Please use a PC Browser to access Register-Tadawul

How Does Analyst Optimism Shape NetApp’s (NTAP) Position in an Evolving Tech Landscape?

NetApp, Inc. NTAP | 115.66 | -2.90% |

- NetApp recently presented at AFCEA TechNet Augusta 2025 in Augusta, Georgia, with Chief Technology Officer Jim Cosby speaking on the company's technological advancements.

- Recent analyst forecasts highlight stable to modest earnings growth and increased investor attention, fueled by strong earnings history and a Zacks Rank #2 (Buy) rating.

- We'll explore how rising analyst confidence and heightened investor interest ahead of earnings may influence NetApp's investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NetApp Investment Narrative Recap

To be a NetApp shareholder, an investor needs to believe that ongoing advancements in data storage and cloud solutions, as well as disciplined execution, will offset short-term challenges and drive sustainable growth. The recent TechNet Augusta presentation and analyst commentary reinforce positive earnings expectations and may support near-term sentiment, but these developments are unlikely to materially alter the most significant short-term catalyst, continued momentum in cloud revenue, or the risk of inconsistent deal execution impacting sales growth toward quarter-end. Among recent announcements, the August 6, 2025, integration of Amazon FSx for NetApp ONTAP with Amazon Elastic VMware Service stands out as especially relevant. This extension of NetApp's enterprise storage capabilities in public cloud environments strengthens its position in a growing market and directly supports the company's efforts to drive public cloud revenue, an important performance catalyst highlighted by Wall Street analysts. Yet, despite solid earnings history, investors should be mindful of how challenges with late-quarter deal execution could still impact outcomes if...

NetApp's forecast envisions $7.5 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes a 4.5% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.2 billion level.

Uncover how NetApp's forecasts yield a $115.43 fair value, a 4% upside to its current price.

Exploring Other Perspectives

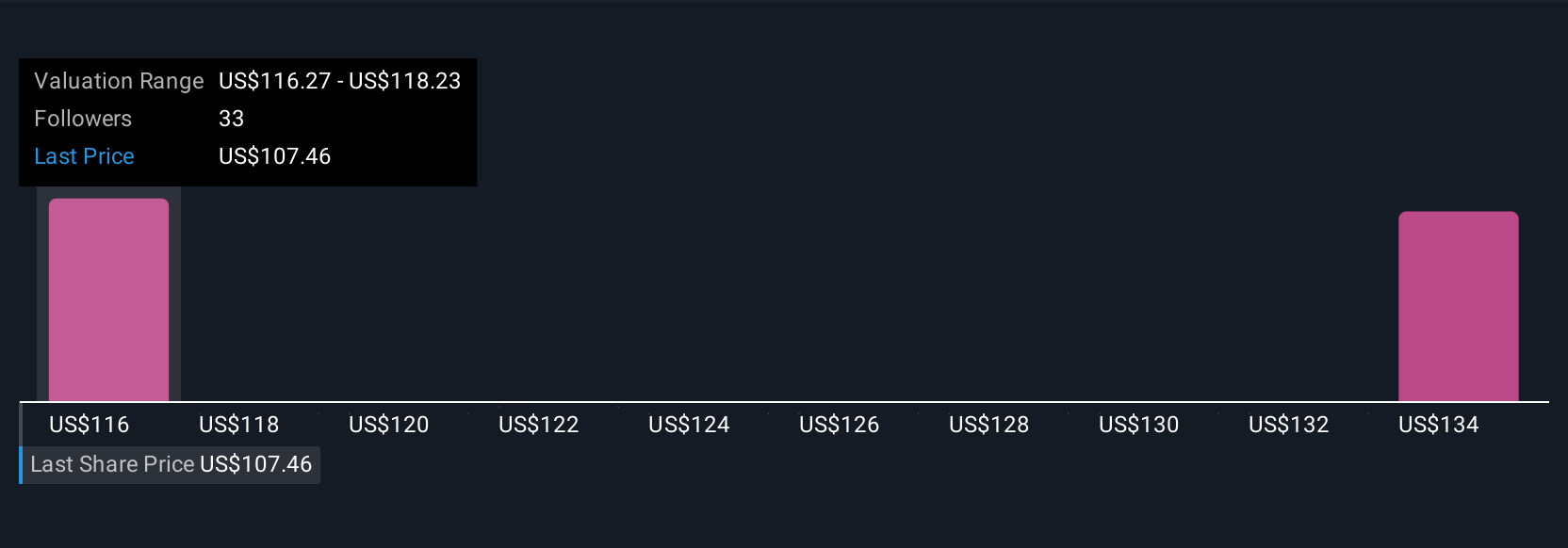

Four fair value estimates from the Simply Wall St Community stretch from US$115.43 to US$182.39 per share. While many see opportunity, momentum in NetApp’s cloud offerings will continue to shape the narrative for future performance.

Explore 4 other fair value estimates on NetApp - why the stock might be worth just $115.43!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

No Opportunity In NetApp?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.