Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Equifax (EFX) Pairing Strong Results With Aggressive Buybacks And M&A Ambitions

Equifax Inc. EFX | 197.46 | +1.11% |

- In early February 2026, Equifax reported higher fourth-quarter and full-year 2025 revenue and earnings, issued upbeat 2026 guidance, detailed around US$1.50 billion of capital available for acquisitions and shareholder returns, and confirmed completion of a US$927.39 million share repurchase program.

- Beyond the headline growth, Equifax’s focus on bolt-on M&A to enhance Workforce Solutions and proprietary data, alongside expectations for margin expansion as mortgage customers gradually adopt VantageScore, highlights how management aims to deepen its data moat and improve profitability.

- We’ll now examine how Equifax’s strong free cash flow outlook and M&A firepower might reshape the earlier investment narrative around growth and risk.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

Equifax Investment Narrative Recap

To own Equifax, you need to believe in its ability to turn proprietary data, verification services and AI-enabled products into durable, high-margin cash flows. The latest earnings and 2026 guidance support that narrative, while strong projected free cash generation appears to lessen near term balance sheet risk but does not directly address ongoing legal and regulatory pressures, which remain the key overhang for many investors.

The most relevant update here is Equifax’s expectation of more than US$1.0 billion in free cash flow and about US$1.5 billion of capital available in 2026 for bolt on M&A and shareholder returns. For investors focused on product and data moat expansion as the main catalyst, that pool of capital, combined with management’s emphasis on Workforce Solutions and international platforms, may shape how quickly Equifax can reinforce its competitive position relative to emerging scoring models and fintech rivals.

Yet against this backdrop of cash generation and M&A capacity, investors should also be aware of how rising regulatory scrutiny and data privacy risks could...

Equifax’s narrative projects $7.8 billion revenue and $1.3 billion earnings by 2028.

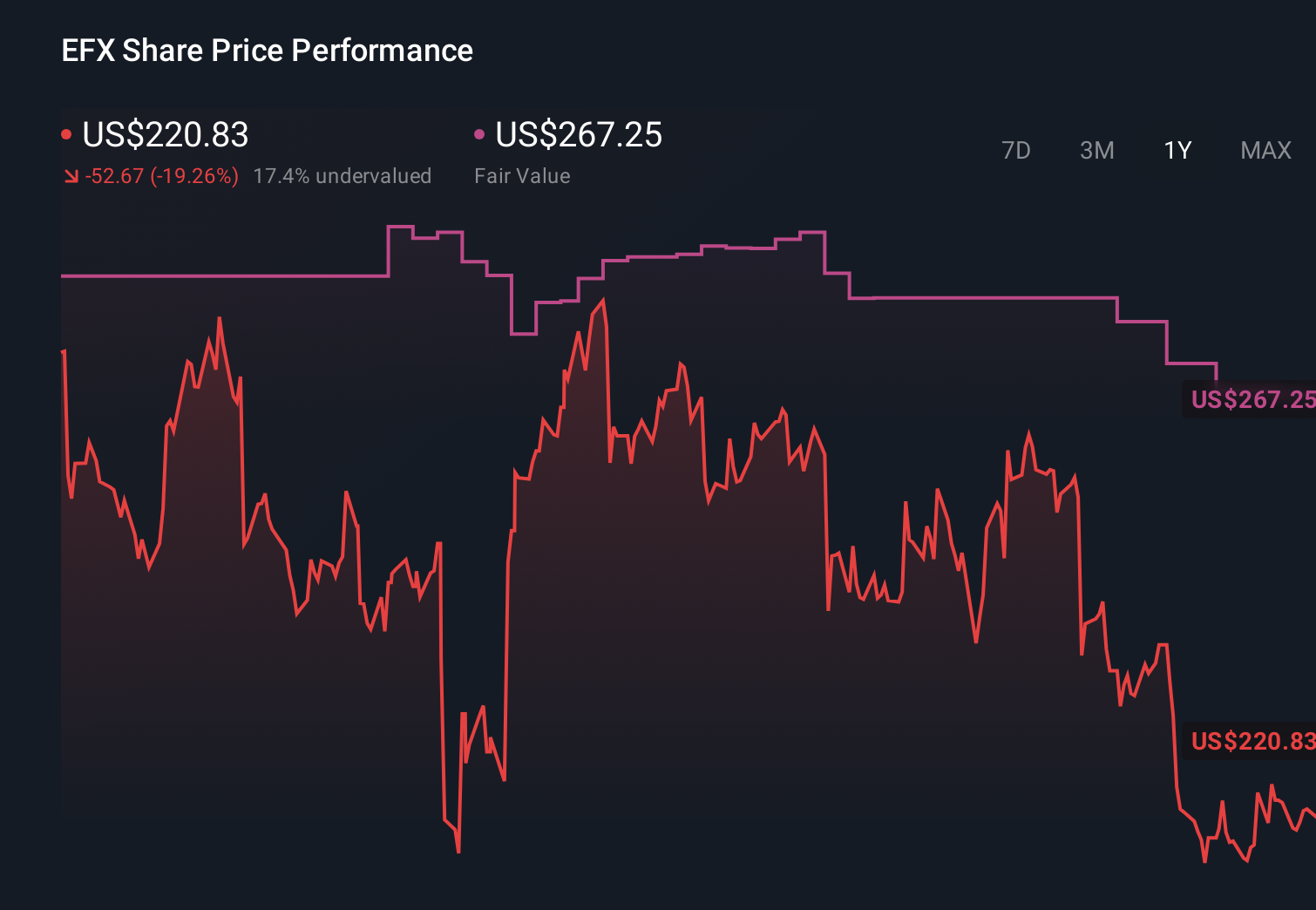

Uncover how Equifax's forecasts yield a $243.15 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see Equifax’s fair value between US$243.15 and US$447.94, highlighting wide disagreement on upside. Set this against Equifax’s own focus on expanding its proprietary data and AI enabled products, which could meaningfully influence how quickly the company can strengthen its competitive position and longer term profitability.

Explore 5 other fair value estimates on Equifax - why the stock might be worth over 2x more than the current price!

Build Your Own Equifax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equifax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equifax's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with 29 elite penny stocks that balance risk and reward.

- Capitalize on the AI infrastructure supercycle with our selection of the 34 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

- The future of work is here. Discover the 32 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.