Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To CBL & Associates Properties (CBL) Acquiring Four Enclosed Regional Malls

CBL & Associates Properties, Inc. CBL | 38.22 | +2.14% |

- Earlier this week, CBL & Associates Properties announced the acquisition of four enclosed regional malls, Ashland Town Center, Mesa Mall, Paddock Mall, and Southgate Mall, marking its first major purchase of this kind in ten years.

- This move underscores the company's renewed commitment to the enclosed mall format and highlights its focus on actively enhancing and managing these retail assets.

- Next, we'll explore how this significant acquisition of multiple malls shapes CBL & Associates Properties’ broader investment narrative and growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is CBL & Associates Properties' Investment Narrative?

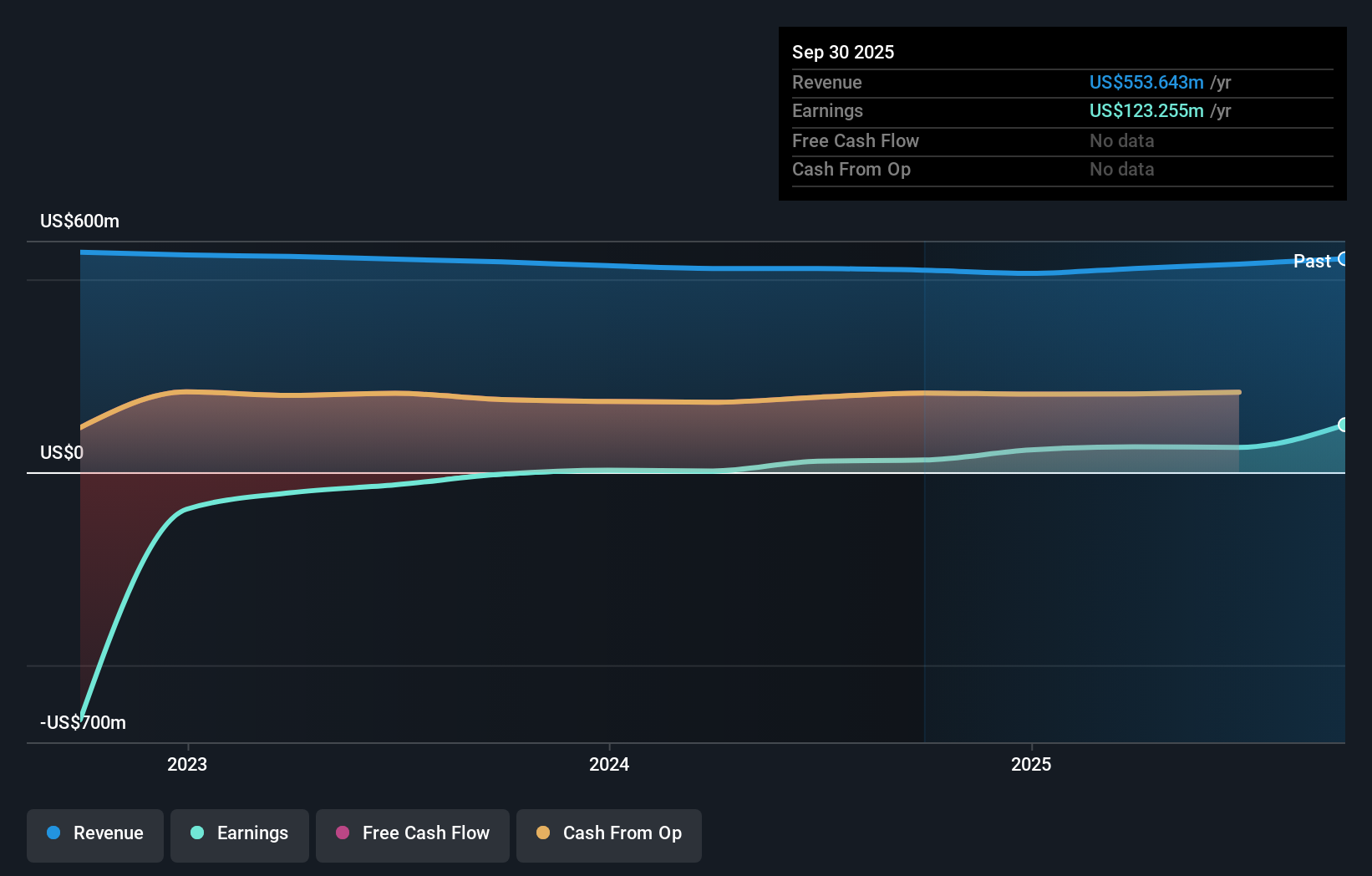

For someone considering CBL & Associates Properties as an investment, the big picture centers on the company's ability to actively manage and revitalize its retail properties while maintaining healthy financials and returns to shareholders. The recent acquisition of four enclosed malls is a clear signal that CBL is doubling down on the enclosed mall segment as a core growth driver, which could potentially shift the company’s short-term catalysts. Previously, buybacks, dividends, and operational improvements in existing assets were front and center, but with the new properties, the near-term focus may turn to the speed and effectiveness of CBL’s asset integration and tenant mix enhancements. This could amplify execution risks and add complexity given sector-wide headwinds; however, if the new malls perform well and CBL leverages its management experience, investors could see a stronger growth narrative develop. That said, recent results included a large one-off gain, so assessing underlying earnings quality remains crucial here.

But investors should be alert to how acquisition integration impacts ongoing earnings potential. CBL & Associates Properties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on CBL & Associates Properties - why the stock might be worth as much as 8% more than the current price!

Build Your Own CBL & Associates Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBL & Associates Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CBL & Associates Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBL & Associates Properties' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.