Please use a PC Browser to access Register-Tadawul

How Gentex’s (GNTX) 40 Million Share Buyback Could Impact Investors

Gentex Corporation GNTX | 23.70 | +0.15% |

- Gentex Corporation recently announced a share repurchase program, with plans to buy back up to 40,000,000 shares of its common stock as authorized by its Board of Directors.

- This program highlights the company's confidence in its financial position and could signal an emphasis on returning value to shareholders amid ongoing industry changes.

- We'll consider how this significant buyback authorization could reinforce Gentex's earnings per share growth focus within its broader investment outlook.

Gentex Investment Narrative Recap

To be a Gentex shareholder, you need faith in the company's ability to drive earnings growth by combining new product innovation, successful integration of acquisitions, and disciplined financial management, even as supply chain volatility, tariffs, and shifting demand in the China market introduce ongoing uncertainty. The newly announced share repurchase program is a significant move but does not materially reduce the near-term risks tied to revenue exposure in China or challenges from tariff-related disruptions, which remain the most pressing issues for the business.

Among the company's recent announcements, the completed VOXX merger stands out, as it brings meaningful new revenue streams and aligns with Gentex's drive to strengthen its portfolio and offset external pressures. This expansion could help cushion impacts from market headwinds, but will also test Gentex's ability to manage greater complexity and potential margin risk amid global trade challenges.

However, despite the emphasis on returning value to shareholders, investors should also consider the possibility that ongoing China market risks could...

Gentex's narrative projects $2.9 billion revenue and $513.0 million earnings by 2028. This requires 8.1% yearly revenue growth and a $127.2 million earnings increase from $385.8 million today.

Exploring Other Perspectives

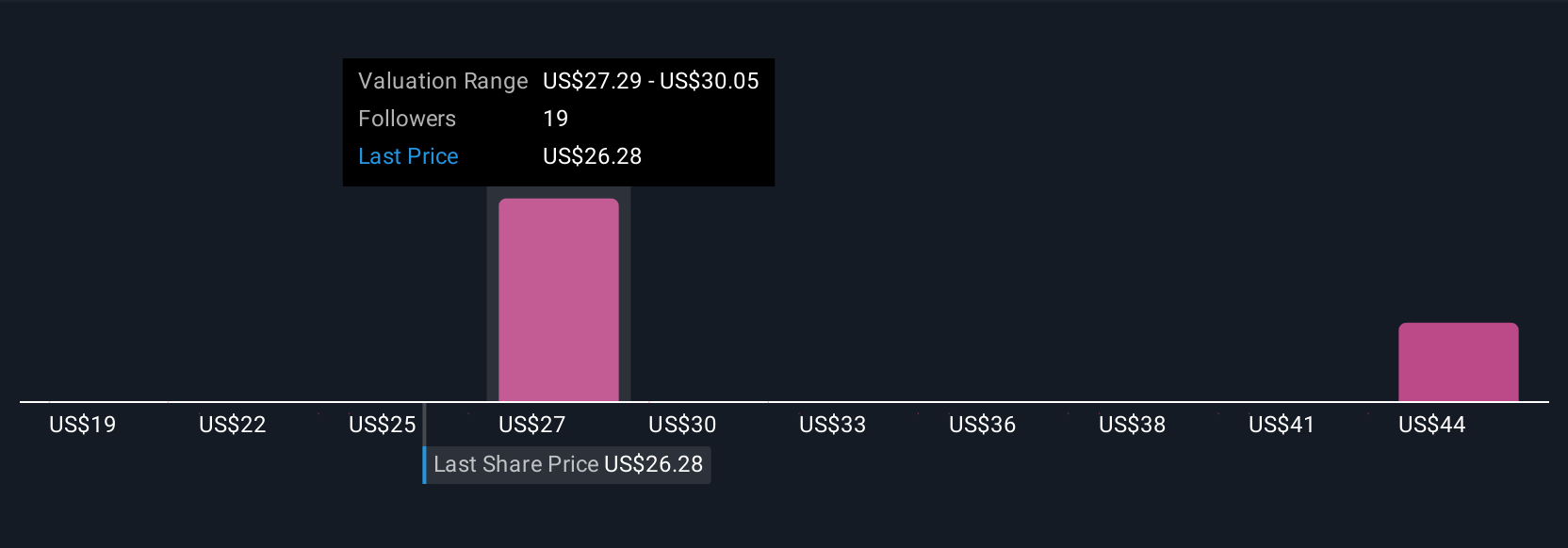

Five community member fair value estimates for Gentex range sharply from US$19 to US$46.58 per share. While views vary, many point to continued tariff and China market risks shaping the company's outlook, encouraging you to review more opinions for a broader understanding.

Build Your Own Gentex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gentex research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Gentex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gentex's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.