Please use a PC Browser to access Register-Tadawul

How GlobalFoundries' RISC-V MIPS I8500 Chip Launch May Shape the Outlook for GFS Investors

GlobalFoundries Inc. GFS | 42.91 | +4.74% |

- Earlier this month, GlobalFoundries unveiled the MIPS I8500 chip at its Technology Summit in Munich, following its acquisition of chip design company MIPS, introducing a RISC-V-based architecture for real-time, event-driven computing applications.

- This development highlights GlobalFoundries' push into customizable, energy-efficient silicon targeting 5G/6G and edge AI hardware markets, strengthening its position in next-generation semiconductor solutions.

- Let's explore how GlobalFoundries' MIPS I8500 launch, and focus on edge AI hardware, could impact its outlook and investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

GlobalFoundries Investment Narrative Recap

For shareholders, the core thesis around GlobalFoundries centers on its ability to serve growing demand in automotive, communications infrastructure, and edge AI through differentiated technologies and a broad manufacturing footprint. The recent MIPS I8500 chip launch signals further innovation in customizable, energy-efficient silicon, but does not materially change the near-term focus on capacity expansions or address the primary risk of limited exposure to advanced process nodes versus leading rivals.

Among recent developments, the expanded partnership with Apple stands out, as it reinforces GlobalFoundries' role in US-based semiconductor manufacturing and could underpin future demand for its mainstream technologies. This collaboration aligns with ongoing catalysts around multi-year agreements, regional supply chains, and government incentives, which together support improved revenue visibility and margin stability.

However, investors should also be aware that, in contrast, GlobalFoundries’ smaller presence in advanced nodes remains a key risk that could...

GlobalFoundries' outlook anticipates $8.6 billion in revenue and $1.4 billion in earnings by 2028. This scenario is based on an 8.0% annual revenue growth rate and a $1.5 billion increase in earnings from the current earnings of -$115 million.

Uncover how GlobalFoundries' forecasts yield a $39.43 fair value, a 11% upside to its current price.

Exploring Other Perspectives

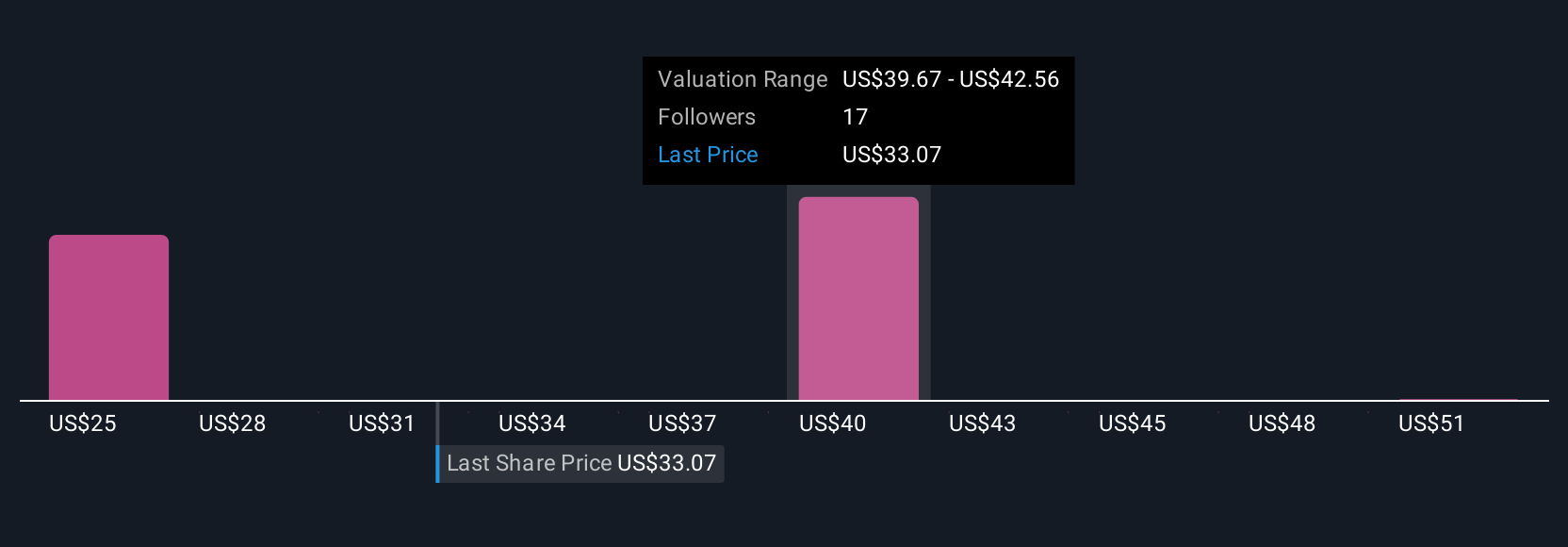

Fair value estimates from five Simply Wall St Community members range widely from US$25.92 to US$54.14 per share. While some see potential upside, the limited advanced-node exposure remains a concern for long-term growth and competitiveness, consider how much perspectives on the company's future prospects can differ.

Explore 5 other fair value estimates on GlobalFoundries - why the stock might be worth 27% less than the current price!

Build Your Own GlobalFoundries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GlobalFoundries research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free GlobalFoundries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GlobalFoundries' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.