Please use a PC Browser to access Register-Tadawul

How Does BioCryst Stack Up After Recent FDA Approval Boosts Biotech Sector?

BioCryst Pharmaceuticals, Inc. BCRX | 7.57 | -0.13% |

If you have BioCryst Pharmaceuticals stock on your watchlist or in your portfolio, you are probably eyeing the price chart and wondering what comes next. After all, even seasoned investors can get whiplash from moves like a 7-day slide of -4.2% and a 30-day drop of -11.6%. Zoom out, and things look complicated, with the stock down -6.4% so far this year but still up an impressive 88.2% over five years. That's a wide spectrum of outcomes, hinting at both opportunity and risk for those on the sidelines or already involved.

So, what’s driving these twists and turns? Recent market chatter around the biotech sector's changing risk appetite could help explain some of the latest volatility. As broader investor sentiment shifts between caution and optimism, stocks like BioCryst tend to feel the effects quickly. Still, price swings can mask underlying value, and this is where things get interesting.

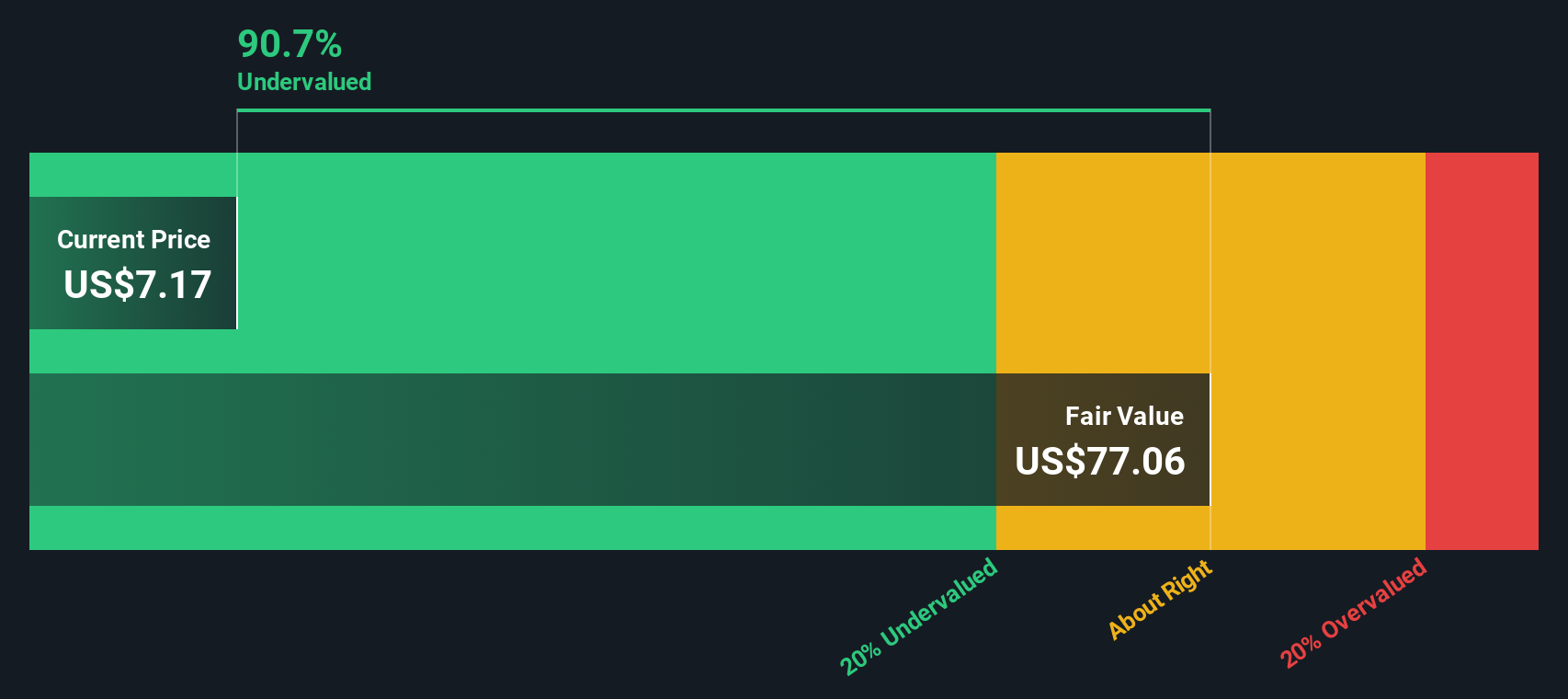

When we put BioCryst Pharmaceuticals through a thorough valuation check, the company stands out as undervalued in 5 out of 6 key criteria, earning a solid value score of 5. That suggests there may be significant upside if the market eventually recognizes the company's true worth.

Next, let’s break down the traditional valuation methods investors use to judge companies like BioCryst Pharmaceuticals. And stay tuned, after reviewing the basics, we’ll explore an even more insightful way to get a read on true value in today’s market.

Approach 1: BioCryst Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For BioCryst Pharmaceuticals, this means taking a close look at both recent financial results and long-term growth expectations to determine what the stock might truly be worth in the current market.

According to the latest numbers, BioCryst generated Free Cash Flow (FCF) of $14.89 million in the last twelve months. Analysts provide FCF forecasts through 2029, with projections showing robust growth, reaching $340.33 million in that year. After the analyst coverage period, estimates are extrapolated based on industry-appropriate assumptions, continuing the theme of strong expansion.

Running these projections through the 2 Stage Free Cash Flow to Equity model yields an intrinsic share value of $41.66. Compared to the current market price, this figure implies the stock is trading at an incredible 82.4% discount. In other words, the DCF model suggests BioCryst is deeply undervalued based on its capacity to generate future cash.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BioCryst Pharmaceuticals is undervalued by 82.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

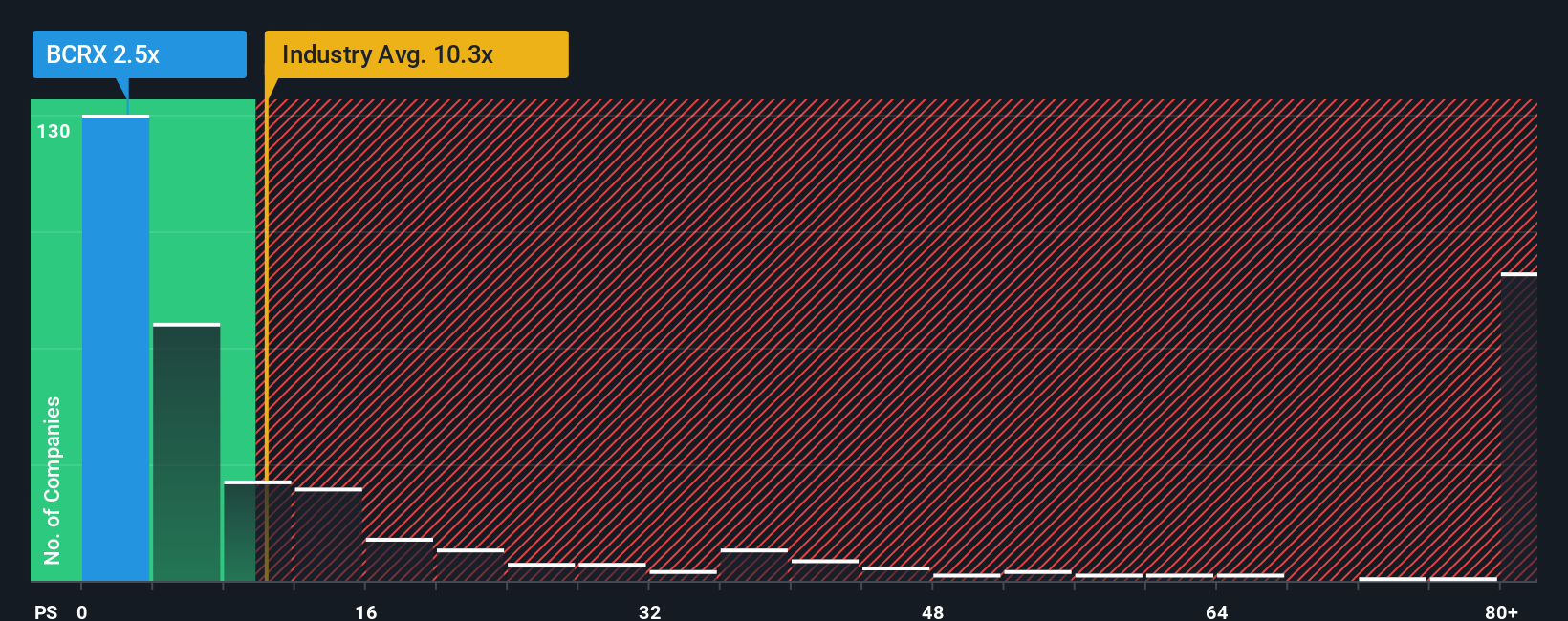

Approach 2: BioCryst Pharmaceuticals Price vs Sales

The Price-to-Sales (P/S) ratio is the preferred valuation metric for BioCryst Pharmaceuticals because it is especially useful for companies that are not consistently profitable, which is common in the biotech sector. Unlike the Price-to-Earnings ratio, the P/S ratio allows investors to assess valuation based on revenue generation rather than net income. This provides a clearer picture for high-growth companies in industries where short-term profits may be volatile.

Growth expectations and risk play a significant role in determining what constitutes a fair P/S ratio. Typically, companies expected to deliver strong revenue growth or operate in less risky environments can justify a higher P/S multiple. In contrast, higher risk or stagnant growth justify a lower ratio. For context, BioCryst currently trades at a P/S of 2.76x, which is well below the biotech industry average of 9.94x and also lower than the peer average of 4.17x.

To get a clearer sense of what multiple is truly appropriate, Simply Wall St calculates a “Fair Ratio.” This proprietary metric takes into account company-specific factors such as growth prospects, risk profile, profit margins, market cap, and industry. Unlike traditional benchmarks, the Fair Ratio adjusts for nuances that standard peer or industry multiples may miss, offering a more tailored measure of value. For BioCryst, the Fair Ratio is 3.78x, which is not far from the current P/S of 2.76x. That small difference suggests the stock is trading fairly close to where it should be given its fundamentals and sector backdrop.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BioCryst Pharmaceuticals Narrative

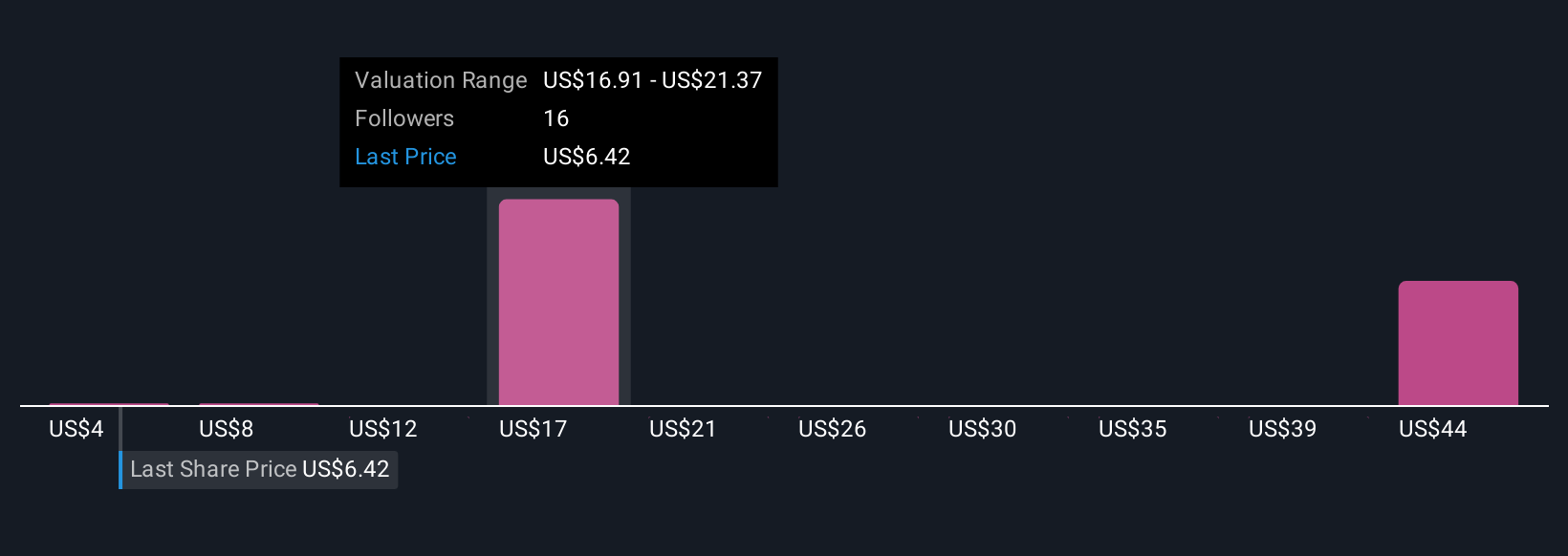

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives, a smarter and more dynamic approach to investing that goes beyond the numbers. In simple terms, a Narrative is your investment story: it is where you can put your perspective on a company’s future into action by connecting your assumptions about revenue, margins, and fair value with the underlying company story.

Every Narrative links what is happening in BioCryst Pharmaceuticals' business to your financial forecast and resulting fair value, clearly showing if the current price is attractive or not. Narratives are easy to create and access right on Simply Wall St's Community page, used by millions of investors to share and challenge ideas.

The power of Narratives is that they update automatically whenever new information arises, such as breaking news or earnings reports, helping you stay ahead in a fast-changing market. For example, one investor might believe BioCryst’s expanded rare disease pipeline will justify a price of $30, while another, more cautious, may set their fair value at just $11. You can see and compare both approaches in real time to sharpen your own decision making.

Do you think there's more to the story for BioCryst Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.