Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Digi International (DGII) Expanding Its SmartSense ONE Unified IoT Platform

Digi International Inc. DGII | 50.20 | -1.99% |

- Digi International recently launched SmartSense ONE, a unified, modular IoT platform built on its SmartSense and Jolt acquisition capabilities, and expanded Digi Ventus managed 5G connectivity solutions to channel partners, aiming to simplify compliance, monitoring, and connectivity across retail, food service, healthcare, and edge environments.

- By combining prescriptive analytics, automated monitoring, and fully managed cellular connectivity into scalable, multi-module offerings, Digi is pushing deeper into higher-value, software-led and service-based solutions that could influence how consistently customers rely on its platforms for mission-critical operations.

- We’ll now examine how Digi’s launch of the SmartSense ONE unified platform may influence the company’s investment narrative and future positioning.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Digi International Investment Narrative Recap

To own Digi International, you need to believe in its shift toward higher-margin, recurring IoT and connectivity services while managing relatively modest topline growth expectations. The SmartSense ONE and Digi Ventus launches reinforce this software and services tilt, but do not materially change the near term reliance on ARR growth as the key catalyst or the risk that hardware revenue or regional demand softness could weigh on overall results.

Among recent announcements, Digi Ventus Managed Connectivity Solutions look especially relevant, because they extend Digi’s managed services and recurring connectivity offerings through channel partners. For investors watching the ARR story, this program highlights how Digi is trying to deepen its role in always-on, 5G-enabled edge connectivity, which ties directly into the core catalyst of expanding subscription-based revenue and service attach across its installed base.

Yet behind the push into SmartSense ONE and managed 5G services, investors should also be aware of the risk that recurring revenue growth slows or...

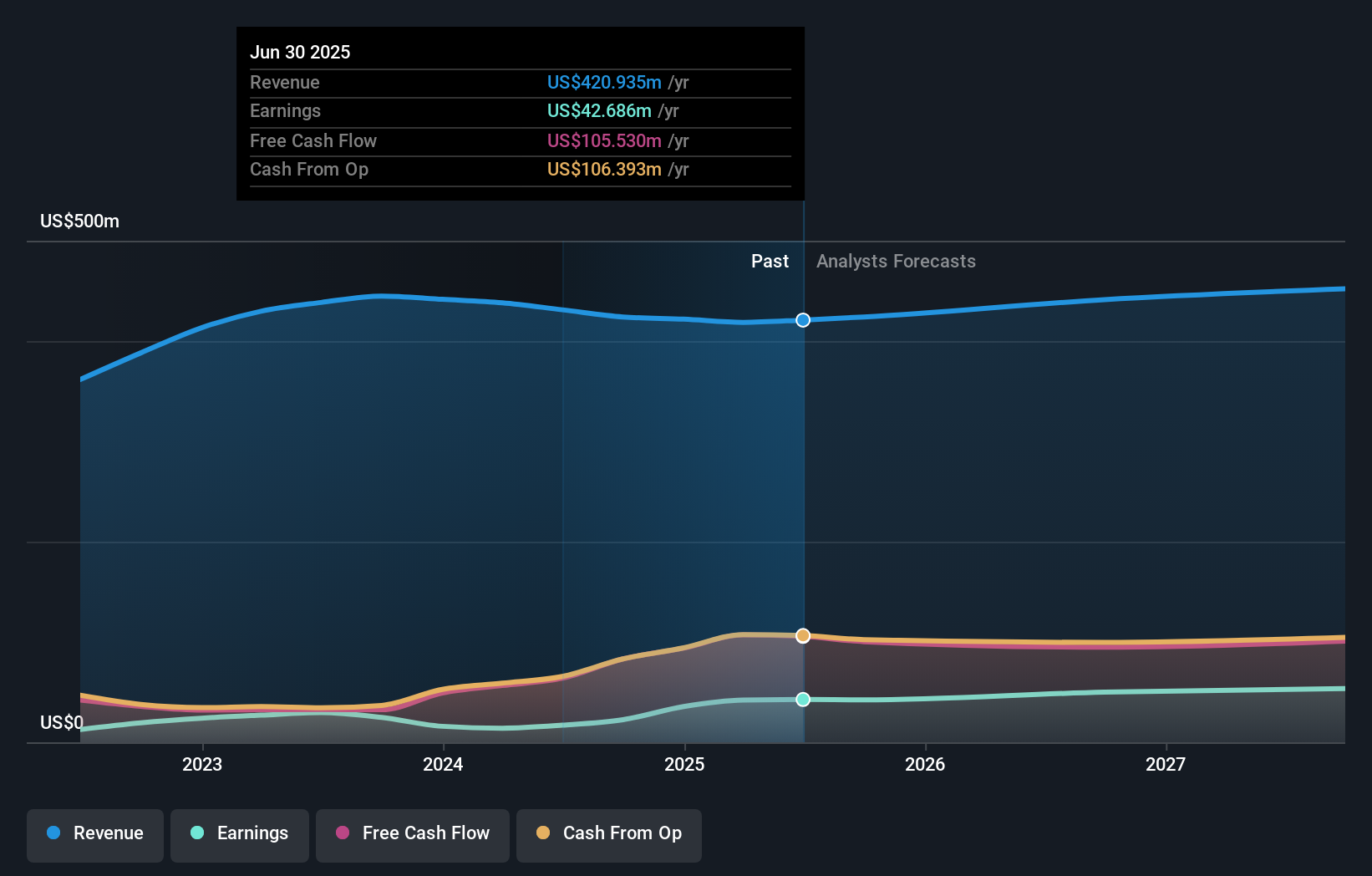

Digi International's narrative projects $497.0 million revenue and $72.6 million earnings by 2028. This requires 5.7% yearly revenue growth and a $29.9 million earnings increase from $42.7 million today.

Uncover how Digi International's forecasts yield a $47.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Digi’s fair value between US$37.38 and US$60.22 across 3 independent views, underscoring how far opinions can stretch. Against that backdrop, the company’s reliance on recurring revenue growth as a key earnings driver gives you a clear focal point to test your own expectations about how its IoT and connectivity platforms might perform over time.

Explore 3 other fair value estimates on Digi International - why the stock might be worth 12% less than the current price!

Build Your Own Digi International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digi International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Digi International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digi International's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.