Please use a PC Browser to access Register-Tadawul

How Early Efficacy Data for ZW191 at Zymeworks (ZYME) Has Changed Its Investment Story

Zymeworks Inc. ZYME | 25.48 | +2.17% |

- Zymeworks Inc. recently presented preliminary results from a Phase 1 study of its antibody-drug conjugate ZW191 targeting folate receptor-alpha in advanced solid tumors, showing a promising objective response rate and manageable safety profile among patients with difficult-to-treat ovarian, endometrial, and non-small cell lung cancers.

- A unique insight from the study is that ZW191 showed responses even in tumors with low or negative folate receptor expression, suggesting potential benefits for a broader patient population beyond conventional biomarker-driven selection criteria.

- We'll take a look at how these early efficacy signals for ZW191 may influence Zymeworks’ outlook as perceived by analysts and investors.

Find companies with promising cash flow potential yet trading below their fair value.

Zymeworks Investment Narrative Recap

To be a shareholder in Zymeworks, you need confidence in the company's ability to convert promising early-stage oncology assets into future revenue streams, especially as milestone and royalty payments from partnered candidates drive short-term cash flow. The recent preliminary Phase 1 results for ZW191 introduce encouraging clinical potential, but the biggest near-term catalyst remains progress with partnered late-stage assets, while the risk of clinical or regulatory setbacks in the pipeline persists. The impact of these interim results is supportive of narrative momentum, yet not materially transformative for the near-term milestone timeline or risk profile.

Among the latest announcements, the discontinuation of ZW171 is particularly relevant as it underscores the all-or-nothing nature of early-stage biotech portfolios, amplifying both the significance of positive ZW191 signals and the inherent risk of pipeline attrition. While ZW191 offers reason for optimism, it also highlights that clinical setbacks in the concentrated pipeline can impact future revenue avenues and overall company valuation.

In contrast, investors should be aware that consistent success in early trials does not guarantee favorable late-stage outcomes, particularly in the context of...

Zymeworks' narrative projects $150.9 million revenue and $24.2 million earnings by 2028. This requires 7.1% yearly revenue growth and a $97.9 million increase in earnings from -$73.7 million today.

Uncover how Zymeworks' forecasts yield a $23.68 fair value, a 33% upside to its current price.

Exploring Other Perspectives

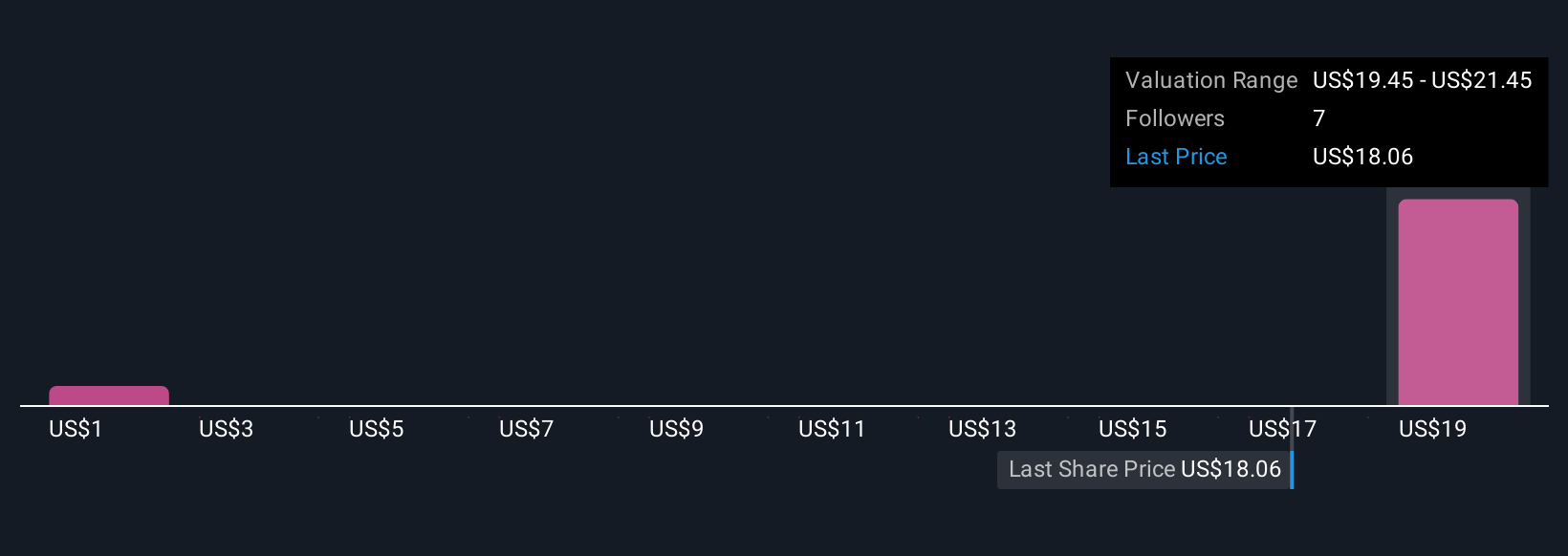

Community members at Simply Wall St have set fair value estimates for Zymeworks ranging sharply from US$1.43 to US$23.68 across just two opinions. Early-stage biotech risks, especially clinical attrition, mean your outlook could differ widely from consensus, see how others compare their assumptions to yours.

Explore 2 other fair value estimates on Zymeworks - why the stock might be worth less than half the current price!

Build Your Own Zymeworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zymeworks research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Zymeworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zymeworks' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.