Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Fortinet (FTNT) Class Action Lawsuits Over Product Refresh Revenue Statements

Fortinet, Inc. FTNT | 82.76 | +4.85% |

- In recent weeks, several law firms announced class action lawsuits against Fortinet, Inc., alleging that the company and certain officers made false and misleading statements about the revenue potential and timing of its FortiGate unit refresh cycle between November 8, 2024, and August 6, 2025.

- This legal action introduces material legal and reputational risks at a time when Fortinet was expected to deliver continued revenue and earnings growth, based on strong operational performance and analyst forecasts.

- We'll explore how the legal uncertainties surrounding the product refresh cycle could influence Fortinet's future earnings expectations and investment outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Fortinet Investment Narrative Recap

To be a Fortinet shareholder, you need to believe in the staying power of integrated cybersecurity demand, especially as digital threats surge and regulatory scrutiny tightens. The recent class action lawsuits tied to the FortiGate unit refresh cycle add legal uncertainty, which could weigh on the most important short-term catalyst: sustained revenue and earnings growth from ongoing hardware and services upgrades. Right now, these lawsuits represent the biggest near-term risk for both reputation and earnings expectations.

One of Fortinet's most relevant recent announcements is its financial guidance for the upcoming quarter, which calls for revenue between US$1.67 billion and US$1.73 billion. This aligns with analyst expectations of double-digit growth, but any adverse developments from the legal proceedings could challenge management’s ability to deliver on these forecasts and maintain investor confidence.

By contrast, the scope of the legal risks facing Fortinet is information investors should be aware of before...

Fortinet's outlook points to $9.2 billion in revenue and $2.4 billion in earnings by 2028. This scenario assumes a 13.1% annual revenue growth rate and a $0.5 billion increase in earnings from current earnings of $1.9 billion.

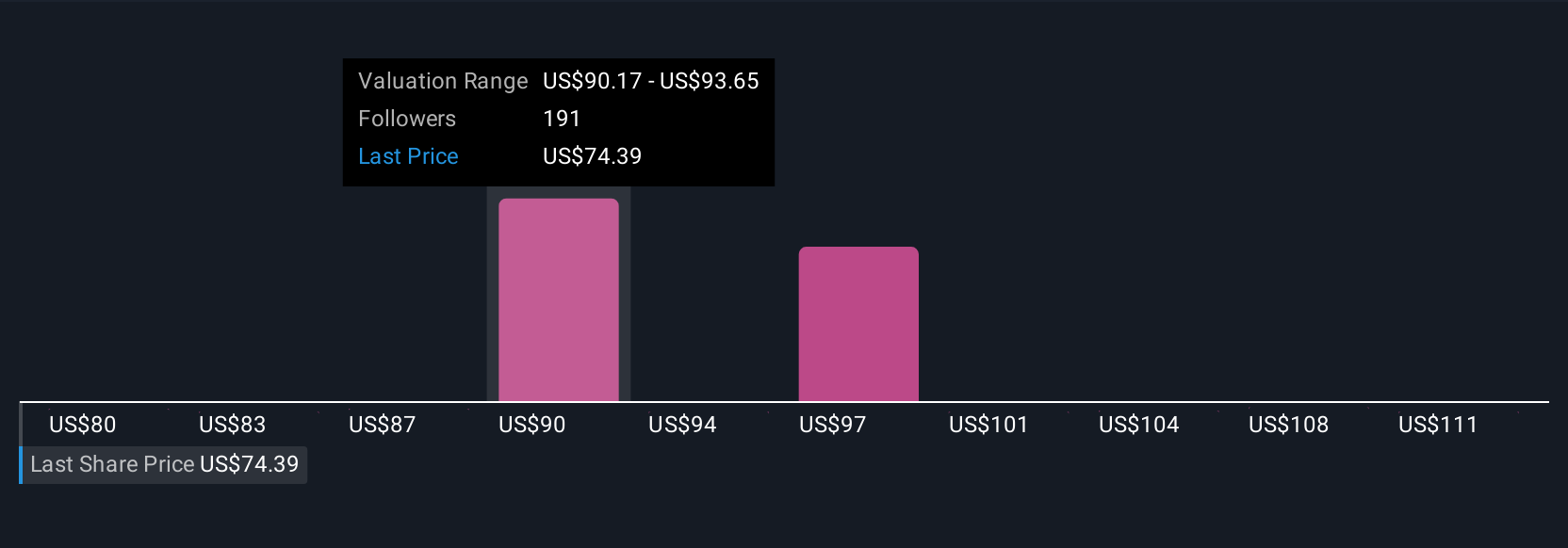

Uncover how Fortinet's forecasts yield a $90.32 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 25 Simply Wall St Community members span US$83.65 to US$110.39 per share, a broad range that underscores wide differences in outlook. Even with projected double-digit revenue growth, your perspective on future risks and earnings potential could shift how you see Fortinet in your portfolio.

Explore 25 other fair value estimates on Fortinet - why the stock might be worth just $83.65!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

No Opportunity In Fortinet?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.