Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Cheniere Energy (LNG) Landing a Historic EU-US LNG Export Agreement

Cheniere Energy, Inc. LNG | 189.28 | +0.24% |

- Earlier this week, the United States and the European Union announced a trade agreement under which the EU will purchase US$750 billion worth of American energy over three years, emphasizing liquefied natural gas exports and lower tariffs on U.S. products.

- This marks the largest energy deal in transatlantic history and reflects the EU's shift toward securing long-term LNG supplies from U.S. producers, including Cheniere Energy.

- We'll explore how these expanded LNG purchases by the EU could influence Cheniere's outlook amid its ongoing capacity expansion plans.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cheniere Energy Investment Narrative Recap

At its core, the Cheniere Energy investment thesis centers on robust US liquefied natural gas (LNG) demand and the company’s ability to expand and deliver to international buyers, especially as Europe seeks long-term alternatives to Russian gas. The recent US-EU energy deal supports LNG demand and could reduce near-term demand risk, but it does not eliminate ongoing concerns about volatile global gas prices, which remain the most significant short-term catalyst and risk for Cheniere’s results.

The recent completion of Train 1 at Corpus Christi Stage 3, adding capacity ahead of schedule, directly aligns with the company’s key catalyst: ramping up production to serve incremental contracts. This operational milestone reinforces Cheniere’s ability to meet rising European demand and seize long-term export opportunities, although supply and pricing headwinds can still materially impact financial outcomes.

On the other hand, investors should also be aware that if global gas prices normalize or trend lower, even strong export contracts may not fully insulate the business from...

Cheniere Energy's narrative projects $23.0 billion in revenue and $2.9 billion in earnings by 2028. This requires 11.1% yearly revenue growth and a $0.2 billion decrease in earnings from $3.1 billion today.

Uncover how Cheniere Energy's forecasts yield a $264.47 fair value, a 16% upside to its current price.

Exploring Other Perspectives

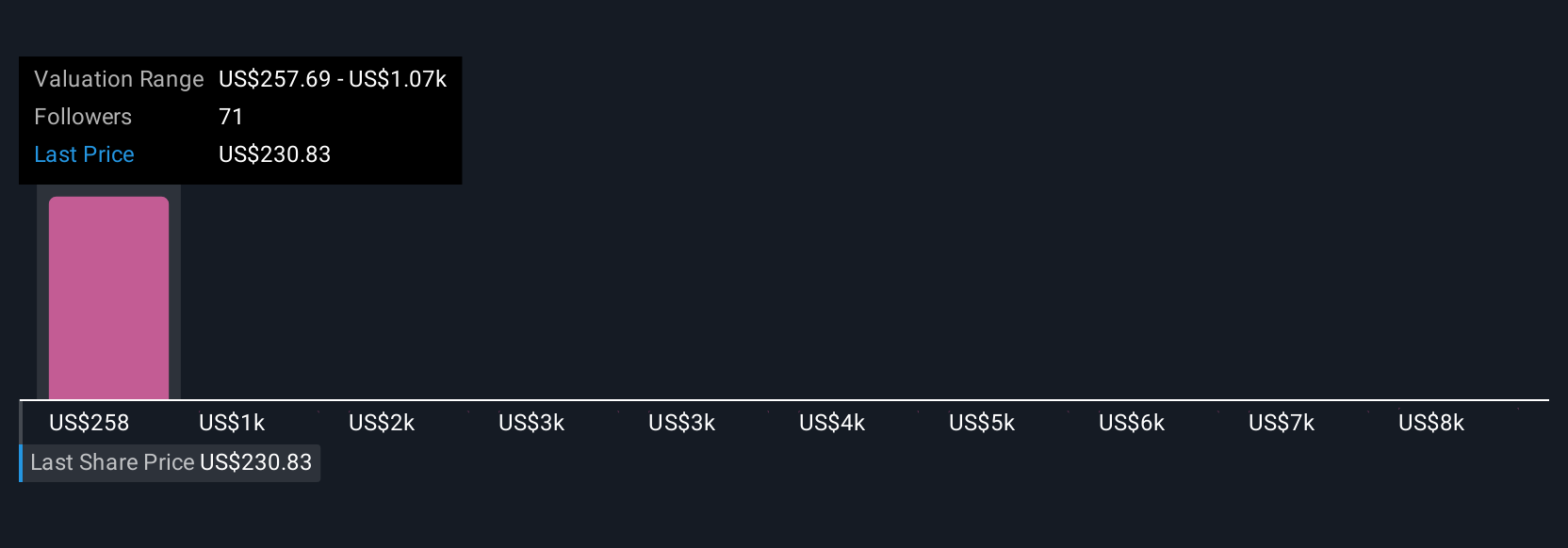

Simply Wall St Community members estimate Cheniere’s fair value anywhere from US$257.69 up to US$8,336.80 across 5 submitted models. While opinions are wide, recent news around US-EU demand highlights just how much future market conditions can sway these outlooks, see how your forecast fits in.

Explore 5 other fair value estimates on Cheniere Energy - why the stock might be a potential multi-bagger!

Build Your Own Cheniere Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.