Please use a PC Browser to access Register-Tadawul

How Credelio Quattro’s Fast Adoption and Zenrelia Expansion Will Impact Elanco Animal Health (ELAN) Investors

Elanco Animal Health ELAN | 22.19 | +2.28% |

- Elanco Animal Health has recently reported major milestones for its pet health innovations, with Credelio Quattro reaching blockbuster status of over US$100 million in net sales in less than eight months and Zenrelia gaining expanded approval in the UK and other international markets.

- This rapid product adoption showcases Elanco's accelerated global expansion strategy and significant progress in addressing both parasite protection and canine dermatology needs worldwide.

- We'll look at how the successful launch and rapid uptake of Credelio Quattro may influence Elanco's broader investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Elanco Animal Health Investment Narrative Recap

To be a shareholder in Elanco Animal Health today, you would likely need confidence in the company’s ability to drive meaningful growth through pet health innovation and international product expansion. The recent rapid adoption of Credelio Quattro as a blockbuster product reinforces the importance of successful new product launches as a primary short-term catalyst, but execution risks around rapid global scaling and clinic market penetration remain front and center. While these developments show progress, the impact on near-term financial risks, particularly higher operating expenses, remains limited for now.

Among recent announcements, Zenrelia’s expanded approval in the UK stands out as directly relevant to Elanco’s emphasis on geographic market expansion as a growth catalyst. Its growing global footprint, especially in competitive canine dermatology treatments, could support wider adoption and revenue generation, but only if rollout is effectively managed amid existing cost pressures.

In contrast, investors should be especially aware that heightened marketing and launch investments may pressure net margins if...

Elanco Animal Health's outlook forecasts $5.1 billion in revenue and $186.7 million in earnings by 2028. This scenario is based on a 4.5% annual revenue growth rate and a decrease in earnings of $247.3 million from the current level of $434.0 million.

Uncover how Elanco Animal Health's forecasts yield a $18.55 fair value, a 3% downside to its current price.

Exploring Other Perspectives

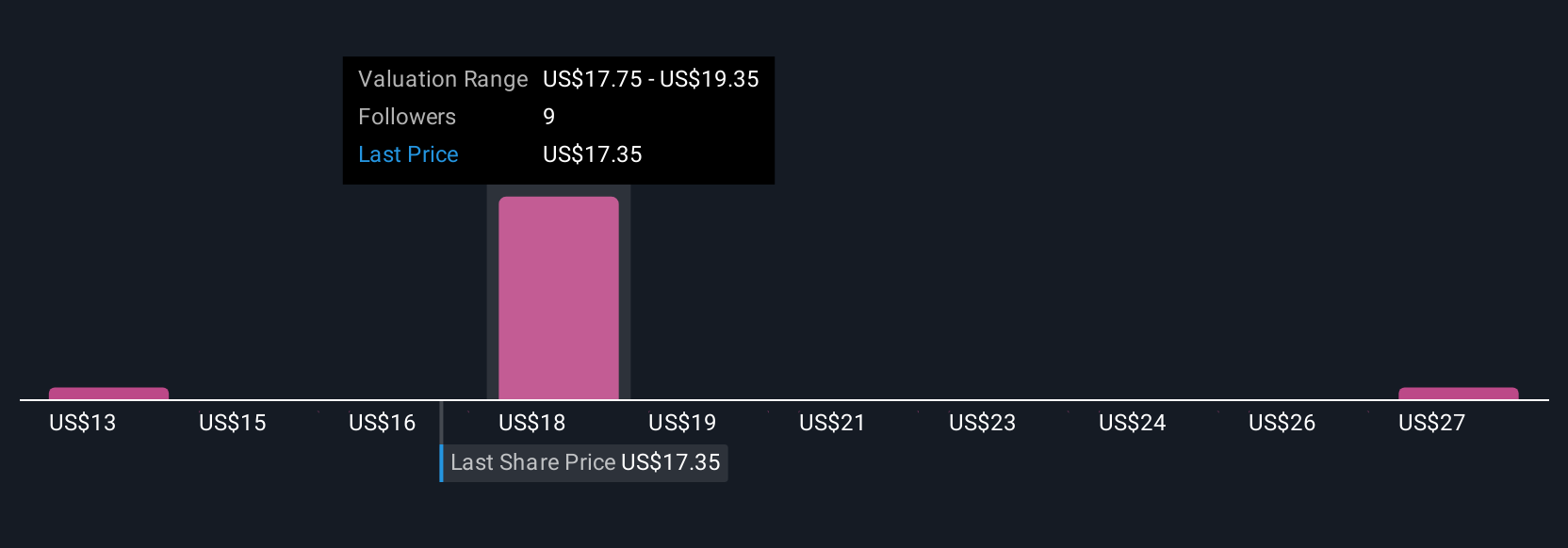

Simply Wall St Community members have set fair value estimates for Elanco Animal Health ranging from US$12.93 to US$29.12, across three perspectives. While innovation-fueled product launches offer upside potential, you should also consider the implications if execution challenges impact the ramp-up of key new products.

Explore 3 other fair value estimates on Elanco Animal Health - why the stock might be worth 33% less than the current price!

Build Your Own Elanco Animal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elanco Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elanco Animal Health's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.