense Properties Common Shares of Beneficial Interest CDP | 29.48 | +1.03% |

- On October 6, 2025, COPT Defense Properties announced an amended and expanded credit agreement with several major lenders, increasing its unsecured revolving credit facility commitment to US$800.0 million, revising interest terms, and extending maturities for both its revolving credit facility and term loan.

- This enhanced credit agreement provides greater financial flexibility and could support future growth initiatives by allowing for additional borrowing capacity and a longer debt maturity profile.

- With the company now able to access expanded and more flexible credit, we'll examine how this could impact COPT Defense Properties' investment narrative.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

COPT Defense Properties Investment Narrative Recap

To be a shareholder in COPT Defense Properties, you have to believe in sustained growth for U.S. defense and government spending, consistent tenant demand for secure, specialized facilities, and the company's ability to maintain high occupancy despite sector headwinds. The recent amendment expanding COPT’s unsecured revolving credit facility provides greater financial flexibility, but does not materially change the short-term catalyst: robust leasing driven by large-scale federal defense funding. The biggest current risk, concentration of government and contractor tenants, remains unchanged by this news.

Among recent announcements, the execution of new investment leases totaling 55,000 square feet at Redstone Gateway stands out, as these completed leases directly support the leasing momentum anticipated from heightened federal defense budgets. This reinforces the core catalyst, increasing occupancy and revenue visibility, while the added credit capacity could facilitate future similar deals or development projects.

But on the other hand, investors should also be mindful of potential volatility if government contract awards are delayed or cancelled in these concentrated regional markets...

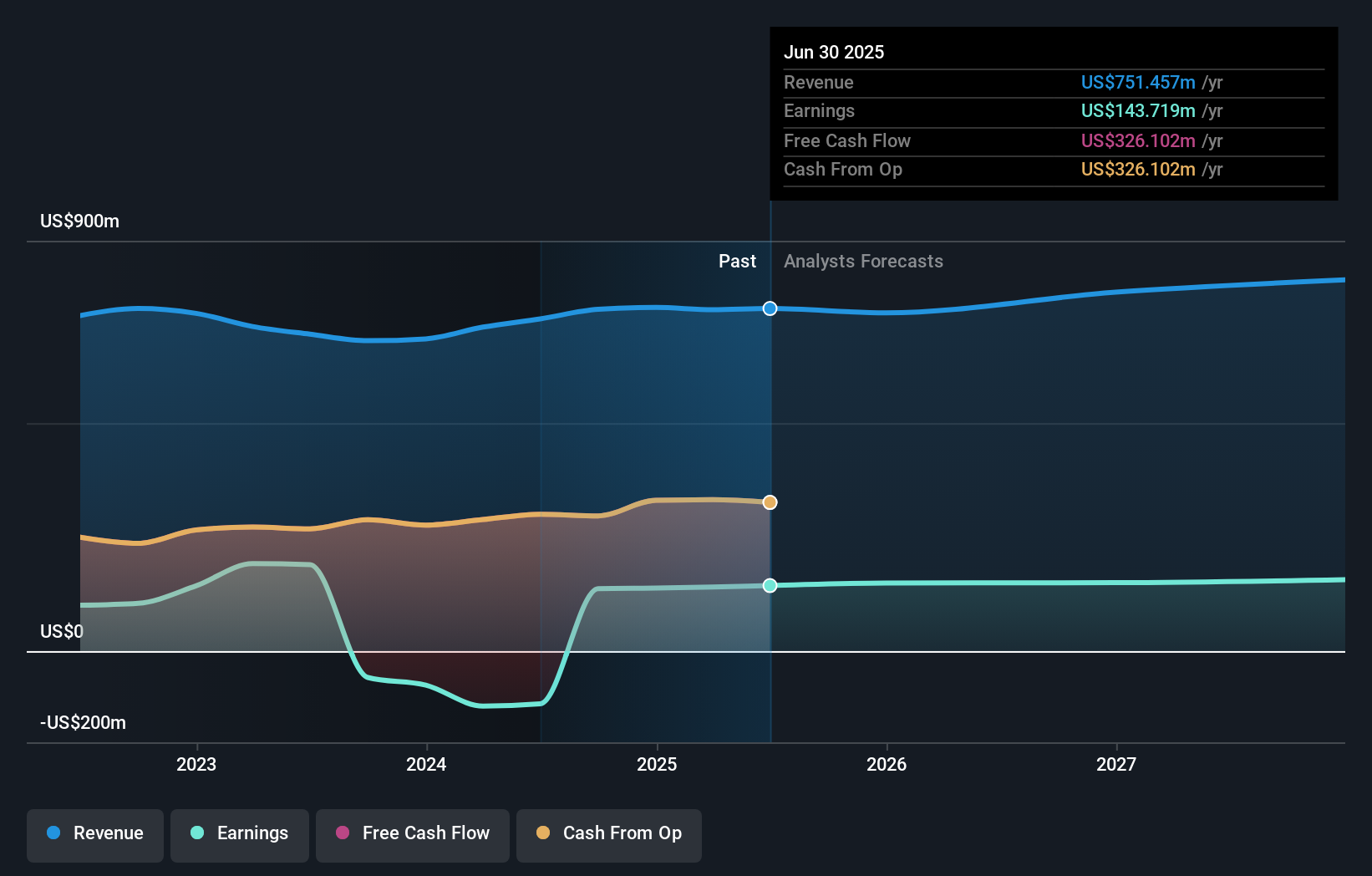

COPT Defense Properties' narrative projects $821.6 million revenue and $152.6 million earnings by 2028. This requires 3.0% yearly revenue growth and a $8.9 million earnings increase from the current $143.7 million.

Uncover how COPT Defense Properties' forecasts yield a $32.57 fair value, a 15% upside to its current price.

Exploring Other Perspectives

With only one US$38.86 fair value estimate from the Simply Wall St Community, individual investors appear strongly aligned on potential undervaluation. While this agreement is rare, keep in mind that tenant concentration risk could still influence overall performance, and consider seeking out additional community perspectives before reaching firm conclusions.

Explore another fair value estimate on COPT Defense Properties - why the stock might be worth just $38.86!

Build Your Own COPT Defense Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your COPT Defense Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free COPT Defense Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate COPT Defense Properties' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.