Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To International Bancshares (IBOC) Dividend Hike and Institutional Backing

International Bancshares Corporation IBOC | 71.46 | -1.92% |

- International Bancshares recently announced an increase in its semi-annual dividend from US$0.66 to US$0.70 per share and received a reaffirmed buy rating from Weiss Ratings.

- With institutional investors holding a substantial 73% ownership and insiders maintaining a significant stake worth roughly US$410 million, shareholder interests appear closely aligned.

- We’ll explore how the recent dividend hike shapes International Bancshares' investment narrative amid sustained institutional support.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

What Is International Bancshares' Investment Narrative?

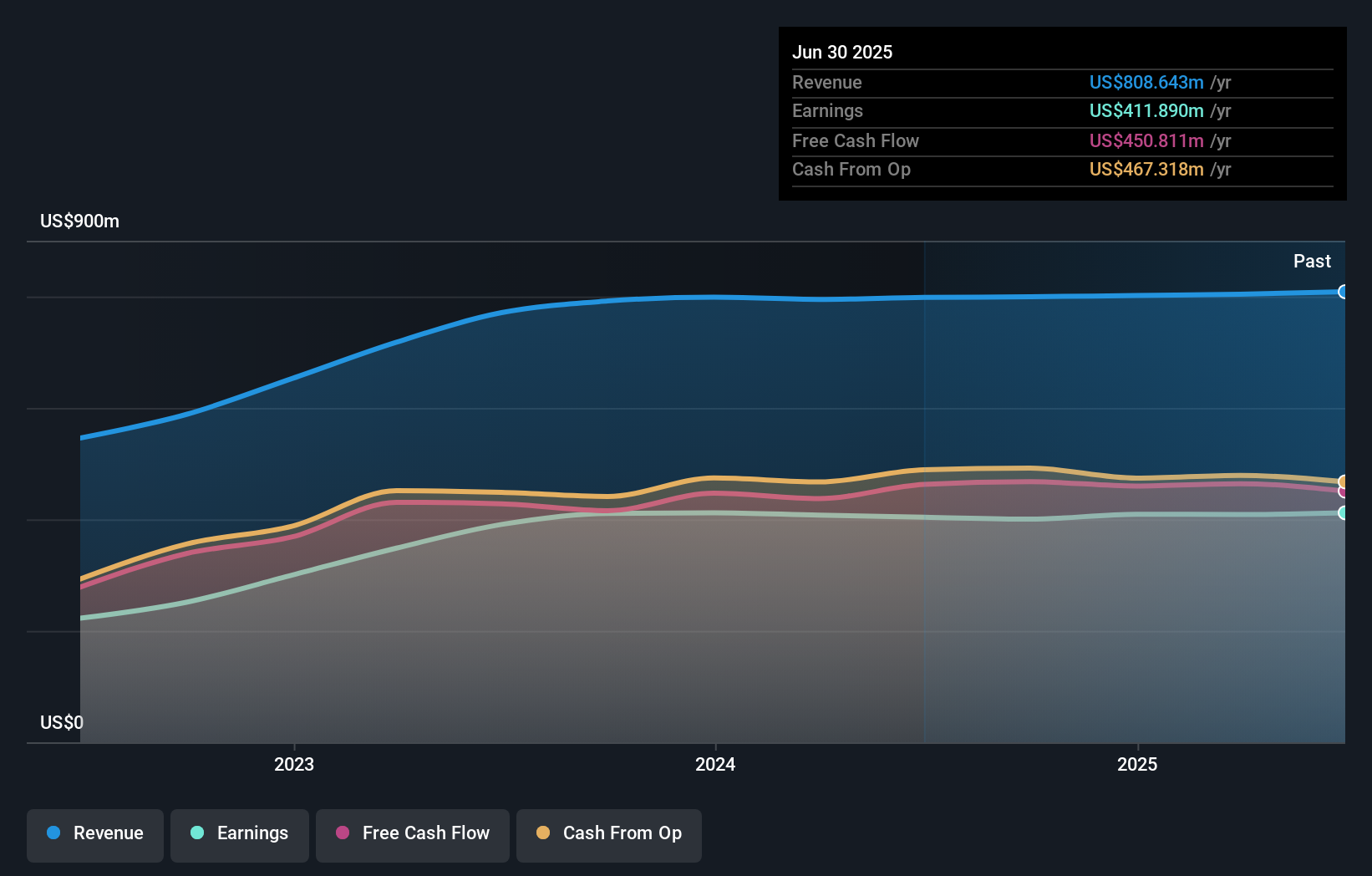

To be a shareholder in International Bancshares, you’d need to believe in the stability and appeal of a regional bank with experienced leadership and strong institutional backing. The latest dividend increase from US$0.66 to US$0.70 per share reinforces a history of shareholder-friendly capital returns and adds weight to the narrative of reliability. This move, coupled with a reaffirmed buy rating and major institutional holders, should bolster confidence and may act as a short-term catalyst at a time of otherwise muted stock performance and subdued earnings growth compared to industry peers. The company’s solid net interest income, disciplined buybacks, and broad index inclusion suggest management is staying the course. That said, recent insider selling and a board light on new faces might temper some enthusiasm. The impact of the dividend hike is positive but likely marginal given ongoing sector headwinds and moderate recent price movements. Instead, consider recent insider sales and an aging board as important factors to watch.

Despite retreating, International Bancshares' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on International Bancshares - why the stock might be worth just $143.21!

Build Your Own International Bancshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free International Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Bancshares' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.