Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Genworth Financial (GNW) Completing Major Share Buyback Amid Lower Earnings

Genworth Financial, Inc. GNW | 8.97 | -0.61% |

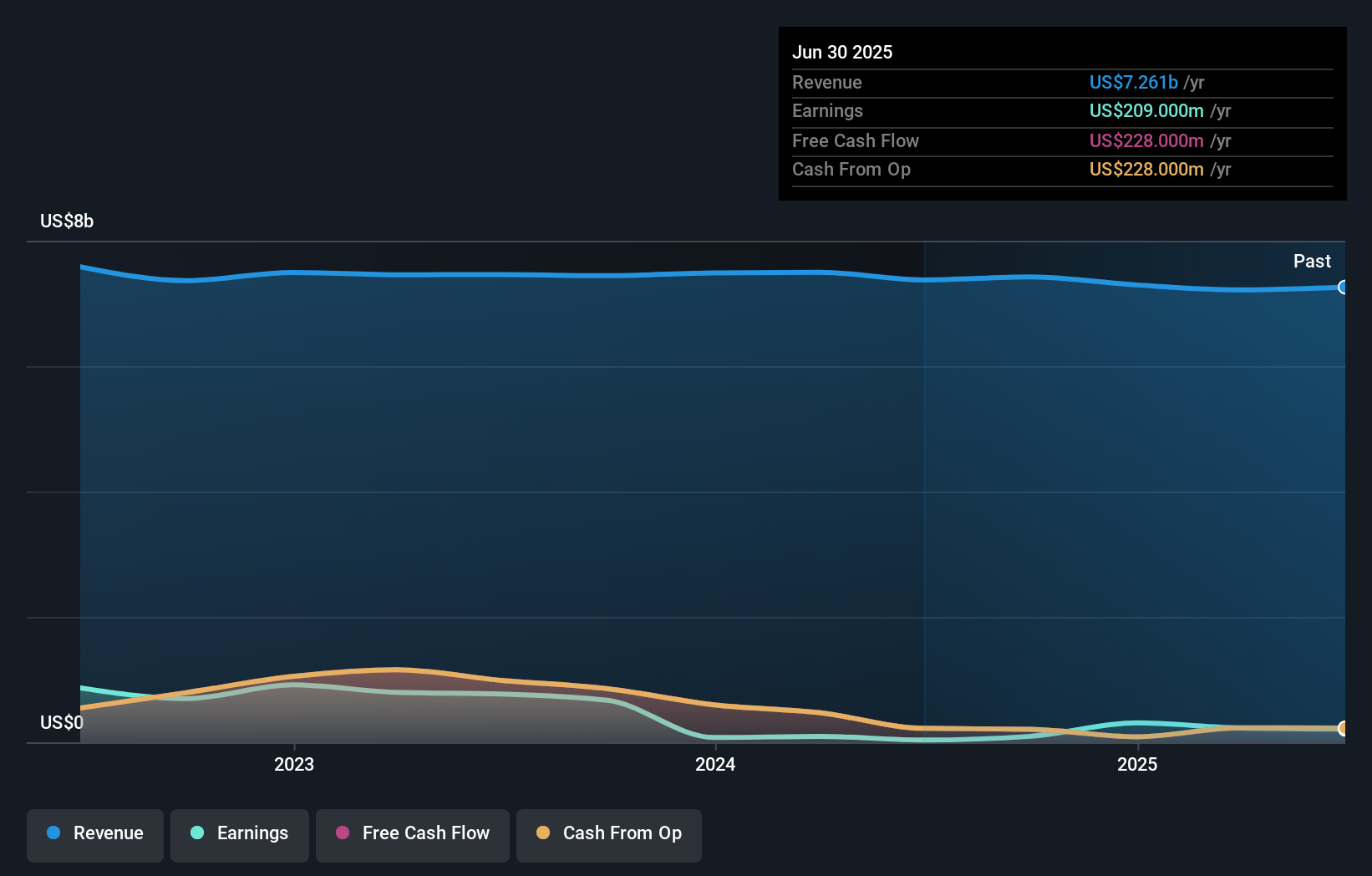

- Genworth Financial has announced the completion of a significant share buyback, repurchasing over 108 million shares for US$629.96 million since May 2022, and reported quarterly earnings showing net income of US$51 million for the period ended June 30, 2025, down from US$76 million the previous year.

- This completed buyback represents more than 23% of shares outstanding, highlighting the company's ongoing efforts to return capital to shareholders even amid lower earnings results.

- We’ll explore how the substantial progress in share repurchases shapes Genworth Financial’s investment narrative alongside recent earnings performance.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is Genworth Financial's Investment Narrative?

To be a Genworth Financial shareholder right now, you need to believe in the long-term benefits of efficient capital management and the potential for further value creation, even with mixed short term results. The just-completed buyback, over 108 million shares or about 23% of shares outstanding, has been a meaningful signal of management’s commitment to returning capital to investors, especially as net income fell year over year. This sharp reduction in share count could help cushion earnings per share, but it does not fully offset the issue of declining profits and revenue. In terms of short term catalysts, while the completion of the buyback could provide some support to the share price (as seen in the modest recent increase), it does not fundamentally change the main challenges facing Genworth: muted revenue trends, margin pressure, and limited visibility on future growth. The biggest risk continues to be whether Genworth can reverse its long standing earnings declines and create sustainable profit growth, a concern that is not meaningfully altered by the latest repurchase. On the flip side, Genworth’s future still depends heavily on whether it can grow earnings rather than just manage its capital.

Genworth Financial's shares are on the way up, but they could be overextended by 17%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Genworth Financial - why the stock might be worth 23% less than the current price!

Build Your Own Genworth Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genworth Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Genworth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genworth Financial's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.