Please use a PC Browser to access Register-Tadawul

How Corpay's (CPAY) ITF Partnership Could Reshape Its Global Payments Growth Narrative

Corpay, Inc. CPAY | 355.91 355.91 | +0.49% 0.00% Pre |

- Earlier this week, the International Tennis Federation announced a multi-year agreement naming Corpay as its Official Foreign Exchange Partner, allowing the ITF and the Davis Cup to use Corpay Cross-Border’s payment management platform to handle global transactions and mitigate foreign exchange risk.

- This partnership highlights Corpay's continued push into large-scale, international enterprise deals designed to expand its footprint in global payments innovation.

- Let’s examine how securing a partnership with a major global sports body like the ITF could influence Corpay’s longer-term growth narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Corpay Investment Narrative Recap

Owning Corpay stock means believing in the company's ability to drive sustained growth through expanding its international payment solutions and securing major enterprise clients, particularly in the sports sector. While the ITF partnership builds on Corpay’s push into global B2B payments and offers reputational benefits, it is less likely to move the needle on short-term financial catalysts or address the most pressing risk: competition from fast-moving fintechs and new payment ecosystems eroding margins and market share.

Among recent announcements, Corpay’s collaboration with Circle Internet Group stands out for its relevance to the evolving payments space. By enabling stablecoin access for global payments and integrating digital wallet capabilities into its core offerings, Corpay is positioning itself as a forward-thinking player as demand for innovative, digital-first solutions increases among enterprises worldwide.

But while major partnerships keep rolling in, investors should not overlook the potential downside if rivals or new technologies begin to compress Corpay’s pricing power or ...

Corpay's outlook anticipates $5.7 billion in revenue and $1.8 billion in earnings by 2028. This scenario implies a 10.9% annual revenue growth rate and an $0.8 billion increase in earnings from the current $1.0 billion.

Uncover how Corpay's forecasts yield a $383.45 fair value, a 25% upside to its current price.

Exploring Other Perspectives

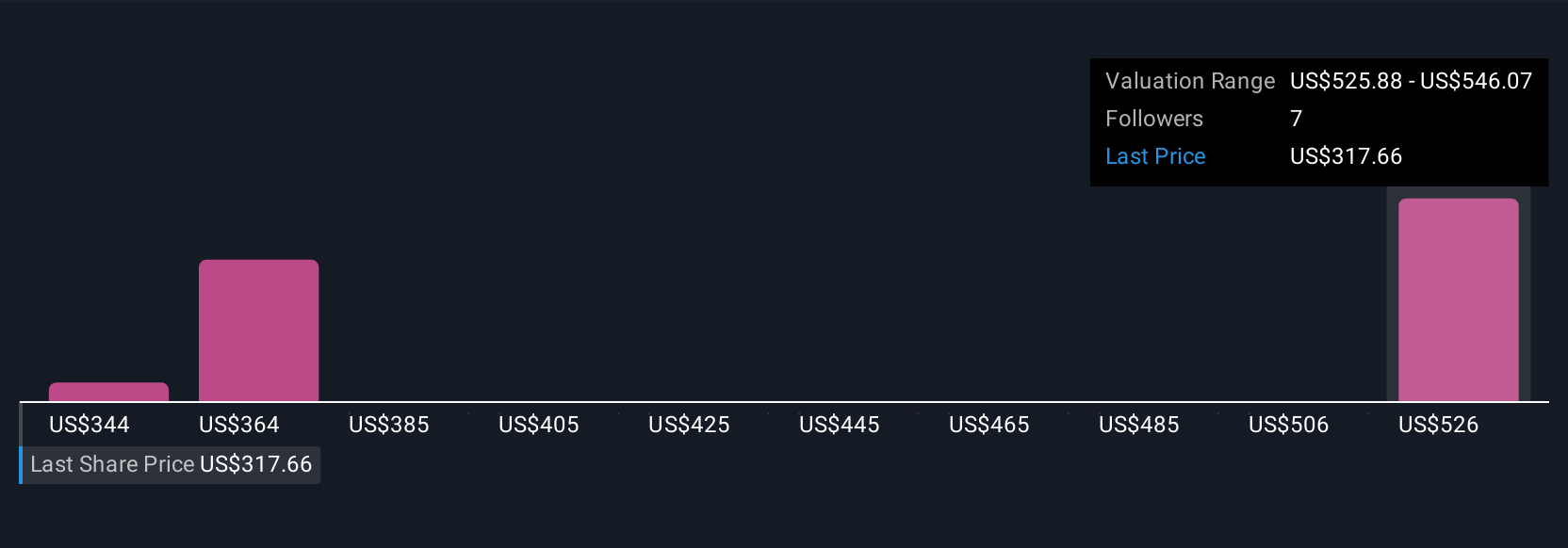

Fair value estimates from the Simply Wall St Community range widely, from US$344.17 to US$549.62 across three perspectives. With competition and the pace of new payment technologies a key risk, consider how such variety in outlooks reflects differing confidence in Corpay’s long-term growth and profitability story.

Explore 3 other fair value estimates on Corpay - why the stock might be worth just $344.17!

Build Your Own Corpay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corpay research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corpay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corpay's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.