Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Automatic Data Processing (ADP) Steady Earnings Growth and Russell 1000 Influence

Automatic Data Processing, Inc. ADP | 266.10 | +1.18% |

- In recent days, Automatic Data Processing (NASDAQ:ADP) reported earnings per share growth of 13% per year over the last three years and a 7.1% increase in revenue to US$21 billion, with EBIT margins holding steady and insider ownership valued at US$78 million.

- ADP’s reinforced role in the Russell 1000 index and sustained institutional interest highlight its operational efficiency, technological advancements, and influence within the technology sector.

- Now, we’ll assess how ADP’s consistent revenue growth and strong index presence shape the latest investment narrative for the company.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Automatic Data Processing Investment Narrative Recap

To be a shareholder in Automatic Data Processing, you need to believe in the long-term demand for outsourced, cloud-based HR and payroll solutions as businesses digitize operations. The recent results, showing stable margins and healthy revenue gains, reinforce the view that ADP’s core franchises remain resilient. These updates do not appear to materially affect the key short-term catalyst for ADP, sustaining growth in advanced technology product adoption, nor do they significantly shift the main risk: ongoing competitive pressure and delayed deal closures. Among recent company news, ADP’s product launches, particularly the rollout of ADP® Embedded Payroll for SMB software providers, aligns closely with the company’s growth catalysts. This move supports ADP’s efforts to increase customer lock-in and expand its addressable market through technology adoption, potentially offsetting booking slowdowns or sales cycle delays if widely embraced. Yet, the growing influence of newer, SaaS-native competitors could lead to an acceleration in pricing pressure and pipeline delays, which investors should be aware of as...

Automatic Data Processing is projected to reach $24.3 billion in revenue and $5.1 billion in earnings by 2028. This outlook depends on a 5.7% annual revenue growth rate and a $1.0 billion increase in earnings from the current level of $4.1 billion.

Uncover how Automatic Data Processing's forecasts yield a $314.17 fair value, a 11% upside to its current price.

Exploring Other Perspectives

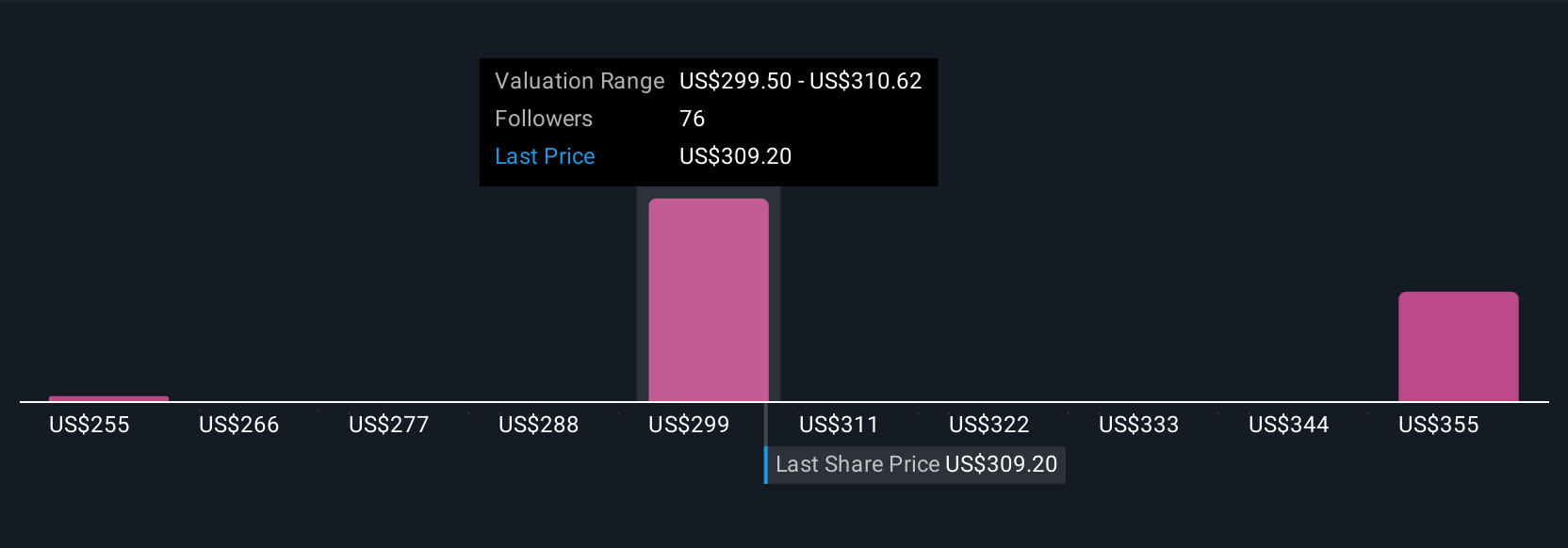

Private fair value estimates from eight Simply Wall St Community members for ADP range widely from US$235 to US$387 per share. With deal cycle delays posing a real risk, you may want to review how others see pressure points shaping future results.

Explore 8 other fair value estimates on Automatic Data Processing - why the stock might be worth 17% less than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.