Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Jefferies Financial Group (JEF) Analyst Upgrades After Recent Deal Wins

Jefferies Financial Group Inc. JEF | 62.00 | -1.96% |

- Jefferies Financial Group recently completed a fixed-income offering of callable senior unsecured notes due September 2026 and was named financial advisor for TELUS Corporation, as announced by TELUS.

- These developments have been accompanied by marked analyst optimism, with consensus earnings estimates for Jefferies rising considerably over recent weeks.

- Next, we'll explore how improved analyst confidence in Jefferies' earnings outlook contributes to its current investment narrative.

This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

What Is Jefferies Financial Group's Investment Narrative?

To be a shareholder in Jefferies Financial Group, you need to believe in its ability to weather fluctuating earnings and drive growth amid a competitive capital markets environment. The recent completion of a fixed-income offering and high-profile advisory mandate with TELUS Corporation highlight Jefferies’ continued focus on expanding its advisory and capital markets footprint, which could strengthen near-term fees and market credibility. While these positive headlines have bolstered analyst confidence and pushed up earnings estimates, the short-term catalysts still hinge largely on Jefferies’ ability to stabilize its revenue and margin profile after a period of mixed quarterly results. At the same time, the announced bond issue, while supporting liquidity, brings additional debt at a time when return on equity is already low and dividend sustainability is an open question. While these new developments reinforce Jefferies’ market relevance, they may not be enough to materially shift the longer-term risk of slow earnings growth and market underperformance. However, uncertainty remains around the sustainability of growth and returns, investors should not overlook these risks.

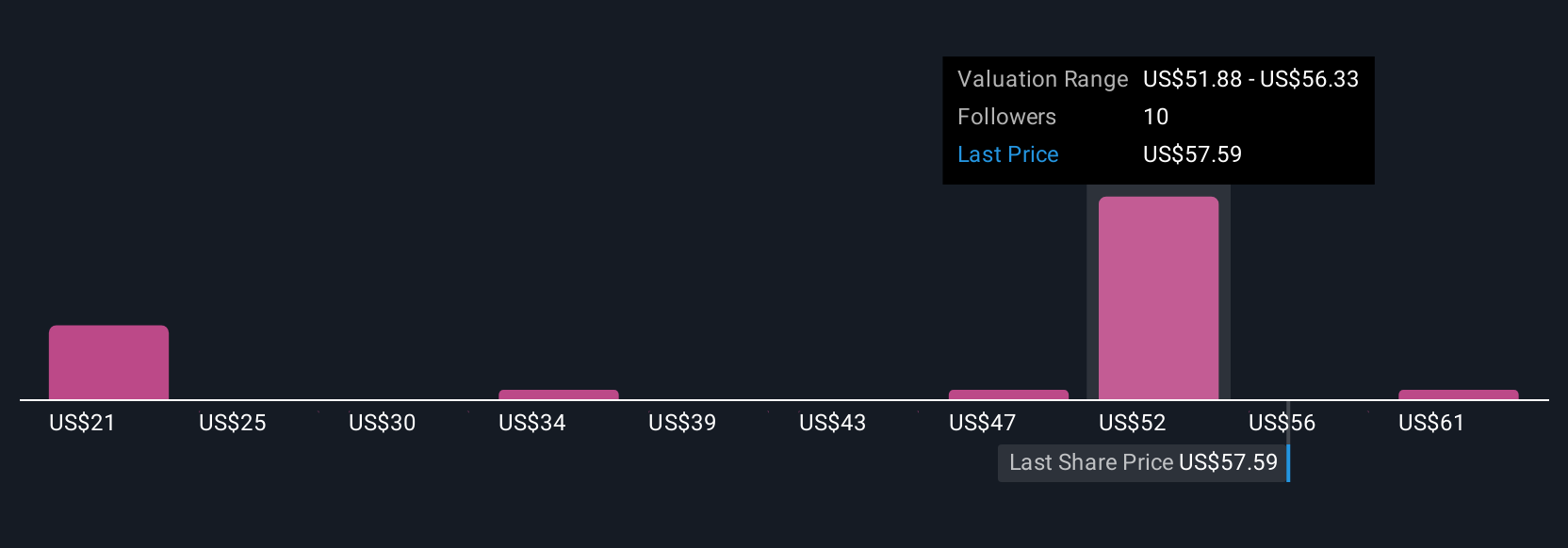

Jefferies Financial Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Jefferies Financial Group - why the stock might be worth less than half the current price!

Build Your Own Jefferies Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jefferies Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jefferies Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jefferies Financial Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.