Please use a PC Browser to access Register-Tadawul

How Does Verisk Analytics (VRSK) Balance Rising Revenue Targets with Falling Earnings and Capital Returns?

Verisk Analytics Inc VRSK | 217.14 | +0.39% |

- On July 30, 2025, Verisk Analytics reported second-quarter results showing year-over-year revenue growth to US$772.6 million, but a decrease in net income to US$253.3 million, alongside the affirmation of its quarterly dividend, an upward revision of its full-year revenue guidance, and an update on share buybacks.

- An interesting insight is Verisk raised its full-year revenue target and continued shareholder returns through both dividends and share repurchases, despite reporting lower earnings.

- We'll explore how Verisk's upgraded annual revenue guidance shapes its investment narrative amid evolving business and capital return priorities.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Verisk Analytics Investment Narrative Recap

To be a Verisk Analytics shareholder, you need to believe in the company’s ability to drive reliable revenue growth from insurance analytics, even as industry risks like inflation and catastrophic events persist. The company’s recent upward revision to full-year revenue guidance is a positive short-term catalyst, but the headline financials, higher sales alongside lower net income, do not appear to radically alter the primary risk of profit margin pressure from economic uncertainty and rising costs.

Among the latest announcements, Verisk’s raised revenue guidance is most relevant. This suggests management sees continued demand for its data and analytics solutions this year, supporting the thesis that new sales strategies and product enhancements could help offset headwinds in margins or economically sensitive segments. For investors focused on top-line growth and business resilience, this guidance update is particularly significant.

By contrast, investors should also be aware of recent downward trends in net income, as underlying margin pressures remain a key consideration...

Verisk Analytics' narrative projects $3.6 billion revenue and $1.2 billion earnings by 2028. This requires 7.1% yearly revenue growth and a $235.9 million earnings increase from $964.1 million today.

Uncover how Verisk Analytics' forecasts yield a $309.75 fair value, a 11% upside to its current price.

Exploring Other Perspectives

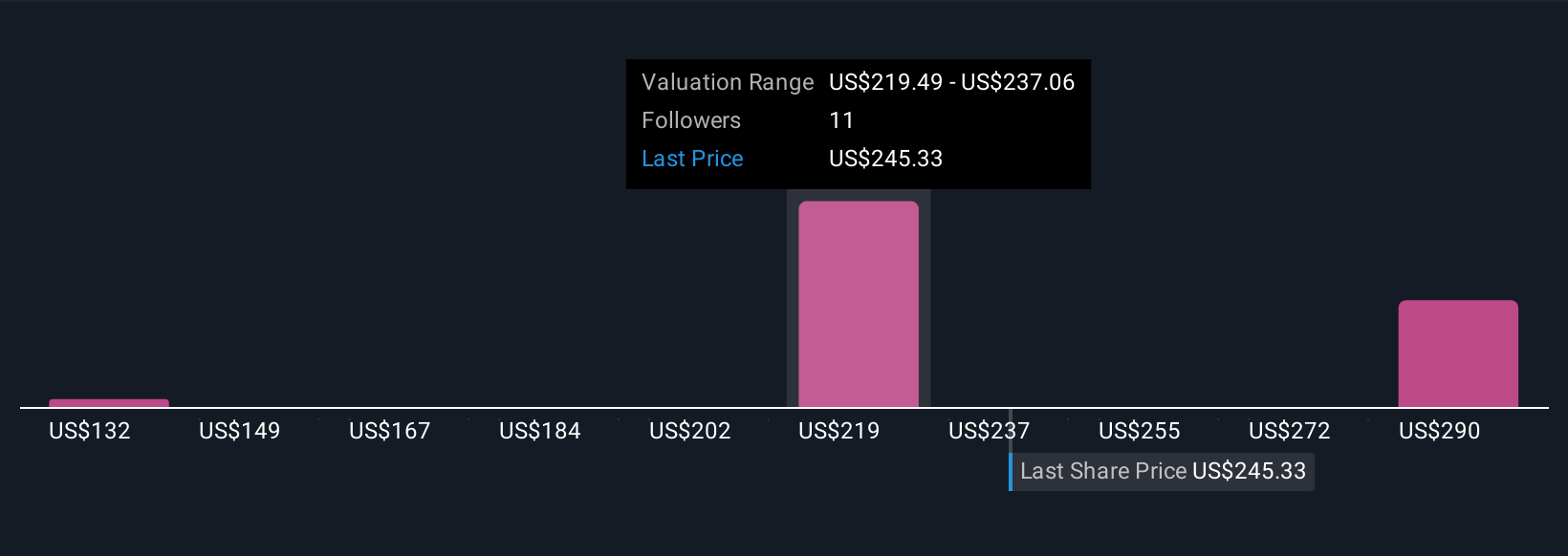

Four recent fair value estimates from the Simply Wall St Community range from US$131.67 to US$309.75 per share. While opinions differ, continued economic volatility may affect Verisk’s future revenue growth, so exploring multiple viewpoints is essential.

Explore 4 other fair value estimates on Verisk Analytics - why the stock might be worth less than half the current price!

Build Your Own Verisk Analytics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verisk Analytics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verisk Analytics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verisk Analytics' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.