Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Avis Budget Group (CAR) $19M Settlement Over Fee Transparency Lawsuit

Avis Budget Group, Inc. CAR | 129.31 | +0.55% |

- In September 2025, Avis Budget Group and Payless Car Rental agreed to pay US$19 million to settle a class action lawsuit alleging improper customer charges for declined Gas Service Option and Roadside Protection fees, following allegations under the New Jersey Consumer Fraud Act.

- This settlement may have implications for the company’s reputation and future operations, as it addresses longstanding customer concerns over fee transparency and business practices.

- We’ll examine how resolving this high-profile lawsuit could influence Avis Budget Group’s investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Avis Budget Group Investment Narrative Recap

To be a shareholder in Avis Budget Group, you need to believe the company’s premiumization efforts and early moves in autonomous mobility will unlock new growth, even as recent results reflect a period of challenge. The US$19 million class-action settlement related to fee transparency addresses reputational questions, but does not appear to materially affect the near-term launch of high-margin products or the primary risk tied to execution in new business lines. This may refocus attention on management’s ability to deliver on its innovation strategies rather than legacy legal issues. Among recent announcements, the July partnership with Waymo is particularly relevant, signaling a push into autonomous vehicle services that could diversify revenue streams beyond traditional rentals. For investors, this suggests that the company is continuing to act on industry catalysts for structural change, even as it manages legal and operational complexities in the background. Yet, despite optimism around premiumization and digital transformation, the possibility that new legal or reputational headwinds could reshape customer perceptions is a risk investors should keep in mind...

Avis Budget Group's outlook anticipates $12.2 billion in revenue and $1.0 billion in earnings by 2028. This is based on analysts estimating a 1.4% annual revenue growth rate and a $3.2 billion increase in earnings from the current level of -$2.2 billion.

Uncover how Avis Budget Group's forecasts yield a $148.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

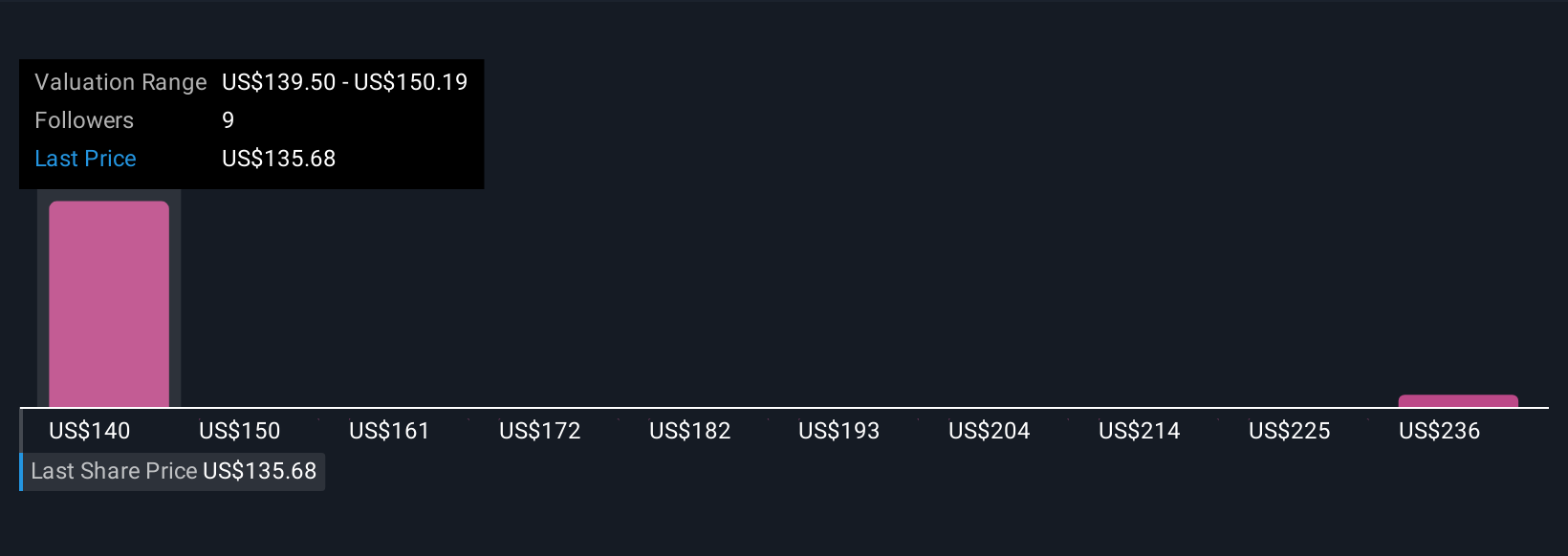

Simply Wall St Community members provided two fair value estimates ranging from US$148 to US$246.44, reflecting significant differences in outlook. Many remain focused on how recent legal resolutions or competitive risks could affect enduring value, so reviewing multiple viewpoints can help you see what others expect.

Explore 2 other fair value estimates on Avis Budget Group - why the stock might be worth as much as 56% more than the current price!

Build Your Own Avis Budget Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avis Budget Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avis Budget Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avis Budget Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.